AUD/USD Price Forecast: There is a minor hurdle around 0.6360

- AUD/USD added to Tuesday’s improvement beyond 0.6300.

- The US Dollar navigated a narrow range near recent lows.

- US recession fears and tariff concerns remained well in place.

The Australian Dollar (AUD) managed to extend Tuesday’s uptick past the 0.6300 hurdle on Wednesday, following the vacillating mood around the US Dollar (USD), which left the US Dollar Index (DXY) near its recent multi-month troughs.

Meanwhile, AUD/USD kept its rebound alive and rose to new two-day peaks near 0.6320 on the back of the widespread better sentiment in the risk-linked galaxy.

Trade tensions still in focus

Fresh tariffs—including a 25% levy on Canadian and Mexican products and a 20% duty on Chinese imports—continue to rattle investors, raising the spectre of retaliatory moves and the threat of a broader trade war.

Risk-sensitive currencies like the Aussie are especially vulnerable, given that a slowdown in China—Australia’s largest trading partner—could curb demand for Australian commodity exports. This concern appeared somewhat alleviated following extra gains in copper and iron prices on Wednesday.

Central banks and inflation: The ongoing narrative

Worries over trade-related inflation could force the Federal Reserve (Fed) to maintain tighter monetary policy for longer. However, growing fears of a US economic slowdown may yet alter the Fed’s stance, a view that seems to have been propped up by lower-than-expected US CPI data in February.

In Australia, the Reserve Bank (RBA) reduced its benchmark rate by 25 basis points in February, bringing it down to 4.10%. While RBA Governor Michele Bullock emphasized that future decisions hinge on inflation data, Deputy Governor Andrew Hauser signalled caution over expecting multiple cuts. Still, market chatter points to as much as 75 basis points of additional easing over the next year amid global trade uncertainties.

Inflation and rate outlook Down Under

Australia’s January Monthly CPI Indicator came in at 2.5%, just below estimates. Minutes from the latest RBA meeting showed policymakers debating whether to hold rates steady or make a small cut; they ultimately chose the latter while clarifying it did not guarantee a full easing cycle. Officials also noted that Australia’s interest rate peak is relatively low compared to other countries and that its labour market remains solid.

