Australian Jobs Preview: Will another positive report really help the Aussie?

- Australia is expected to report an increase of 20,000 jobs in September following a surge in August.

- The labor market has demonstrated resilience, adding over 400,000 jobs in the past 12 months despite RBA rate hikes.

- The AUD/USD remains in a downward trend, trading near monthly lows and struggling to sustain a recovery.

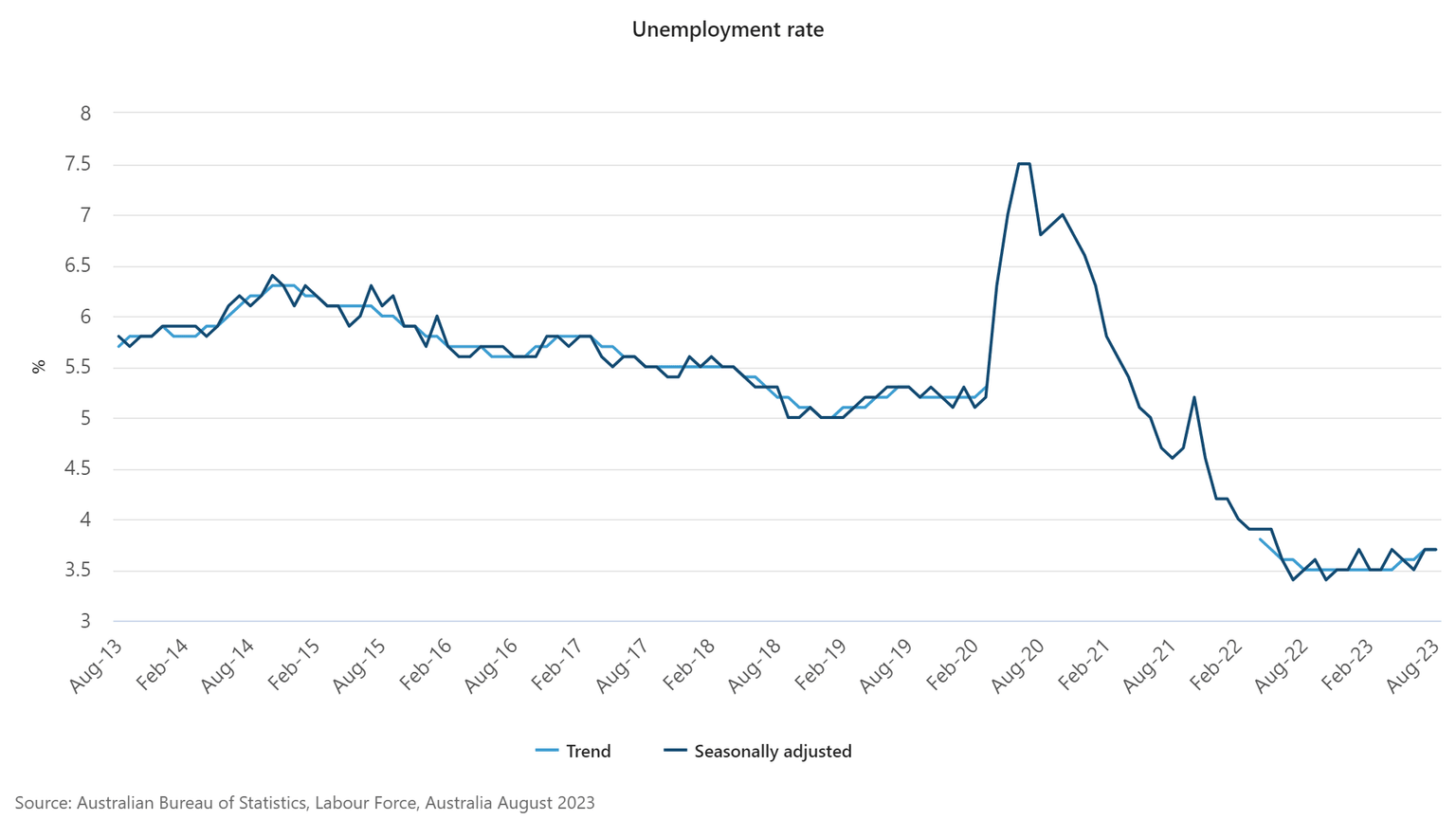

The Australian Bureau of Statistics will release September employment data on Thursday, October 19, at 01:30 GMT. Following the impressive addition of 64,900 jobs in August, which exceeded expectations, the country is expected to have added 20,000 new jobs in September. The Unemployment Rate is forecasted to remain unchanged at 3.7%, while the Participation Rate is seen holding steady at 67%.

Australian Jobs report: Important but not decisive

The August employment report in Australia surpassed expectations but only temporarily boosted the Australian Dollar (AUD). The combination of a gloomy Chinese economic outlook, expectations of prolonged high interest rates, and risk aversion limited the currency's gains. A month later, the economic outlook remains gloomy as signs of the Chinese economy bottoming out are offset by geopolitical issues. Since the last report, the US Dollar has remained strong, supported by robust US economic data, which has kept Treasury yields at multi-year highs.

The Australian labor market has proven resilient, not only due to the strong August numbers but also because it has added 410,000 jobs over the past 12 months, despite the Reserve Bank of Australia (RBA) setting the interest rate at 4.1%, the highest level in over ten years.

On Tuesday, the RBA released the minutes of its latest meeting. The minutes indicated that the Board had a low tolerance for a slower return of inflation to the target rate. While the central bank considered raising rates, it noted that there was insufficient information at the time. The minutes also highlighted the Board's concern that inflation was not slowing as expected, leaving the door open for a rate hike at the November meeting.

For a rate hike to be more seriously considered, the labor market needs to remain on track, and inflation needs to rebound further. Next week, new inflation data, including the quarterly prints, will be released and critical in influencing the Australian Dollar. The next RBA meeting is November 7.

AUD/USD levels to watch

Despite market expectations of a moderate increase of 20,000 jobs in September, a positive reading would suggest that the labor market remains resilient and would keep the door open to a potential rate hike. However, the impact could be limited considering the current headwinds in AUD/USD, such as the strengthening US Dollar and risk sentiment.

A negative reading would likely hurt the Aussie, not only because it would indicate a softer employment market but also because it would probably not rule out another rate hike by the Reserve Bank of Australia, which would harm the economy.

The AUD/USD pair is trading near year-to-date lows and has been unable to sustain a recovery. The trend is downward. Despite any positive signs from China or Australia, the stronger Dollar and fresh concerns have overshadowed them.

The pair needs to consolidate above 0.6380 to alleviate bearish pressure, and a weekly close above 0.6540 would suggest that it has bottomed. Conversely, a break below 0.6280 would indicate a path toward last year's low of 0.6170.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638332371849094678.png&w=1536&q=95)