Australian Dollar Price Forecast: No changes to the range bound trade

- AUD/USD added to Friday’s pullback and challenged the 0.6500 region.

- The US Dollar picked up extra pace ahead of US inflation and the trade deadline.

- Market consensus sees the RBA lowering its OCR by 25 basis points on Tuesday.

The Australian Dollar (AUD) has started the week on the back foot vs. the US Dollar (USD), prompting AUD/USD to recede to two-day lows and put the 0.6500 contention zone to the test once again.

Domestic data: A mixed bag

Australia’s Q2 headline CPI rose 0.7% QoQ (2.1% YoY), while June’s Monthly CPI Indicator printed 1.9%, suggesting price pressures are easing—but only reluctantly.

On the brighter side, activity data impressed: manufacturing PMI rebounded to 51.6, services PMI to 53.8, and retail sales jumped 1.2% in June. The jobs market, however, showed signs of fatigue, with just 2K positions added last month, nudging unemployment to 4.3% as participation edged up to 67.1%.

Trade data offered a rare highlight as the trade surplus widened sharply to A$5.365 billion in June (from A$1.604 billion).

RBA: Locked in?

At its early-August meeting, the Reserve Bank of Australia (RBA) kept the cash rate steady at 3.85%. Governor Michele Bullock described the choice as “one of timing rather than direction,” signalling that cuts remain an option if inflation continues to cool. Deputy Governor Andrew Hauser backed that cautious stance, stressing any easing would be gradual.

Against the backdrop of a more benign inflation scenario, market participants widely anticipate the RBA lowering its Official Cash Rate (OCR) by 25 basis points at its meeting on August 12.

China: Patchy progress

Australia’s biggest export market is sending conflicting signals. Q2 GDP grew 5.2% YoY and industrial output rose 7%, but retail sales missed the 5% mark. Beijing left its one- and five-year Loan Prime Rate (LPRs) unchanged at 3.00% and 3.50%, respectively, while July’s official PMIs slipped—manufacturing to 49.3 and non-manufacturing to 50.1. Caixin’s readings echoed the uneven tone, highlighting how fragile the recovery remains.

Last week, China’s trade surplus narrowed to $98.24 billion in July, with exports up 7.2% and imports 4.1% YoY. Over the weekend, inflation showed some tepid signs of life after the Consumer Price Index (CPI) rose 0.4% MoM in July, while coming in flat over the last twelve months.

Positioning: The bearish sentiment dominates

According to the Commodity Futures Trading Commission (CFTC) data to August 5, speculators added to their net short Aussie Dollar holdings, taking them to levels last seen in April 2024 near 83.6K contracts. In addition, open interest rose to eight-week highs near 164K contracts.

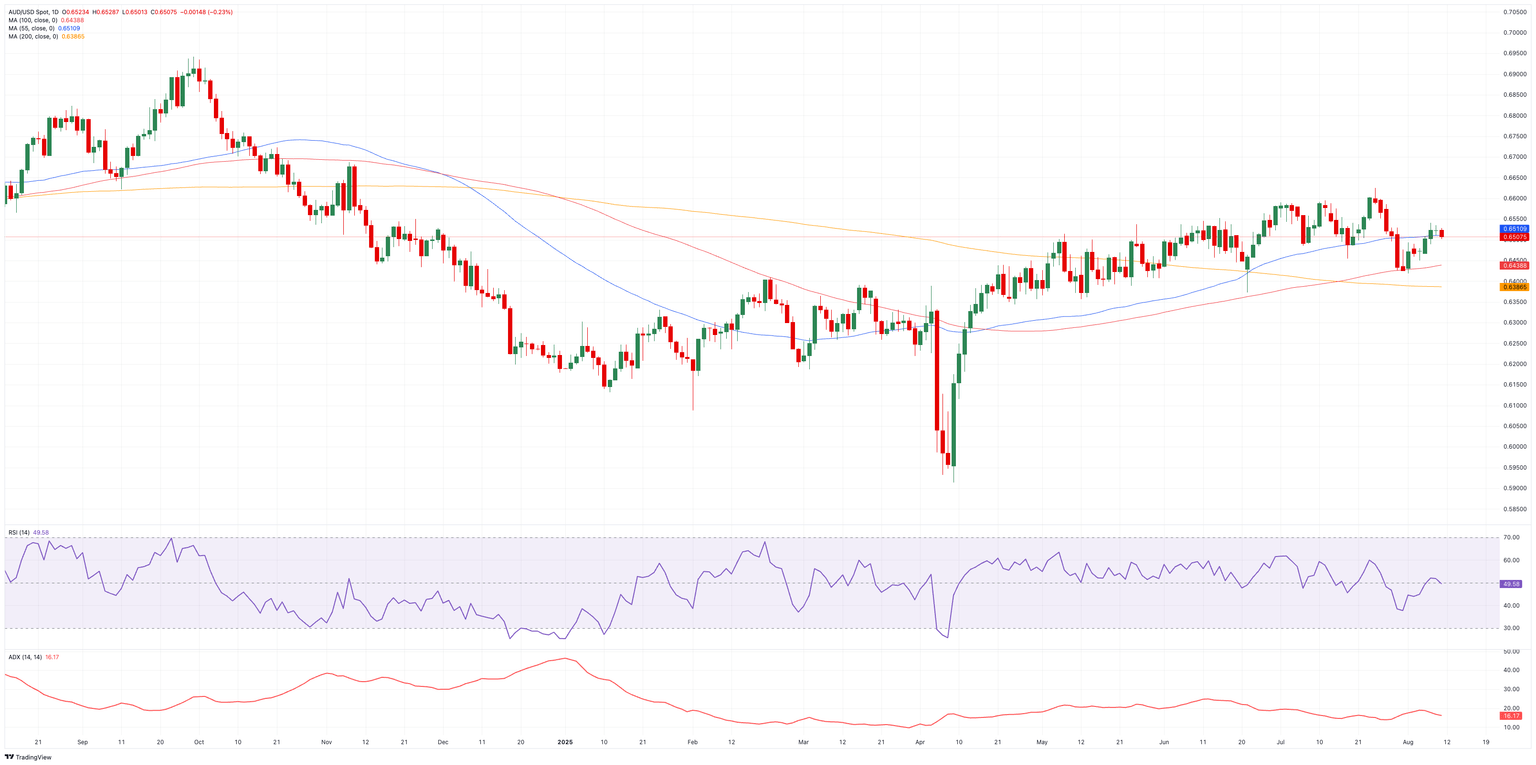

Chart watch: Levels to note

The YTD peak at 0.6625 (July 24) is the next resistance, ahead of the November 2024 high at 0.6687 (November 7) and the psychological 0.7000 mark.

Support starts at the August base of 0.6418 (August 1), seconded by the key 200-day SMA at 0.6388 and the June base of 0.6372 (June 23).

Momentum signals remain mixed: the Relative Strength Index (RSI) has eased to nearly 49, hinting at mild downside pressure, while an Average Directional Index (ADX) near 16 still points to a broadly weak trend.

AUD/USD daily chart

Outlook: Stuck in the middle

Without a rebound in Chinese data, a policy jolt from the Fed, or a surprise move from the RBA, the Aussie looks likely to keep meandering between 0.6400 and 0.6600—marking time until the next big trigger.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.