Aussie wavers as RBA governor predicts slower Australian recovery

The Australian dollar was little changed today as investors reacted to a statement by Governor Philip Lowe and mixed data from China. In a statement to a parliamentary panel, Governor Lowe said that the country’s economy was unlikely to recover until the third quarter of the year because of the new outbreak in Victoria, a state responsible for about a third of the Australian economy. He said that people and businesses are likely to remain more cautious on their spending, which will affect consumption and investment. He also said that he preferred a weaker Aussie, which will help spur employment.

The Australian dollar also reacted to mixed data from China. According to the statistics office, the country’s retail sales dropped by 1.1%, which was lower than the median estimate of a 0.1% growth. The country’s industrial production rose by 4.8%, lower than the median estimate of 5.1%. At the same time, fixed asset investments declined by 1.6% while house prices rose by 4.8%. China’s growth has been relatively strong in recent months. It rose by 5.3% in the second quarter while the US contracted by more than 32%.

The euro was little changed as investors reacted to the Eurozone’s economic data. According to Eurostat, the Eurozone’s economy contracted by an annualised rate of 15% in the second quarter. It dropped by 12.1% on a quarter-on-quarter basis. In the quarter, payrolls increased by 155K while in June, the trade surplus increased to €21.2 billion from the previous €9.4 billion. Other data released earlier showed that the French consumer prices increased by 0.8% in July, a modest improvement from the previous month’s 0.2%.

EUR/USD

The EUR/USD pair is trading at 1.1800, which is an important psychological level. The price is along the 50-day exponential moving averages and slightly above the 100-day EMA. The moving average of oscillator has dropped to the negative zone. The price is also between the important support and resistance of 1.1713 and 1.1910. Therefore, the pair is likely to remain in the current holding pattern during the American session.

