AUD/USD struggles for stability: Chances are slim

The AUD/USD pair is attempting a recovery toward 0.6681, though the prospects seem uncertain as the pair remains near a six-week low. The strengthening of the US dollar and the rise in US Treasury yields, driven by expectations of a confident victory for Donald Trump in the upcoming US presidential election, are weighing heavily on the Australian dollar.

Despite ongoing expectations for interest rate cuts by the US Federal Reserve in November and December, signs of stability in the US economy further bolster the US dollar. However, the market is tempering its expectations for further monetary easing next year.

On the domestic front, Australia's recent labour market data was positive. September figures showed a job increase of 64.1k, significantly above the forecasted 25.0k. The unemployment rate held steady at 4.1%. Investors are now looking forward to upcoming PMI data, which could provide further insights into the health of Australia's economy.

Despite these positive domestic indicators, China's influence remains a critical factor for the Australian dollar, given its role as Australia's primary trading partner. The market has deemed recent stimulus measures in China insufficient, adding to the challenges for the AUD.

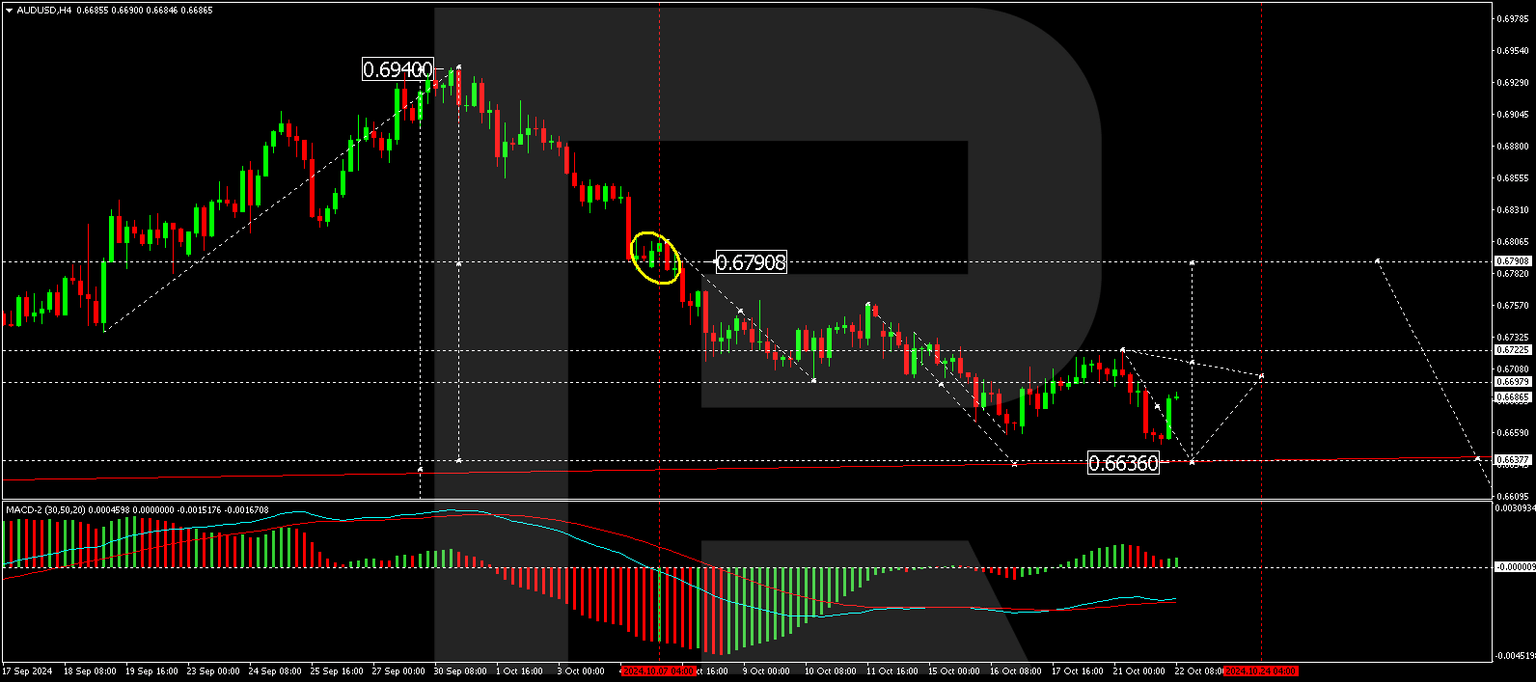

Technical analysis of AUD/USD

The AUD/USD is downward towards the target level of 0.6636. Upon reaching this target, the market may form a new consolidation range at these lows. If an upward breakout occurs, a correction towards 0.6790 might be considered. The MACD indicator supports this scenario, with its signal line below zero and poised for potential growth, suggesting a possible shift in momentum.

