Aussie shrugs after RBA says no rush to ease

The Australian dollar is showing limited movement on Tuesday. In the European session, AUD/USD is trading at 0.6501, down 0.14% on the day. The Aussie flew out of the gates on Monday, climbing 0.75%.

RBA minutes: No rush to cut rates

The Reserve Bank of Australia has maintained its cash rate at 4.35% over the past year, making it an outlier among other major central banks that are in the midst of a rate-cutting cycle. The RBA released the minutes of the meeting earlier this month, which indicated that policymakers are not in any rush to lower rates.

The minutes stated that the Board considered underlying inflation to be “too high” and it did not expect inflation to return sustainably to the 2%-3% target range until 2026. The Board remained “viligant to the upside risks of inflation” and that “it was not possible to rule anything in or out in relation to future changes in the cash rate target”. That is a long way of saying that the Bank has not ruled out rate cuts or hikes.

The minutes reiterated that the Board’s highest priority is returning inflation to target. Given that the Board stated that inflation remains too high and goods inflation is expected to rise, the message from the minutes is that a rate cut is not imminent. The minutes served as a message to the markets that the RBA is willing to maintain rates unless inflation falls unexpectedly. The RBA meets next on Dec. 10 and is expected to hold rates.

AUD/USD technical

-

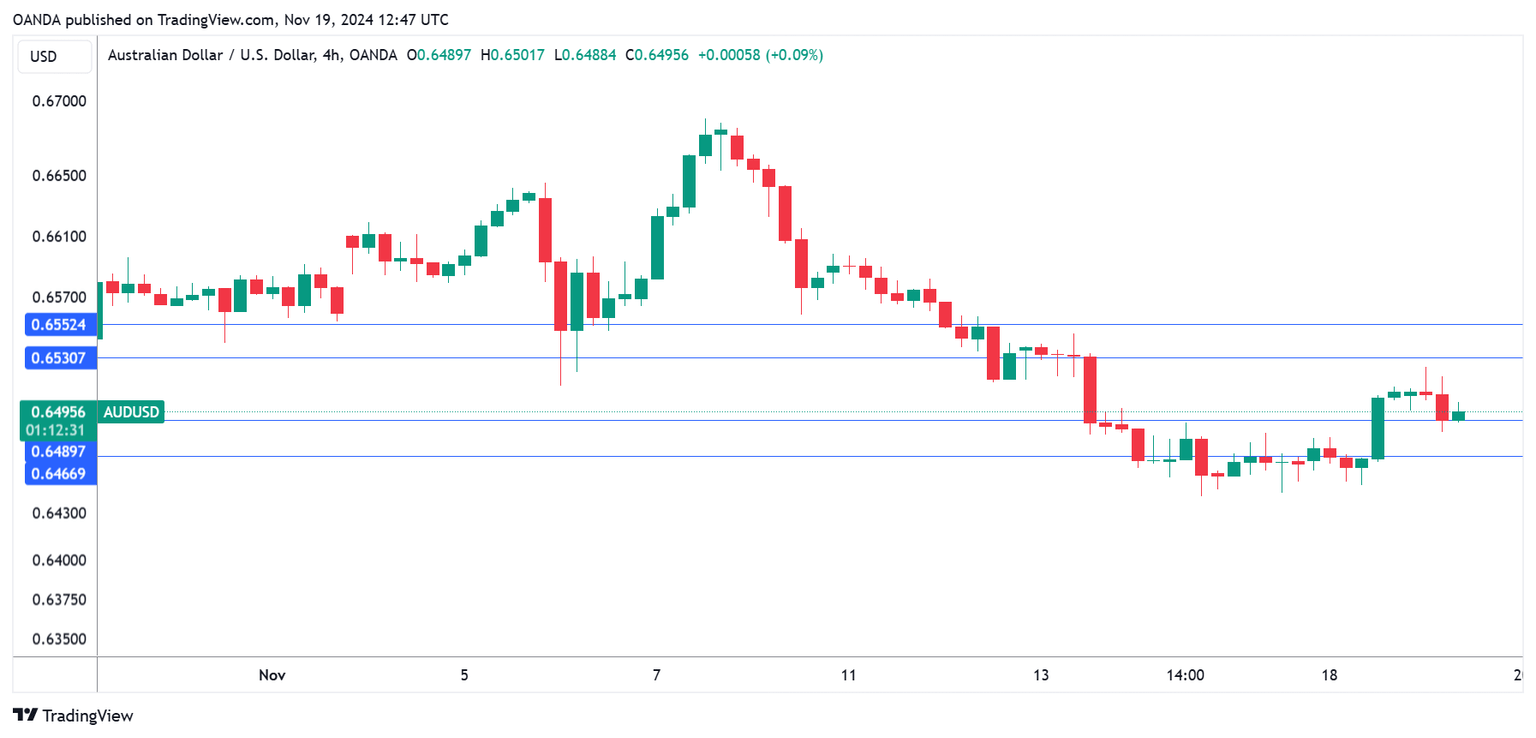

AUD/USD tested support at 0.6489 earlier. Below, there is support at 0.6467.

-

0.6530 and 0.6552 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.