Australian Dollar Price Forecast: Immediately to the upside emerges 0.6700

- AUD/USD ran into new selling orders and dropped to two-day lows near 0.6580.

- The US Dollar gathered strong balance despite fears around the US shutdown.

- The Australian trade surplus narrowed to A$1.825 billion in August.

The Australian Dollar (AUD) lost momentum on Thursday, with AUD/USD sliding back under the 0.6600 mark and hitting two-day lows.

The shift came as the US Dollar (USD) clawed back ground, snapping its four-day losing streak even as the government shutdown drama in Washington dragged on.

Resilient backdrop at home

Australia’s economy continues to surprise on the upside. September’s final PMI readings showed some cooling but stayed above the 50 expansion line.

The data flow has backed that resilience: retail sales jumped 1.2% in June, the August trade surplus narrowed to A$1.825 billion, and business investment picked up through Q2. GDP also ticked along at 0.6% QoQ and 1.8% YoY.

Jobs are the one weak spot. Unemployment held steady at 4.2% in August, but employment slipped modestly, down 5.4K.

RBA keeping its guard up

Inflation is proving stickier than policymakers would like. The August Monthly CPI Indicator (Weighted Mean) edged up to 3.0% from 2.8%, while Q2 CPI rose 0.7% QoQ and 2.1% YoY.

That backdrop kept the Reserve Bank of Australia (RBA) on a hawkish hold earlier this week. The cash rate stayed at 3.60%, as expected, but the statement quietly dropped previous hints about possible easing.

Officials flagged that disinflation could be slowing after the CPI surprise, warning that Q3 could easily overshoot their 2.6% forecast. At the same time, the broader economy isn’t rolling over: real wages are nudging higher, asset prices are climbing, and households are feeling better off. Hard to cut rates into that.

Governor Michele Bullock stressed in her press conference that policy decisions will stay data-driven, taken one meeting at a time. Rate cuts aren’t off the table, but the RBA needs more proof that supply-demand imbalances are easing.

For now, the trimmed mean CPI at 2.7% YoY in Q2 remains the key reference point and is still inside the RBA’s 2–3% comfort band.

Futures are now pricing around 15 bps of easing by year-end.

China still the wild card

Australia’s outlook remains tethered to China. Growth there has been uneven: Q2 GDP came in at a strong 5.2% YoY, but August retail sales disappointed at 3.4%. September PMIs were mixed too: manufacturing stuck in contraction at 49.8, services just clinging to 50.0. On top of that, CPI fell 0.4% YoY in August, keeping deflation fears alive.

The People’s Bank of China (PBoC) left its Loan Prime Rates (LPR) unchanged in September as expected, with the one-year at 3.00% and the five-year at 3.50%.

Positioning still negative

Traders aren’t convinced on the Aussie. Commodity Futures Trading Commission (CFTC) data through September 23 showed net shorts climbing to 101.6K contracts, the highest in two weeks, while open interest also ticked up to 160.8K contracts.

