Australian Dollar Price Forecast: Focus shifts to 0.6800

- AUD/USD reverses part of the recent drop and reclaims the 0.6700 barrier.

- Fresh concerns over the Fed’s independence undermine the US Dollar.

- Markets’ attention now shifts to the US inflation figures on Tuesday.

AUD/USD is starting to look a bit brighter again. After three straight days on the back foot, the pair has shaken off the weakness and pushed back above the 0.6700 handle, helped along by a renewed bout of selling in the US Dollar (USD).

The Aussie Dollar (AUD) has kicked off the new week with some welcome momentum, lifting AUD/USD to two-day highs in the 0.6520–0.6530 region on Monday. The bounce reflects a broader improvement in sentiment toward risk currencies, rather than anything Australia-specific.

At the heart of the move is a softer Greenback. Fresh concerns about the Federal Reserve’s (Fed) independence are weighing on confidence, fuelling speculation that a more dovish Fed could lie further down the road. That backdrop has given spot room to breathe and recover lost ground.

Taking a step back, the bigger picture for AUD/USD still looks fairly healthy. The pair is holding comfortably above both its 200-week and 200-day moving averages, at 0.6624 and 0.6514, which helps keep the medium-term bias leaning gently to the upside rather than signalling any deeper trouble.

Steady progress, nothing flashy

Australia’s data flow hasn’t exactly dazzled, but it hasn’t disappointed either. The economy is still ticking along at a steady pace, and recent releases fit neatly with the soft-landing narrative.

That said, December PMI figures reinforced that view. Manufacturing and Services both dipped slightly in the preliminary readings, but they remain firmly in expansion territory. Retail Sales continue to hold up reasonably well, and while the trade surplus narrowed to A$2.936 billion in November from A$4.356 billion, it’s still solidly in the black.

Furthermore, growth has cooled a touch. GDP rose 0.4% inter-quarter in Q3, down from 0.7% previously. Even so, annual growth held at a respectable 2.1%, broadly in line with what the Reserve Bank of Australia (RBA) had pencilled in for year-end.

The labour market is also starting to show some signs of easing. Employment fell by 21.3K in November, although the Unemployment Rate held steady at 4.3%.

Inflation remains the sticking point: Price pressures are easing, but only gradually as the headline CPI slowed to 3.4% in November, while the trimmed mean edged down to 3.2%, still well above the RBA’s comfort zone.

China helps, just not like it used to

China is still offering some support for the Aussie, though it’s no longer doing the heavy lifting it once did.

Indeed, GDP growth held at 4.0% YoY in the July–September quarter, while Retail Sales rose 1.3% YoY in November. Solid numbers, but a far cry from the growth impulses seen in earlier cycles. More recent data hint at a modest improvement in momentum, with both the official Manufacturing PMI and the Caixin index nudging back into expansion at 50.1 in December.

Services activity has also picked up. The non-manufacturing PMI rose to 50.2, while Caixin’s Services PMI stayed firmly expansionary at 52.0. On the trade front, the surplus widened to $111.68 billion in November, with exports up nearly 6% and imports down almost 2%.

There are a few tentative bright spots on inflation: Headline CPI remained positive at 0.8% YoY in December, though Producer Prices are still falling, down 1.9% YoY, a reminder that deflationary pressures haven’t fully gone away.

For now, the People’s Bank of China (PBoC) is staying patient. Loan Prime Rates (LPR) were left unchanged in December at 3.00% for the one-year and 3.50% for the five-year, reinforcing the sense that any policy support will be gradual rather than aggressive.

An RBA that’s in no rush to ease

The RBA delivered exactly what markets expected at its latest meeting: a “hawkish hold”.

The Official Cash Rate (OCR) was kept unchanged at 3.60% in December, but the tone of the statement remained firm. Policymakers continue to flag capacity constraints and weak productivity as medium-term risks, even as the labour market begins to cool.

That said, Governor Michele Bullock pushed back against expectations for near-term rate cuts, stressing that the Board is weighing an extended pause, and hasn’t ruled out further tightening if inflation refuses to cooperate. Q4 trimmed mean CPI was singled out as a key input, though that data won’t land until late January.

The Minutes published in late December revealed a fair amount of internal debate, with some questioning whether financial conditions are restrictive enough. The message is clear: rate cuts this year are far from a done deal.

That makes the late-January inflation data a potentially pivotal moment for AUD pricing.

