Bank of Canada Preview: Three reasons to expect a CAD rally on an interest rate hike

- The Bank of Canada is expected to raise rates by 25 bps to 5%, contrary to its pause hints.

- By ignoring falling inflation, the BoC will have proved its stubbornness, raising prospects of future hikes.

- The bank's stubbornness would come while markets lower expectations for the path of US borrowing costs.

A currency rises in response to a rate hike – that should not be a surprise, should it? Normally, a move is fully priced in, and investors look beyond the current decision rather than current one. That is not the case with the Bank of Canada (BoC) which plays tricks with markets. That may lead to a wild reaction, especially in USD/CAD.

Here is a preview for the Bank of Canada's rate decision due on July 12 at 14:00 GMT.

The Bank of Canada's surprises

Contrary to the US Federal Reserve (Fed) and the European Central Bank (ECB), the BoC does not feel an urge to pre-commit to its decisions. Those bigger central banks want to provide certainty – something the BoC feels unshackled from.

In the last decision in June, the BoC surprised with a hike from 4.50% to 4.75%, after leaving rates unchanged twice in a row and hinting it is done increasing borrowing costs. BoC Governor Tiff Macklem and his colleagues signaled that June's hike was a one-off, a response to stronger data. However, markets are left with disbelief.

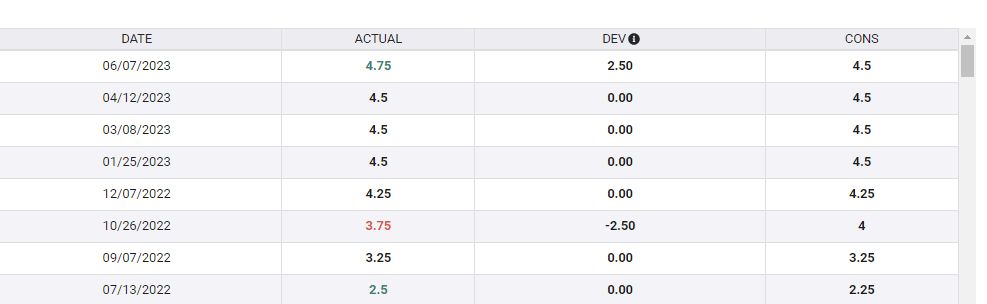

The BoC surprised markets in three of the last eight decisions:

Source: FXStreet

Officials' comments about fighting inflation and the latest upbeat jobs report raised expectations for another increase to 5% in the upcoming meeting. In addition, the Federal Reserve hawkish twist – projecting two more rate hikes after pausing – raises expectations.

Nevertheless, by hiking, the BoC would surprise still defy expectations and send USD/CAD tumbling.

Three reasons for a USD/CAD fall on a BoC interest rate hike

1) Uncertainty breeds uncertainty and fears of further increases

"Fool me once, shame on you, fool me twice, shame on me" – this saying is relevant to markets. Even if the BoC goes beyond hints and vows to leave rates unchanged after this move, markets will remain worried about further moves.

Any "dovish hike" would be met with skepticism and keep markets awaiting for further moves – supporting the Canadian Dollar.

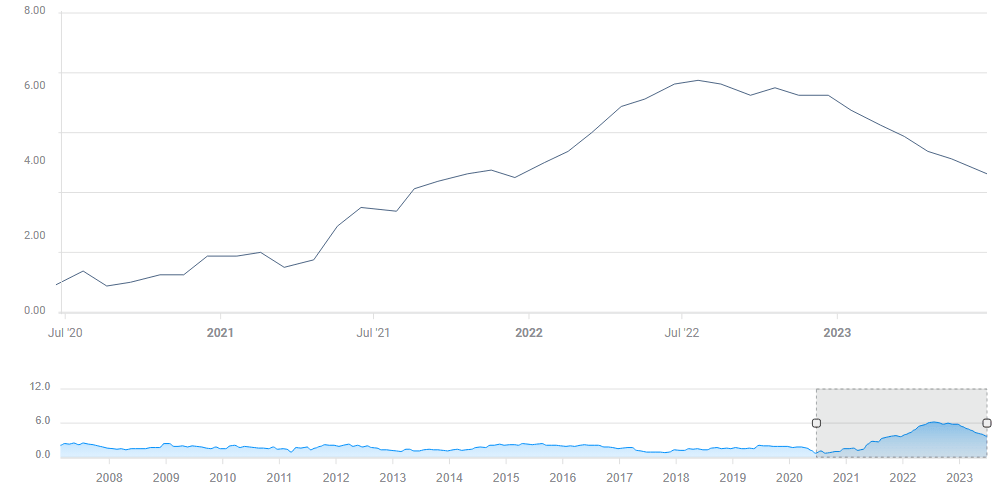

2) Inflation is falling in Canada

The headline Consumer Price Index (CPI) fell to 3.4% in May, while Core CPI missed estimates and slid from 4.1% to 3.7%. This core figure is significantly below 5.3% in the US for the same month and substantially below interest rates.

Source: FXStreet

By extending its tightening cycle and pushing borrowing costs to highly restrictive territory, investors would worry that the BoC would not stop until inflation fully returns to the bank's 2% target. Such hawkishness gives the Loonie an advantage.

3) Inflation is falling in the US

Just 90 minutes before the BoC announces its decision in Ottawa, statistics agencies in Washington release a fresh inflation report for June. It is expected to show a drop of headline inflation to 3.1% YoY and Core CPI to 5%. Investors expect one more hike in the US and are happy to see the end fo the tightening cycle.

That would contrast with a stubborn BoC and send USD/CAD tumbling down.

Why is the US so important to Canada? Roughly 75% of Canadian exports go south, and both countries have an extensive trade agreement that encourages even closer ties. The smaller northern economy – Canada's population is about one-ninth of that in the US – heavily depends on the southern one.

The other scenario

After mentioning the BoC's tendency to surprise, I would be remiss to ignore the other scenario – leaving rates unchanged. In doing so, the BoC would respond to weaker inflation, concerns about a US slowdown, and it would follow its own hints.

As markets expect a hike, skipping one would send the Canadian Dollar tumbling. The fall would likely be less significant against the US Dollar, yet it would have room to decline against others.

Final Thoughts

An as-expected rate hike from the Bank of Canada is far from being a non-event. There is room for a downside move in USD/CAD in response to a hike – regardless of what the institution signals about the future.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.