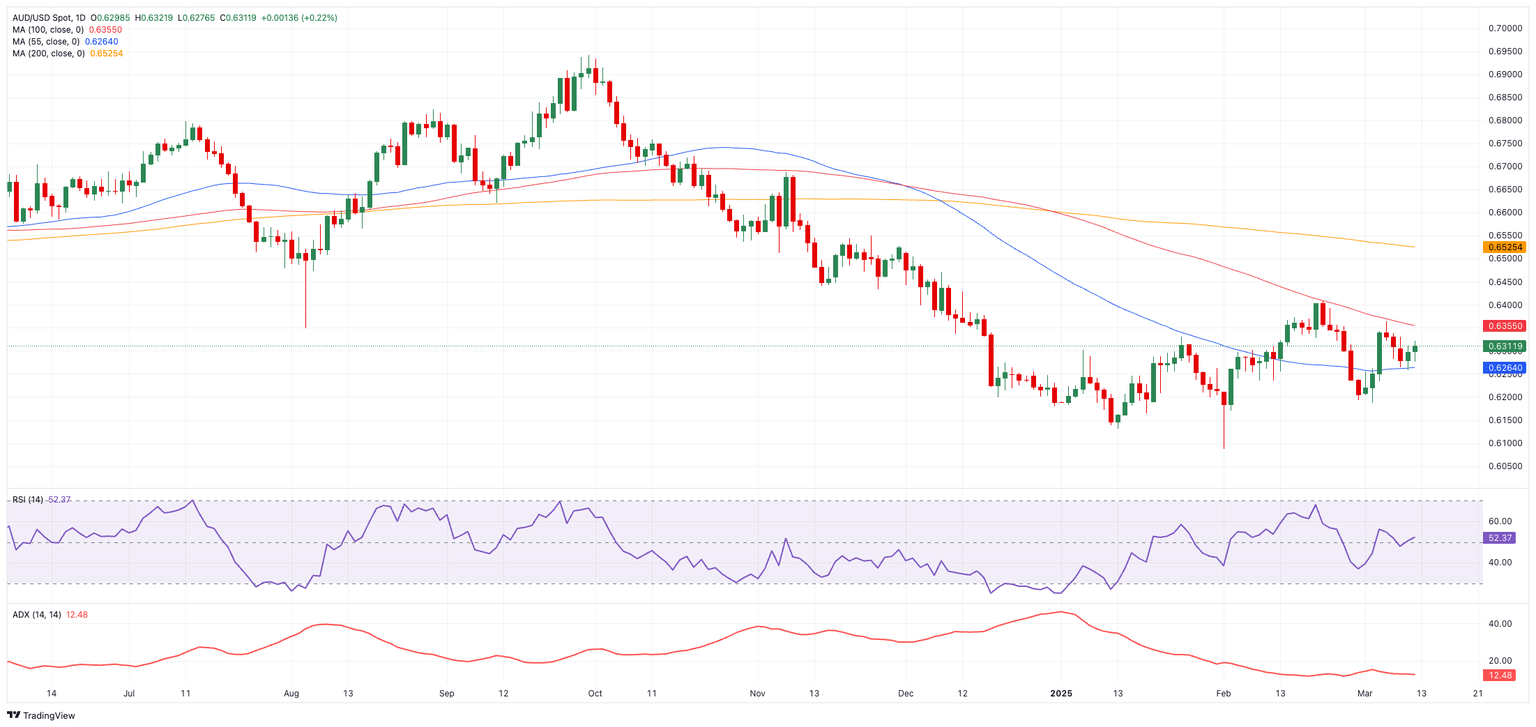

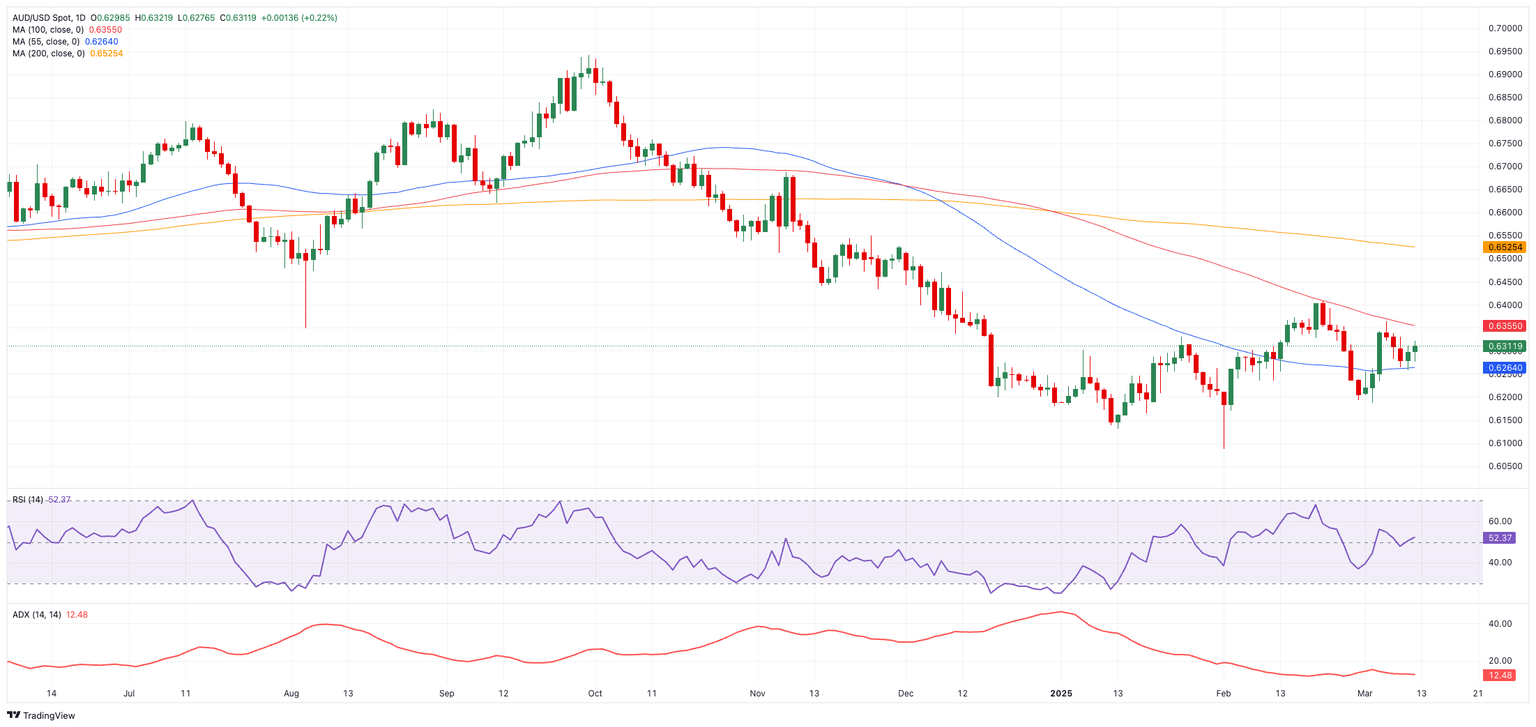

AUD/USD technical view

If AUD/USD can surpass its March high of 0.6363 (March 6), the next test is the 2025 peak at 0.6408 (February 21). A clear break above that level could open the door to the 200-day Simple Moving Average (SMA) at 0.6528.

On the downside, initial support lies at the March low of 0.6186 (March 4). A more pronounced drop could see the pair targeting the 2025 bottom at 0.6087 or even the psychologically significant 0.6000 threshold.

Momentum indicators shifted to slightly bullish, although still remain unclear. That said, the Relative Strength Index (RSI) above 52 points to some pick-up of the bullish bias, while the Average Directional Index (ADX) near 12 continues to suggest a generally weak trend.

AUD/USD daily chart

Key data releases ahead

Key data releases ahead

Looking forward, traders will monitor Australia’s final Building Permits, Private House Approvals, and Industrial Production figures, due on March 13, for further clues about the Aussie’s near-term direction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.