AUD/USD Price Forecast: The 0.6300 region remains a strong resistance

- AUD/USD added to Monday’s uptick but faltered ahead of 0.6300.

- Chief Powell’s testimony failed to lend support to the US Dollar.

- Australia’s Consumer Confidence rose by 0.1% in January, Westpac said.

The US Dollar (USD) has faded part of the optimism seen at the beginning of the week, coming under renewed downside pressure and motivating the US Dollar Index (DXY) to flirt once again with the 108.00 key support.

The Aussie ignores tariffs, gathers pace on USD selling

The Australian Dollar (AUD) mirrored its risk-linked peers on Tuesday, prompting AUD/USD to extend the promising start to the week and once again trade at shouting distance from the key hurdle around 0.6300. It is worth recalling that the pair kept its recovery-mode well in place after dropping below 0.6100 just a week ago, a region last seen back in April 2020. Against that backdrop, spot entered its second consecutive week of gains.

Trade turbulence and tariff tensions

Trade dynamics have been especially unpredictable lately. While President Trump’s decision to delay a 25% tariff on Canadian and Mexican imports by a month offered a brief boost for riskier assets, fresh threats of further tariffs to be announced in the short-term horizon lent extra wings to the Greenback on Monday.

On another end, when the US slapped a 10% tariff on Chinese imports, concerns about potential retaliation from Beijing surged. This development is particularly worrying for Australia since China is its largest export market. With hints that Beijing might challenge these tariffs at the WTO, there's growing anxiety that demand for Australia’s resource exports could take a hit.

Inflation, Fed policy, and what lies ahead

In the meantime, while the US Dollar has regained part of the ground lost during the first half of last week, the threat of a full-blown trade war still looms. Such tensions could drive up inflation in the US, pushing the Federal Reserve (Fed) to keep interest rates high for a longer period.

Meanwhile, all eyes are on the Reserve Bank of Australia (RBA). Recent data suggests that inflationary pressures in Australia are easing—a glancing at the Q4 Consumer Price Index (CPI) shows a yearly increase of 2.5%, down from 2.8% in the previous quarter. More strikingly, the trimmed mean CPI, a key gauge for the RBA, has dropped to a three-year low of 3.2%. This has led many to expect a 25 basis point rate cut at the upcoming meeting on February 18, with the possibility of further easing over the next year.

Commodities lend a helping hand

On the commodities front, even though weaker Chinese demand has traditionally weighed on Australian exports like iron ore and copper, prices for these key resources remain in centre stage and have receded from recent tops in the last couple of days.

Technical snapshot

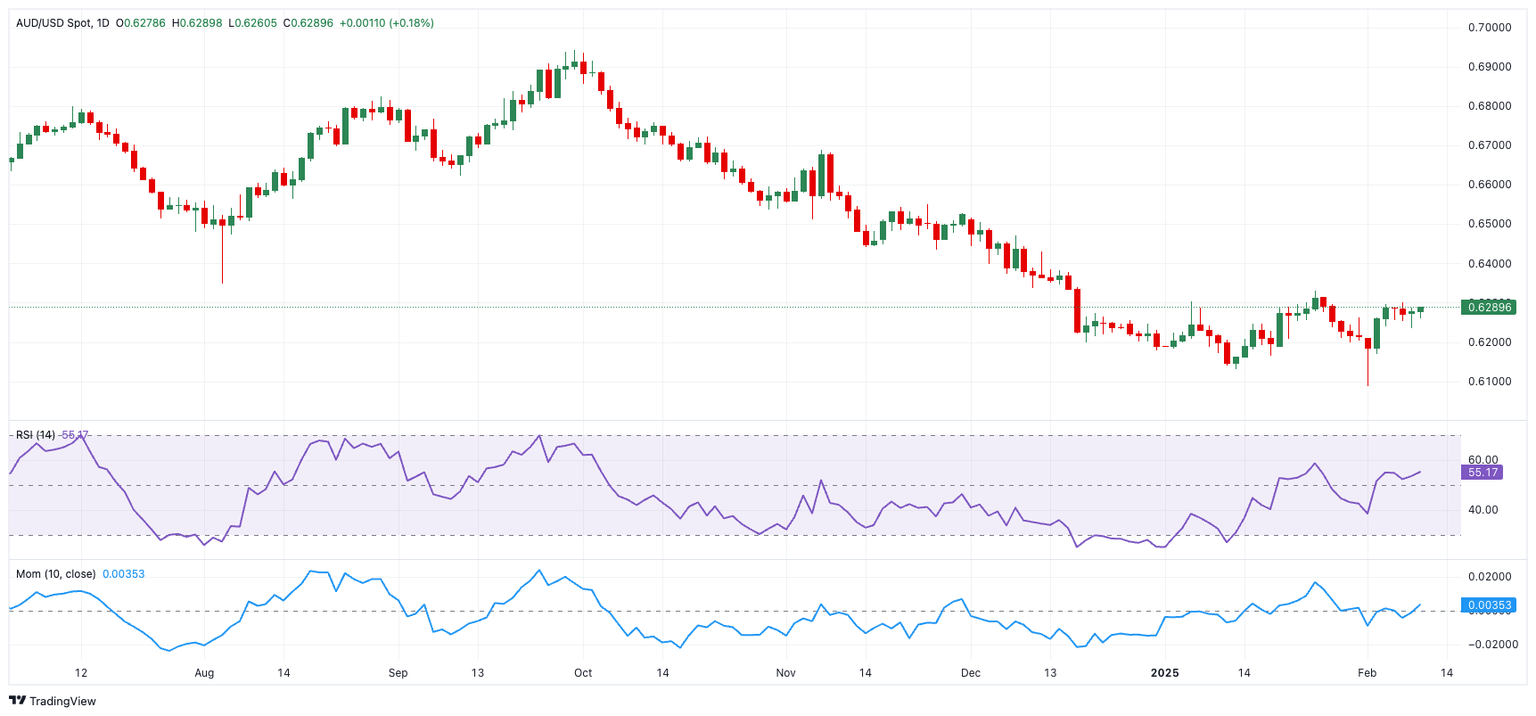

From a technical perspective, investors should remain cautious. For AUD/USD, a crucial support level is at 0.6087—the lowest we've seen this year. If the pair falls below this, it might quickly slide toward 0.6000. On the upside, resistance is present around 0.6330, with a tougher barrier at 0.6549, which was the weekly high back on November 25.

While the Relative Strength Index (RSI) has nudged to the vicinity of 55, hinting at some bullish momentum, the Average Directional Index (ADX) has dropped to around18, suggesting that the current trend might be losing steam.

AUD/USD daily chart

What’s Next?

Looking ahead, the Australian calendar will include:

- Data on Home Loans and Investment Lending for Homes on February 12.

- The Melbourne Institute will release its Consumer Inflation Expectations February 14.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.