Technicals unchanged

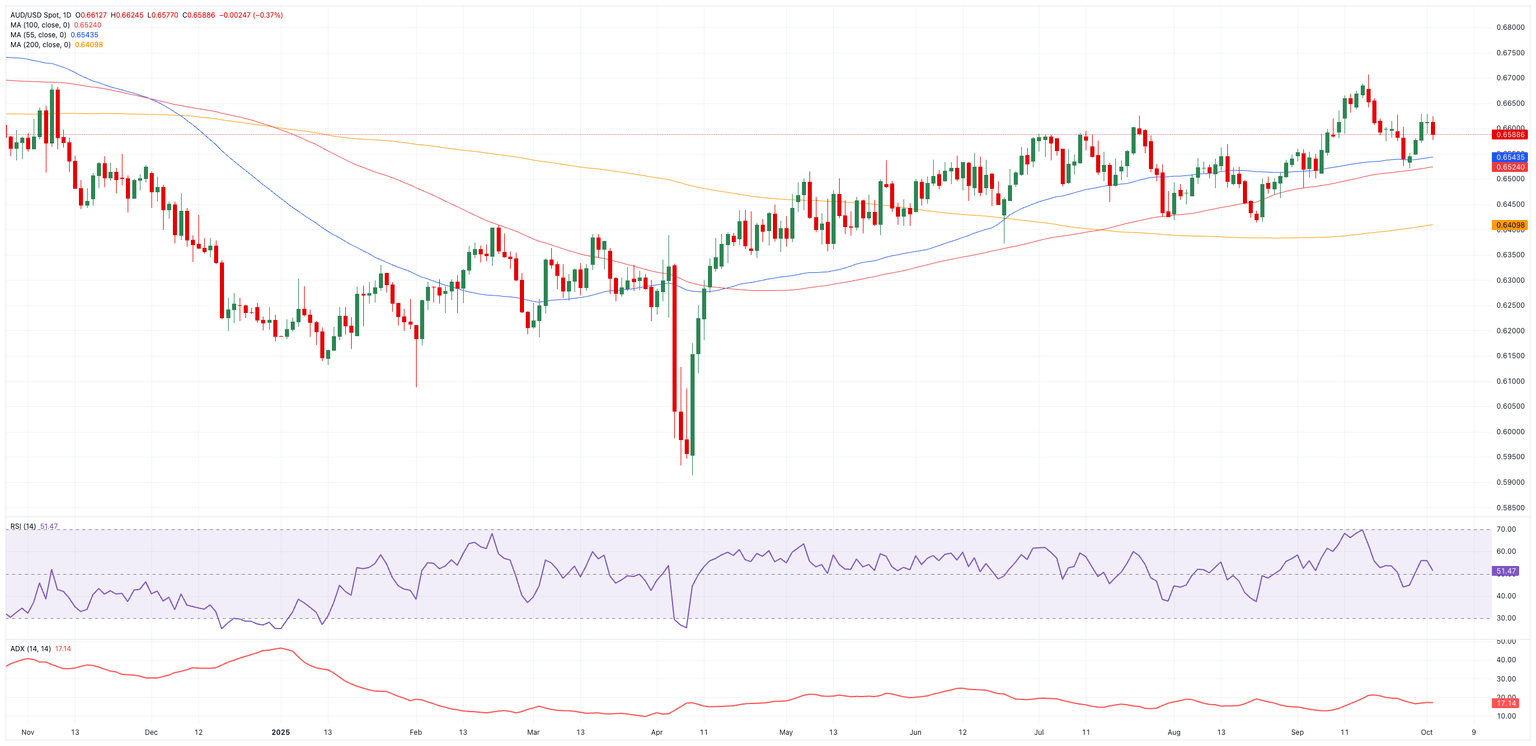

The near-term outlook for AUD/USD keeps pointing to further gains as long as the pair trades above its key 200-day SMA at 0.6408.

Indeed, the resumption of the bullish bias should target the 2025 ceiling at 0.6707 (September 17). North from here emerges the 2024 peak at 0.6942 (September 30), prior to the psychological 0.7000 threshold.

On the flip side, the weekly low at 0.6520 (September 26) appears reinforced by the temporary 100-day Simple Moving Average (SMA). The loss of the latter could prompt AUD/USD to confront the August floor at 0.6414 (August 21), reinforced by the vicinity of the 200-day SMA. Below that sits the June trough at 0.6372 (June 23).

Momentum indicators remain mixed: the Relative Strength Index (RSI) has deflated below 52, hinting at still some buying pressure, while the Average Directional Index (ADX) just over 17 suggests a pale trend.

AUD/USD daily chart

Stuck waiting for a spark

For now, AUD/USD is trapped in a wide 0.6400–0.6700 range. Breaking out likely needs a bigger catalyst: perhaps stronger Chinese data, a dovish shift from the Fed, or a persistently cautious RBA.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.