For now, markets are pricing in around 36 basis points of tightening by year-end, though the RBA is widely expected to keep rates unchanged at its February 3 meeting.

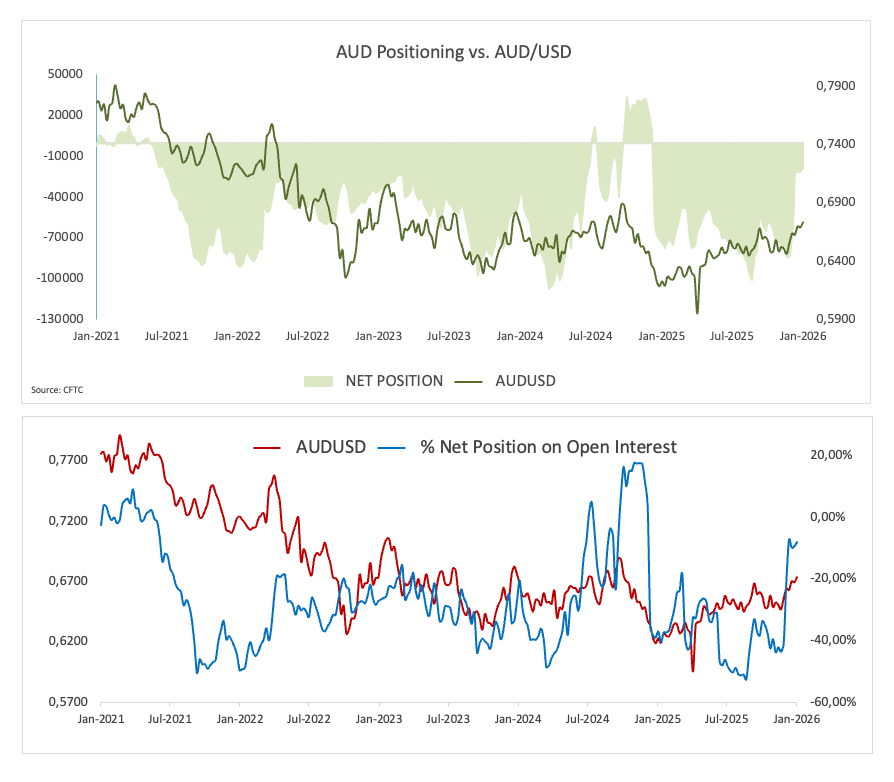

Positioning improves, but conviction is still lacking

The Commodity Futures Trading Commission (CFTC) data for the week ending January 6 show speculative net shorts in the Aussie shrinking to around 19K contracts, the lowest level since September 2024.

At the same time, open interest rose for a second consecutive week, approaching 231K contracts. That points to some renewed buying interest, although a decisive shift into bullish positioning still looks premature.

What could move the needle next

Near term: Markets will be watching Tuesday’s US CPI release closely for short-term direction in AUD/USD.

Risks: A sharp risk-off swing, renewed pessimism around China, or a meaningful rebound in the US dollar could all cap the upside quickly.

Technical picture

The continuation of the ongoing recovery could put AUD/USD en route to its 2026 ceiling of 0.6766 (January 7), prior to the 2024 peak at 0.6942 (September 30), and the 0.7000 milestone.

In the opposite direction, the weekly lows at 0.6659 (December 31) and 0.6592 (December 18) offer initial, albeit minor, contention. The loss of this region could pave the way for a move toward the 0.6590-0.6575 band, where sit the 55-day and 100-day SMAs. Down from here emerges the key 200-day SMA at 0.6514, prior to the November floor at 0.6421 (November 21).

The pair’s near-term positive outlook is expected to persist as long as it trades above its 200-day SMA.

Momentum indicators continue to support the case for additional upside: The Relative Strength Index (RSI) climbs past the 61 level, while the Average Directional Index (ADX) around the 30 region suggests quite a firm trend.

-1768237685637-1768237685637.png&w=1536&q=95)

So, what’s the takeaway?

No fireworks, but no reason to turn bearish either.

AUD/USD remains highly sensitive to swings in global risk sentiment and China’s outlook. A clean break above 0.6800 would likely be needed to signal a more convincing uptrend.

For now, an indecisive US Dollar, steady domestic data, an RBA that isn’t blinking, and modest support from China keep the balance tilted toward gradual gains rather than a sharp upside break.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.