Australian Dollar Price Forecast: There is a minor top at 0.6550

- AUD/USD reversed two daily declines in a row, advancing past 0.6500 once again.

- The US Dollar faced renewed selling pressure following mixed US CPI data in July.

- The RBA lowered its OCR by 25 basis points to 3.60%, as widely expected.

The Australian Dollar (AUD) showed a positive reaction on Tuesday, prompting AUD/USD to reclaim the 0.6500 hurdle and beyond on the back of the resumption of the selling bias in the US Dollar (USD).

Domestic data: A mixed picture

Australia’s Q2 headline Consumer Price Index (CPI) rose 0.7% vs. the previous quarter and 2.1% on a yearly basis, while June’s Monthly CPI Indicator came in at 1.9%, suggesting that while price pressures are easing, they’re doing so grudgingly.

The activity side told a brighter story in July. The Manufacturing PMI rebounded to 51.6, the Services PMI climbed to 53.8, and Retail Sales jumped 1.2% in June. The labour market, however, lost some steam, with just 2K jobs added and unemployment nudging up to 4.3% as participation edged to 67.1%.

Trade figures offered a rare upside surprise: the surplus widened sharply to A$5.365 billion in June from A$1.604 billion in the prior month.

RBA: Comfortable amid cooling inflation

The Reserve Bank of Australia (RBA) cut the cash rate by 25 basis points to 3.60% on Tuesday, a move widely expected by markets. Policymakers also lowered their year-end 2026 rate forecast to 2.9% from 3.2% in May, signalling a shift towards a slightly looser stance while still aiming to keep the labour market steady.

The growth outlook was trimmed, with the central bank now seeing the economy expanding just 1.7% in 2025, down from 2.1% previously, as global headwinds bite. Forecasts for unemployment and trimmed mean CPI at the end of next year were left unchanged at 4.3% and 2.6%, respectively.

In her press conference, Governor Michele Bullock said a bigger half-point cut wasn’t on the table and stressed the bank would remain “data-dependent, not data-point dependent” in deciding its next steps. She noted the case for further easing will hinge on the economy finding a better balance between a cooling labour market and easing price pressures.

China: Mixed signals persist

China—Australia’s largest export market—continues to send a patchy economic signal. Q2 GDP grew 5.2% YoY, and Industrial Production rose 7%, but Retail Sales fell short of the 5% mark.

That said, the People’s Bank of China (PboC) left its one- and five-year Loan Prime Rate (LPR) unchanged at 3.00% and 3.50%, respectively, while July’s official PMIs slipped—Manufacturing to 49.3 and Non-manufacturing to 50.1. Caixin’s readings told a similar story, underscoring the fragility of the recovery.

Latest trade data showed the surplus narrowing to $98.24 billion in July, with exports up 7.2% and imports 4.1% over the last twelve months. Over the weekend, inflation showed tentative signs of life as the Consumer Price Index (CPI) rose 0.4% in July, though it was flat over the year.

Positioning: Bears in control

Commodity Futures Trading Commission (CFTC) data to August 5 showed speculators adding to net short AUD positions, taking them to around 83.6K contracts—levels last seen in April 2024. Open interest also climbed to an eight-week high near 164K contracts.

