Bank of Japan Preview: Expectations are high, but will the BoJ deliver?

- The 10-year Japanese Government Bond yield soared to 0.59% ahead of the event.

- The Bank of Japan may prefer to cool down market expectations and limit JPY strength.

- USD/JPY is technically bearish and could plunge towards the 125.00 figure.

The Bank of Japan (BoJ) will announce its monetary policy decision on Wednesday, January 18. Ahead of the announcement, the USD/JPY pair, meanwhile, trades over 100 pips above an eight-month low of 127.21 reached on Monday.

The Japanese Yen strengthened against the US Dollar as the 10-year Japanese Government Bond (JGB) yield peaked at 0.52%, just above the upper limit of the BoJ’s desired range. Back in December, the central bank introduced a change to its Yield Curve Control YCC), lifting the ceiling of what the 10-year note could offer from 0.25% to 0.50%. Speculative interest saw the movement as a prelude to a further withdrawal of the stimulus program, adding fuel to the narrative that policy could change when Governor Haruhiko Kuroda ends his tenure next April.

Market participants somehow anticipate another twist in monetary policy in January, pushing yields further up. At the time of writing, the 10-year JGB yield stands at 0.59%, its highest since the BoJ introduced the YCC in September 2016.

Bank of Japan is in no rush to normalize monetary policy

Most central banks have shifted from ultra-loose monetary policies to quantitative tightening early in 2020, but the Bank of Japan stubbornly remained on the dovish path. But is there a reason for Japanese policymakers to move into a more aggressive path?

According to the latest data available, the Japanese Consumer Price Index (CPI), excluding volatile fresh food prices, rose at an annual pace of 3.7% in November, up from 3.6% in October. It was the biggest annual increase since 1981, with the CPI standing well above the BoJ’s 2% target.

However, Japan’s backstory is one of years of deflation and stagnant growth. Back in the 90s, the economy slowed to minimal levels while inflation remained subdued. At the time, Prime Minister Shinzo Abe announced a series of measures - known as Abenomics - to turn the economy around. His policies helped the country to recover, but the unseen effects of the coronavirus pandemic erased the little progress seen in the previous decade.

At 3.7% YoY, inflation is almost double the BoJ’s target and yet still below that of many other developed economies and far from needing extreme measures. With such a conservative central bank at the helm, it seems that market expectations are way more than what we can actually expect from the event. The Bank of Japan is in no rush to normalize monetary policy.

USD/JPY possible reactions

The Bank of Japan could leave its policy unchanged to cool down market expectations and hence, limit JPY gains. The central bank could also opt to further lift the ceiling of the YCC, although the chances of that are low, since the BOJ is not precisely an organism that moves to the rhythm of markets. Finally, policymakers could choose to drop the yield curve control altogether, although that seems a most unlikely scenario. The Bank of Japan will likely prefer to cool down the market’s expectations of a tighter monetary policy.

The bigger the surprise, the wilder the action around USD/JPY. The highly volatile pair is bearish in the mid-term, and there are no technical signs of a potential shift.

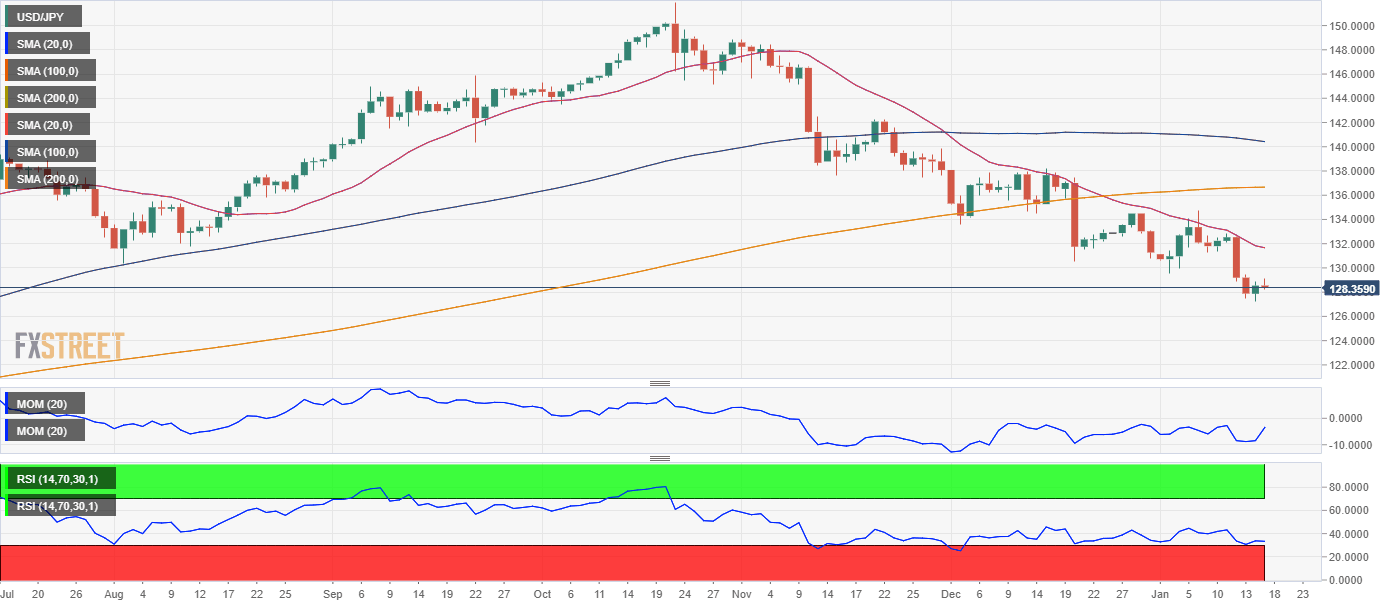

From a technical point of view, the daily chart of USD/JPY hints at further JPY strength. The Momentum indicator maintains its downward strength well into negative territory, while the Relative Strength Index (RSI) indicator consolidates at around 34, reflecting sellers' retention of control and that they probably take their chances off intraday bounces. Furthermore, a bearish 20 Simple Moving Average (SMA) rejected advances last week until buyers finally gave up, allowing bears to push the pair further down.

Near-term support could be found at around the 128.00 figure, ahead of this month's low at 127.21. If the latter gives up, an approach to 126.00 is on the table. On the other hand, and given the broad US Dollar weakness, potential gains seem limited. A recovery beyond 129.20 could open the door for a test of the 130.00 figure, where selling interest will likely reappear.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.