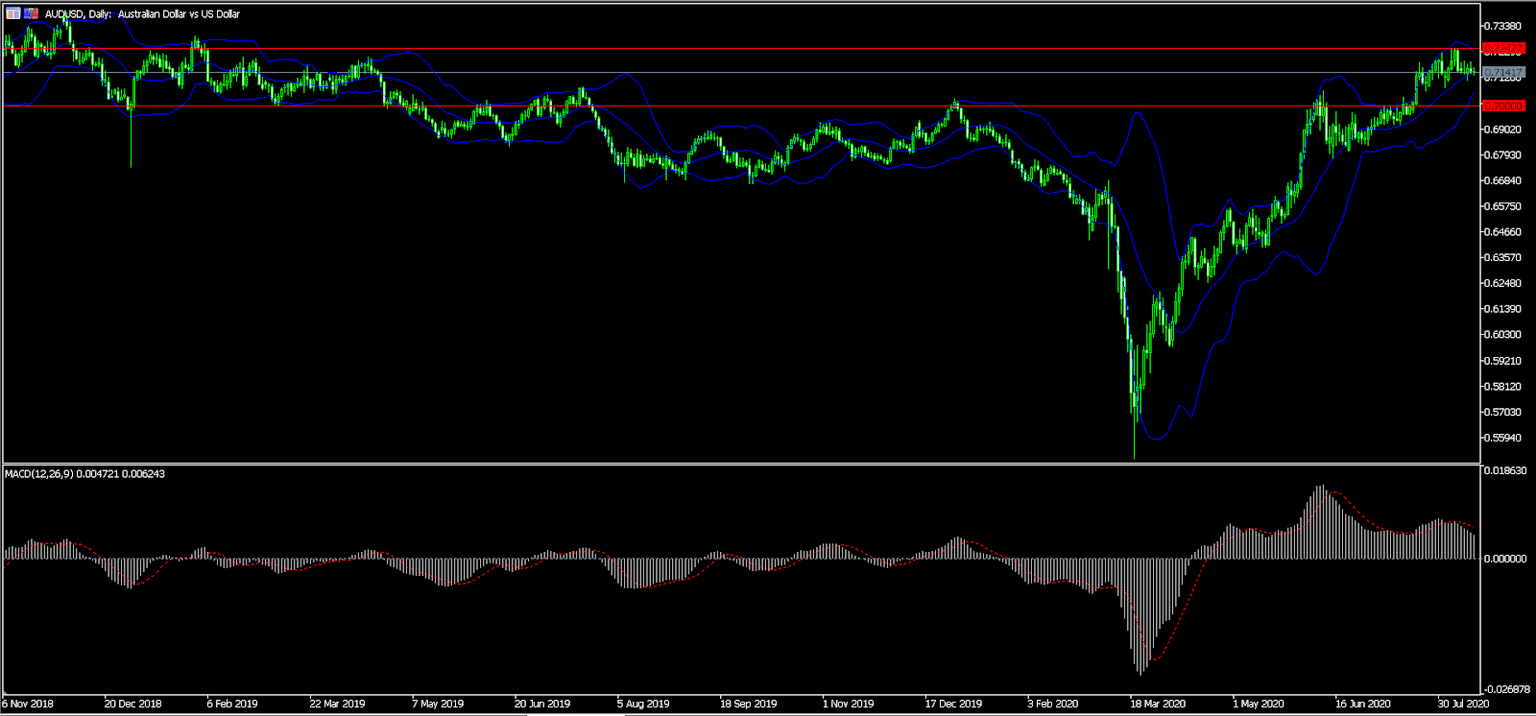

AUD/USD

The AUD/USD pair was little changed today as investors reacted to the statement by Philip Lowe. The pair is trading at 0.7140, which is slightly below this month’s high of 0.7242. On the daily chart, this price is between the middle line of the Bollinger Bands. The signal and main line of the MACD are declining. Also, the price is on the right shoulder of the head and shoulder pattern. Therefore, the price is likely to break out lower as bears target the next support at 0.7000.

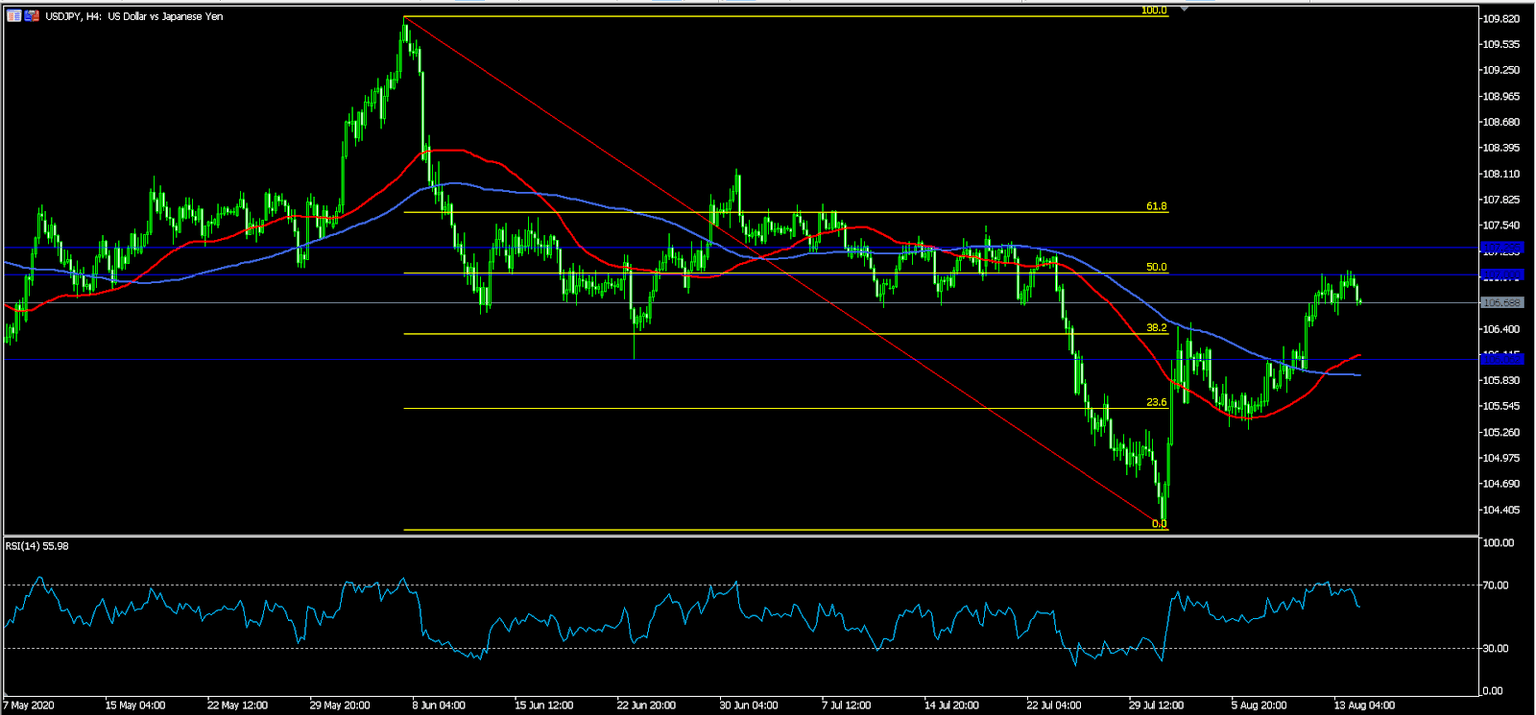

USD/JPY

The USD/JPY pair declined to an intraday low of 106.68, which is the lowest it has been since yesterday. On the four-hour chart, the price is between the 38.2% and 50% Fibonacci retracement level. Meanwhile the RSI has dropped from the overbought level of 70 to the current 55. The pair is likely to continue falling as bears target the next support at 106.50.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.