AUD/USD Price Forecast: The 0.6600 region continues to cap the upside

- The AUD/USD begins the week weakly and declines to 0.6550.

- Trade jitters and Trump's tariff threats generate additional momentum for the US Dollar.

- Investors will shift their attention to the upcoming US CPI data.

The Australian Dollar (AUD) extended its losses for a second straight session on Monday, with AUD/USD returning to the 0.6550-0.6540 range.

The RBA's rate hold and dovish signals

The unexpected hold on interest rates by the Reserve Bank of Australia (RBA) earlier in the month, keeping its cash rate at 3.85%, provided much of the impetus for the rally in the subsequent days. Returning to the bank's steady hand, six out of nine board members voted in favour of maintaining rates, while three others preferred a reduction of 25 basis points.

Governor Michele Bullock later characterised the split as one of timing rather than policy direction, signalling that easing would follow if second-quarter inflation data were aligned with forecasts.

In the wake of the event, futures markets have begun pricing in nearly a 90% chance of a rate cut in August and have raised the projected terminal rate from 2.85% to 3.10%.

The impact of Chinese data on the economic outlook is mixed

Data from Australia’s largest trading partner offered mixed support.

Chinese industrial output, retail sales, and services activity all beat expectations in May, keeping official PMI readings near the expansion-contraction threshold and underpinning a consensus forecast of roughly 5% GDP growth for 2025.

But a sluggish property market and the gradual rollback of stimulus measures cloud the outlook for China’s commodity-dependent economy, while consumer inflation remains subdued at just 0.1% annually in June.

Monday’s data releases saw China’s trade surplus widen to $114.77 billion in June, with Exports up by 5.8% and Imports rising by 1.1%, all ahead of the key Q2 GDP results and extra hard data due on Tuesday.

Divergent central bank narratives

Monetary policy narratives appear to be diverging. The RBA’s cautious stance echoes the Federal Reserve’s (Fed) decision in June to hold the benchmark rate, but recent comments from Fed Chair Jerome Powell, warning that US tariffs could rekindle goods-price inflation, have raised the prospect of a sharper policy split should inflation reaccelerate in either economy.

Speculators remain bearish on the Aussie

According to the Commodity Futures Trading Commission (CFTC) data, speculative positioning in the Australian currency shifted towards the bearish camp during the week ending July 8: Net short positions in AUD increased to around 74.3K contracts, or two-week highs, amid the fourth consecutive weekly increase in open interest, this time to nearly 153.4K contracts, a sign that pessimism is well in place.

What about techs?

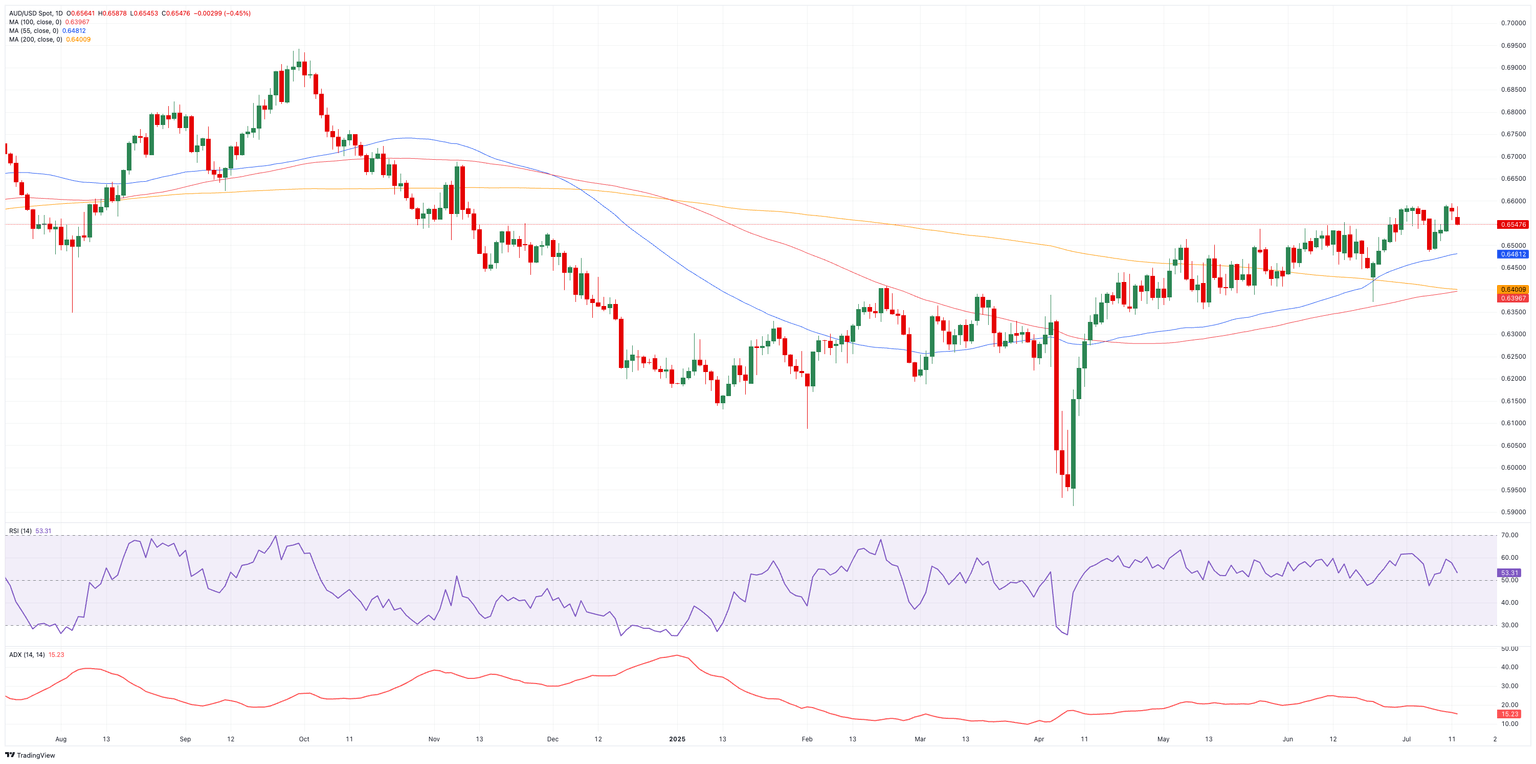

AUD/USD must clear the 2025 high of 0.6590 (June 30) to target the November 2024 peak of 0.6687 and, ultimately, the pivotal 0.7000 level.

Immediate support lies at the July trough of 0.6485 (July 7), prior to the transitory 55-day SMA at 0.6479 and then the 200-day SMA at 0.6405. Down from here sits the June trough of 0.6372 (June 23) and the May base at 0.6356.

Momentum indicators are mixed: the RSI eases to nearly 53, suggesting there is still room for some upside, but the ADX below 17 points to a trend lacking conviction.

AUD/USD daily chart

To sum up

With China’s recovery uneven and both Beijing and Washington hinting at further trade policy adjustments, the Australian Dollar may remain range-bound until one of the major economies delivers a more definitive catalyst.

On the monetary policy front, the RBA is expected to remain cautious, despite signalling that further rate reductions are in the pipeline. If it materialises, the easing cycle is predicted to be gradual rather than aggressive.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.