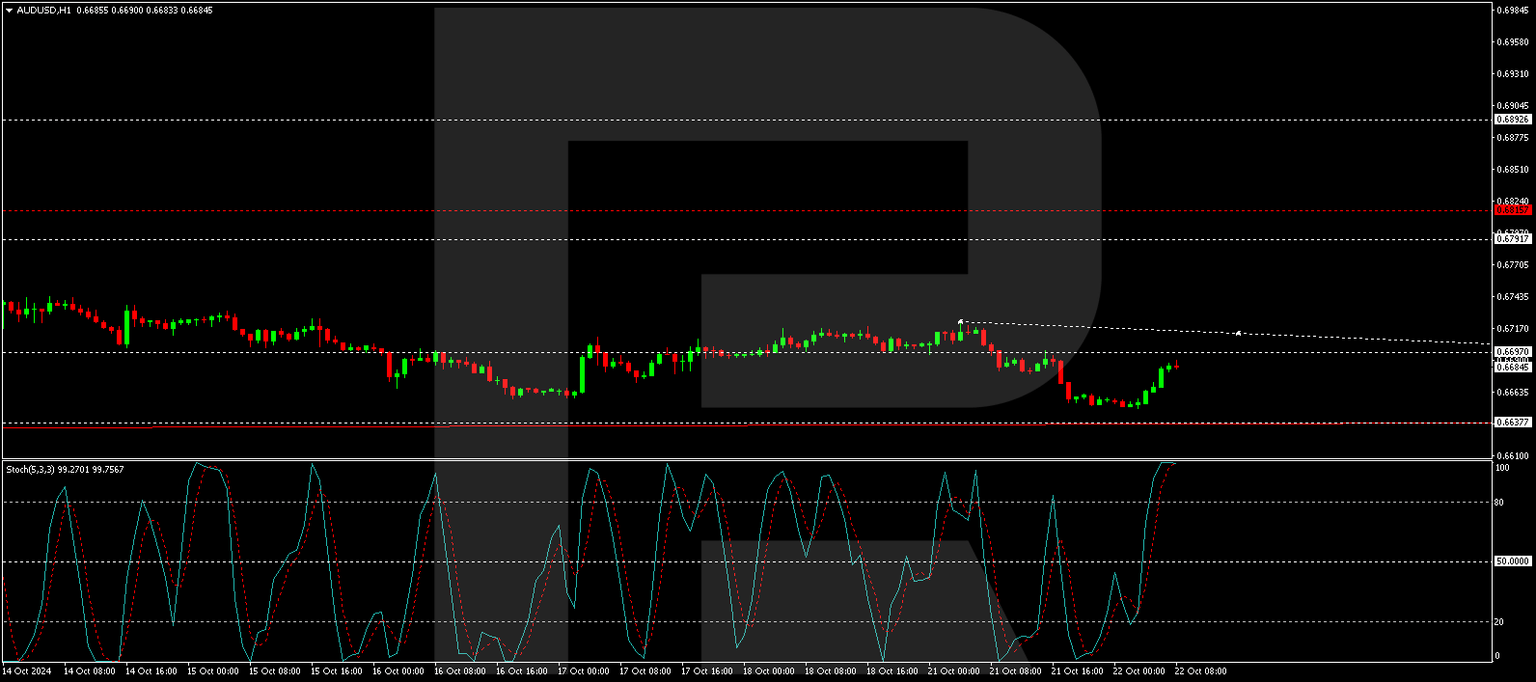

On the hourly chart, AUD/USD has completed a downward wave to 0.6650, followed by a correction to 0.6690. Another downward movement towards 0.6636 is anticipated today. A subsequent growth wave towards 0.6722 may develop if this level is reached. The Stochastic oscillator backs this outlook, with its signal line currently above 80 but expected to descend sharply towards 20, indicating the potential for further downward movement before any recovery.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.