AUD/JPY: Possible sleeper trade – FXStreet Signals

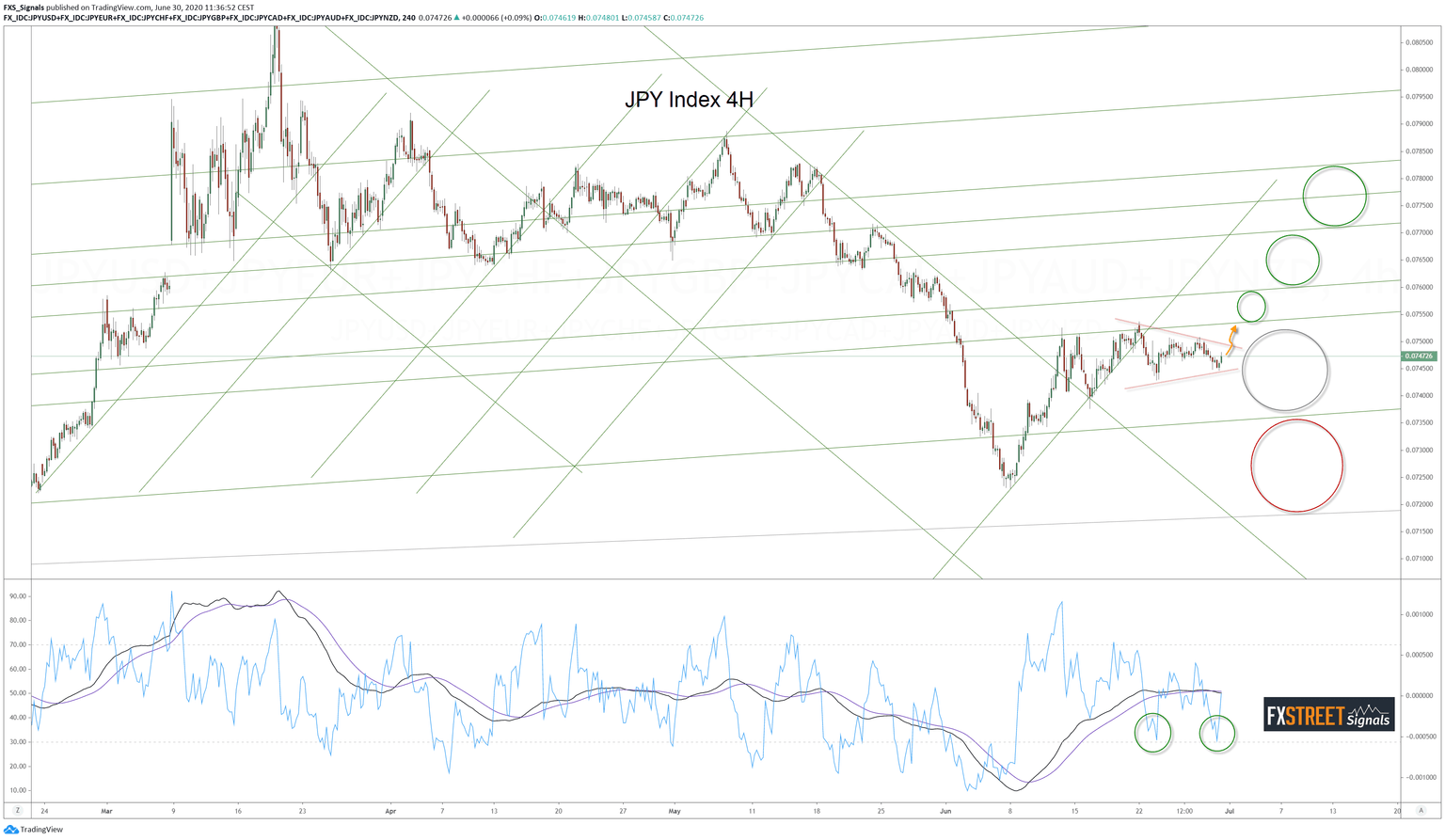

Using our discretion, we intend to add to the JPY exposure another AUDJPY short trade. From a technical view, both currencies, in their indexed form, are in no-man's-land as most of the major currencies have been the past two weeks. But we do see signs of at least a short-term continuation which could put us in positive for this trade. Eventually, on a progression to profits, we would add to the position. These are the carts for the AUD and JPY separately:

On the AUDJPY it would look like an entry at market with SL at 74.20 and TP at 72.45 risking 50 pips to target 125 aprox.

For more info on the FXStreet Signals service click here.

Author

Gonçalo Moreira, CMT

Independent Analyst

As a trader in the foreign exchange market since 2005, Gonçalo Moreira honed his analytic and strategic skills through the Chartered Market Technician (CMT) designation.