Chart watch: Key levels

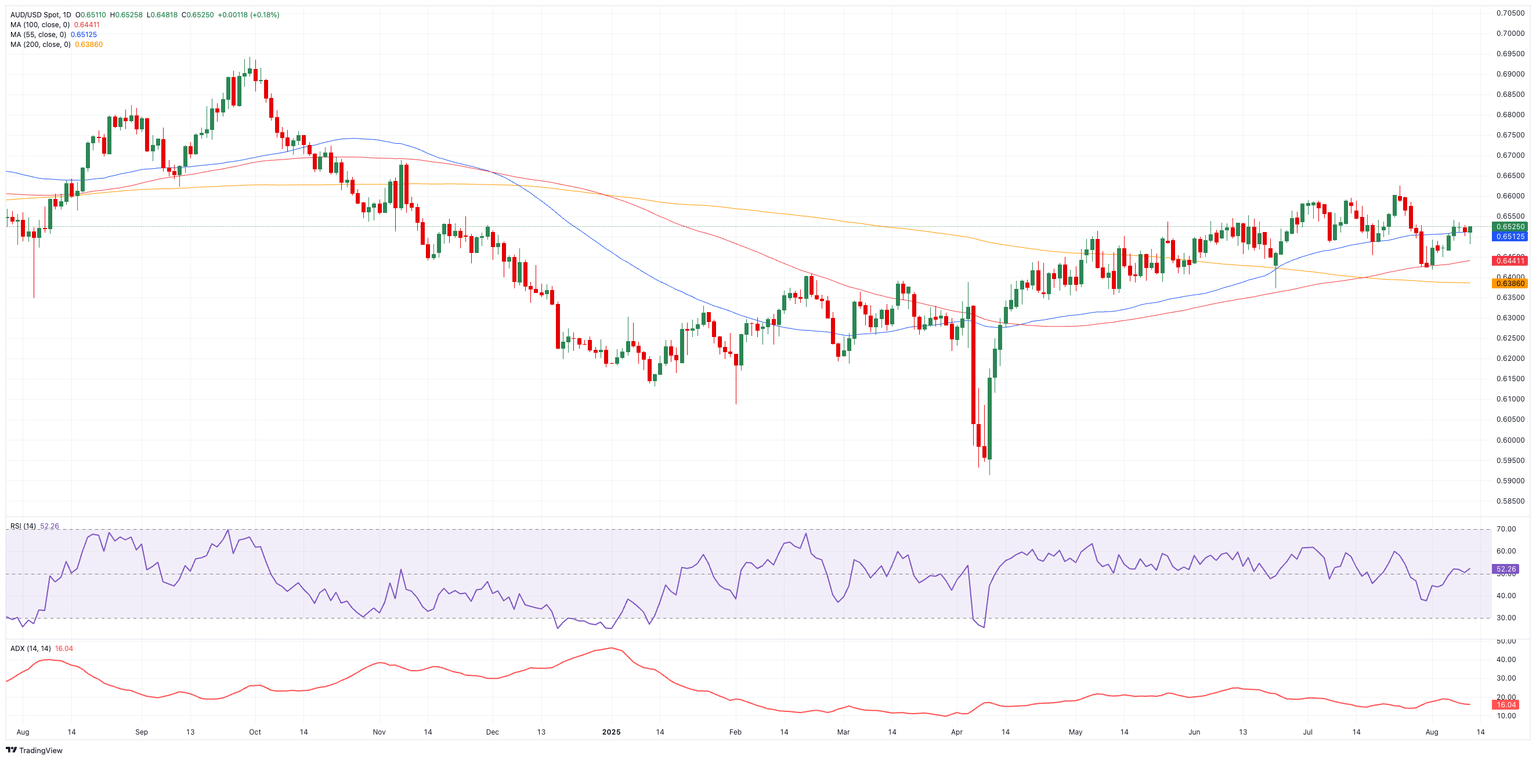

Initial resistance emerges at the 2025 ceiling of 0.6625 (July 24), seconded by the November 2024 peak at 0.6687 (November 7). Once the latter is cleared, spot might revisit tothe psychological threshold of 0.7000.

On the other hand, immediate support is at the August low of 0.6418 (August 1), prior to the critical 200-day Simple Moving Average (SMA) at 0.6388, and the June floor at 0.6372 (June 23).

In addition, the Relative Strength Index (RSI) has gone back over 52, which means there is some upward pressure. The Average Directional Index (ADX) is below 16, which means the overall trend is still weak.

AUD/USD daily chart

Outlook: For now, it's stuck in a range.

The Aussie appears locked in a range, probably between 0.6400 and 0.6600, until Chinese data shocks to the upside, the Fed changes its mind, or the RBA changes its mind. It's just waiting for the next spark to break the range.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.