Bank of England Preview: Bailey may boost pound by going big on bond-buying, beware negative rates

- The Bank of England is expected to boost its bond-buying scheme and leave rates unchanged.

- More money-printing is pound-positive, contrary to pre-pandemic logic.

- The specter of negative rates may limit sterling gains.

Debt monetization is creeping in – but it is turning positive for underlying currencies. The euro benefited from a larger-than-expected increase in the European Central Bank's bond-buying scheme – and the pound could follow.

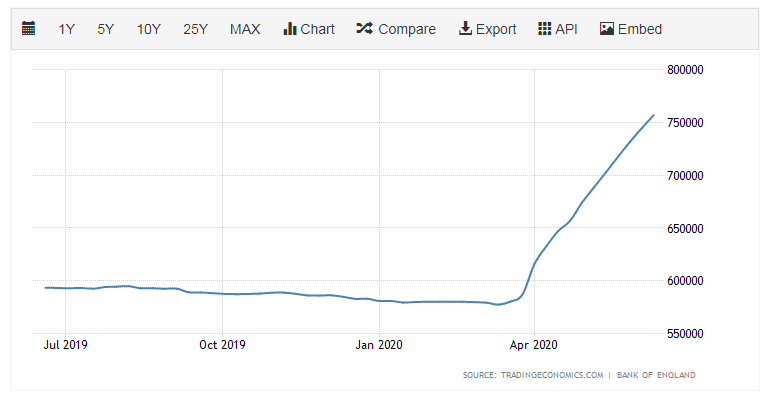

Andrew Bailey, Governor of the Bank of England, has made it clear that he is ready to further enlarge the Asset Purchase Facility – or Quantitative Easing scheme. The BOE's already oversaw an increase of the program by around £200 billion to a total of £645 billion in March – and another boost is on the cards.

The BOE's balance sheet has already grown considerably in the coronavirus crisis:

Source: Trading Economics

The "Old Lady" as the bank is also known, would be responding to the slow emergence of the UK from the lockdown. Britain has flattened the coronavirus curve but the pace is frustratingly slow and loosening restrictions is moving at a glacial pace in comparison to European countries.

While the government's furlough scheme is keeping the official unemployment rate low, it also weighs on public finances – and that is where BOE buying comes into play. Creating more money out of thin air used to be seen as devaluing the currency and potentially triggering price rises.

However, as the most recent evidence has shown – as well as a decade of post-financial crisis central bank activity – inflation is nowhere to be seen. There is a greater fear of deflation, which can turn into a downward spiral for the economy.

UK inflation 2007-2020:

Investors see central bank support as lowering the government's borrowing costs and allowing it to provide relief and stimulus at an accelerated pace. A stronger economy means a stronger currency.

Bailey's bailout – main sterling trigger

Estimates about the BOE's additional QE boost range from £80 billion to £150 billion. The latter figure would raise the total close to £800 billion and if the bank moves closer to the £1 trillion mark, sterling could surge.

Conversely, a sub-£100 billion boost would be seen as disappointing and insufficient given the UK's troubles.

In addition to coping with coronavirus, Brexit uncertainty remains high. Four rounds of talks about future EU-UK relations have been inconclusive. While an online summit of leaders resulted in optimistic voices, details are lacking and Britain may still find itself falling to unfavorable World Trade Organization terms.

Negative rates?

While monetary stimulus in the form of QE would send sterling higher, setting negative interest rates would plunge the pound. Bailey reduced borrowing costs to 0.10% – the lowest in the BOE's 300 years+ history on his fourth day on the job.

He later said that negative rates are "under active consideration" – hurting the pound. The eurozone, Japan, and several other countries have set sub-zero borrowing costs and failed to boost inflation nor growth – only eroding bank profits without gains to the real economy.

At some point, the idea gained momentum as several of Bailey's colleagues at the BOE also seemed to warm up to the idea. However, the governor lowered expectations in a recent public appearance, hinting it is not imminent.

Investors will dive into the bank's meeting minutes – published alongside the decision – and try to gauge if moving below zero is on the radar for the next meetings. Any hint that such a move is likely in the summer would hurt the pound while keeping it as a remote possibility would support sterling.

The minutes are projected to show a unanimous decision on rates. However, if someone dissents and opts for a cut to zero or sub-zero rates – highly unlikely at this point – the pound may plummet.

The protocols from the rate decision will surely shed some light on how the BOE sees the economy at this juncture. Apart from stressing the high level of uncertainty, the bank may convey a message of cautious optimism – similar to the US Federal Reserve.

Bailey could show satisfaction from achievements against the disease and the reopening while cautioning that the labor market may suffer for longer.

UK Claimant Count Change – on the rise

Conclusion

The BOE is set to expand its QE program and the amount is still unknown. A larger sum would boost the pound while a lower one would hurt it. Investors are also watching for any hints about negative rates, and any sign they are coming may send sterling lower.

More Why EUR/USD may rally, where to find the key to gold move, lots more – Interview with Richard Perry

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.