Australian Dollar Price Forecast: Minor support comes at 0.6530

- AUD/USD added to Wednesday’s downtick, easing to five-day lows near 0.6600.

- The US Dollar gathered serious upside impulse following the Fed’s rate cut.

- The Australian labour market report failed to lend support to the Aussie.

The Australian Dollar (AUD) lost more ground on Thursday, with AUD/USD sliding back toward the 0.6600 support zone. The dip comes just a day after the pair briefly tested levels above 0.6700, marking multi-month highs.

The pullback has less to do with Australia and more with the US Dollar (USD). The US Dollar Index (DXY) has climbed to three-day highs, well above 97.00, as US yields moved higher across the curve, giving the Greenback fresh momentum.

Stubborn inflation keeps the RBA cautious

Australia’s inflation problem isn’t going away as quickly as hoped. July’s Monthly CPI (Weighted Mean) rose to 2.8% from 1.9% in June, while Q2 CPI climbed 0.7% QoQ and 2.1% from a year earlier.

This stickiness explains why the Reserve Bank of Australia (RBA) remains wary of cutting too aggressively. With inflation still running above comfort levels, policymakers are keeping a careful line between supporting growth and avoiding a renewed inflation spike.

Domestic economy holding up better than feared

Despite the global backdrop, Australia’s economy has been surprisingly resilient. Manufacturing PMI for August printed at 53.0 and Services at 55.8, both comfortably in expansion.

Retail Sales rose 1.2% in June, and the July trade surplus widened to A$7.3 billion. in addition, business investment ticked slightly higher in Q2, and GDP surprised on the upside, expanding 0.6% QoQ and 1.8% YoY.

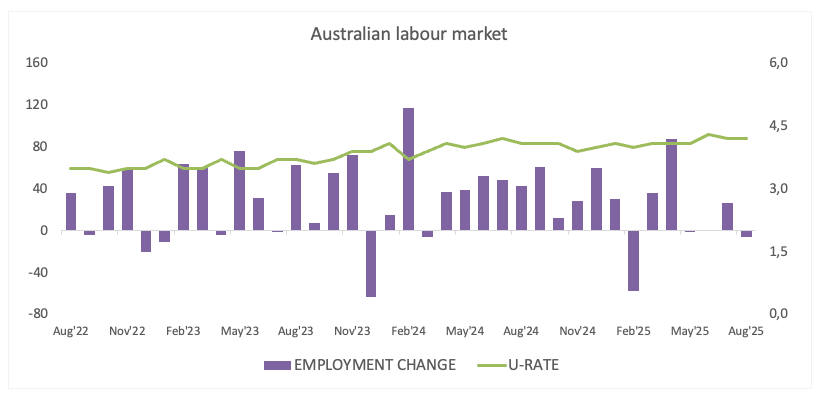

The labour market is a touch more mixed: The Unemployment Rate held at 4.2% in August, but the Employment Change dropped by 5.4K individuals.

RBA sticks to data-driven path

The RBA cut the Official Cash Rate (OCR) by 25 basis points earlier this month, bringing it to 3.60%, while trimming its 2025 growth forecast. Governor Michele Bullock ruled out deeper cuts while stressing that decisions remain data-dependent.

Minutes from the last meeting highlighted a conditional approach: if the labour market weakens, the RBA could move faster, but if growth holds up, policy adjustments will be gradual.

Markets now expect that there will be no change at the September 30 meeting; however, they still anticipate around 30 basis points of additional easing by year-end.

China still the swing factor

Australia’s fortunes remain tightly linked to China. Q2 GDP there expanded 5.2% YoY, but retail sales disappointed with just 3.4% growth in August.

Furthermore, PMIs are also mixed, as manufacturing slipped into contraction at 49.4, while services edged up to 50.3. Additionally, deflationary pressures risk linger, with the CPI down 0.4% in the year to August.

The People’s Bank of China (PBoC) kept Loan Prime Rates steady in August, 3.00% on the One-Year and 3.50% on the Five-Year, and is expected to stand pat again this weekend.

AUD/USD Technical Outlook: Range Still Intact

AUD/USD continues to trade inside its familiar range.

Bulls target the 2025 ceiling at 0.6707 (September 17), while a clear break higher would bring the 2024 peak at 0.6942 (September 30) into play, seconded by the 0.7000 yardstick.

On the downside, initial support sits at the August base of 0.6414 (August 21), ahead of the key 200-day SMA at 0.6394 and the June trough at 0.6372 (June 23).

Momentum signals are softening somewhat: The Relative Strength Index (RSI) has eased back below 57, hinting at waning bullish pressure, while the Average Directional Index (ADX) just above 21 suggests the broader trend is only gradually strengthening.

AUD/USD daily chart

Short-Term View

Currently, AUD/USD remains sidelined. A decisive break of this theme likely needs a catalyst: Stronger data from China, a meaningful shift in Federal Reserve (Fed) policy, or a surprise move from the RBA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.