AUD/USD Price Forecast: Tariffs weigh on potential gains

- AUD/USD dropped to multi-day lows near 0.6320 on Tuesday.

- The US Dollar reversed recent gains despite the tariff narrative.

- The RBA’s Monthly CPI Indicator comes next on the docket.

The US Dollar (USD) drifted lower and set aside part of the recent gains on Tuesday, returning to the lower end of its recent range and trading at shouting distance from multi-week lows when gauged by the US Dollar Index (DXY).

In the meantime, the Australian Dollar (AUD) added to the ongoing leg lower and retested the 0.6330-0.6320 band, extending the rejection from recent yearly peaks north of 0.6400 the figure as the tariff narrative continued to weigh on sentiment.

Lingering tariff worries

Indeed, ongoing trade disputes continue to sway currency markets. Currencies that thrive on risk, like the Australian Dollar, have benefited from the weaker US Dollar, although renewed concerns about fresh United States (US) tariffs have been taking a toll on the Aussie’s performance as of late.

Earlier this month, President Donald Trump gave markets a temporary boost by delaying a planned 25% tariff on Canadian and Mexican goods for one month. However, optimism soon waned when the US announced the possibility of a 10% tariff on Chinese imports, sparking fears of retaliation from Beijing.

Because China is Australia’s biggest export market, any escalation in tariffs could dampen demand for Australian commodities.

Central bank crossroads

Despite the recent ups and downs for the Greenback, investors remain cautious about further trade conflicts that might push inflation higher and keep the Federal Reserve (Fed) on a path toward more restrictive policy.

In Australia, the Reserve Bank of Australia (RBA) trimmed its policy rate by 25 basis points to 4.10% at its February meeting—a widely expected move that the bank insists is not the start of a broader easing cycle. Underlying inflation is expected to hover around 2.7%, and better-than-anticipated jobs data prompted the RBA to lower its unemployment forecast to 4.2%.

Last Friday, Governor Michele Bullock said there is potential for more rate cuts, though any additional easing will depend on continued moderation in inflation. Speaking before lawmakers, she urged patience and stressed that decisions would be driven by incoming data.

That caution is underscored by January’s robust employment figures, which showed a gain of 44K new positions—mostly full-time—and a dip in the jobless rate to 4.1%, just below the RBA’s projection.

Deputy Governor Andrew Hauser later remarked that market pricing of fewer than 50 basis points of rate reductions over the next year might still be too optimistic.

Commodities treading carefully

Australia’s economic outlook is deeply connected to its commodity exports, making any slowdown in Chinese demand a potential headwind. On Tuesday, copper prices deepened the ongoing decline, while iron ore prices managed to gather some fresh upside traction after three days of losses.

Key technical levels

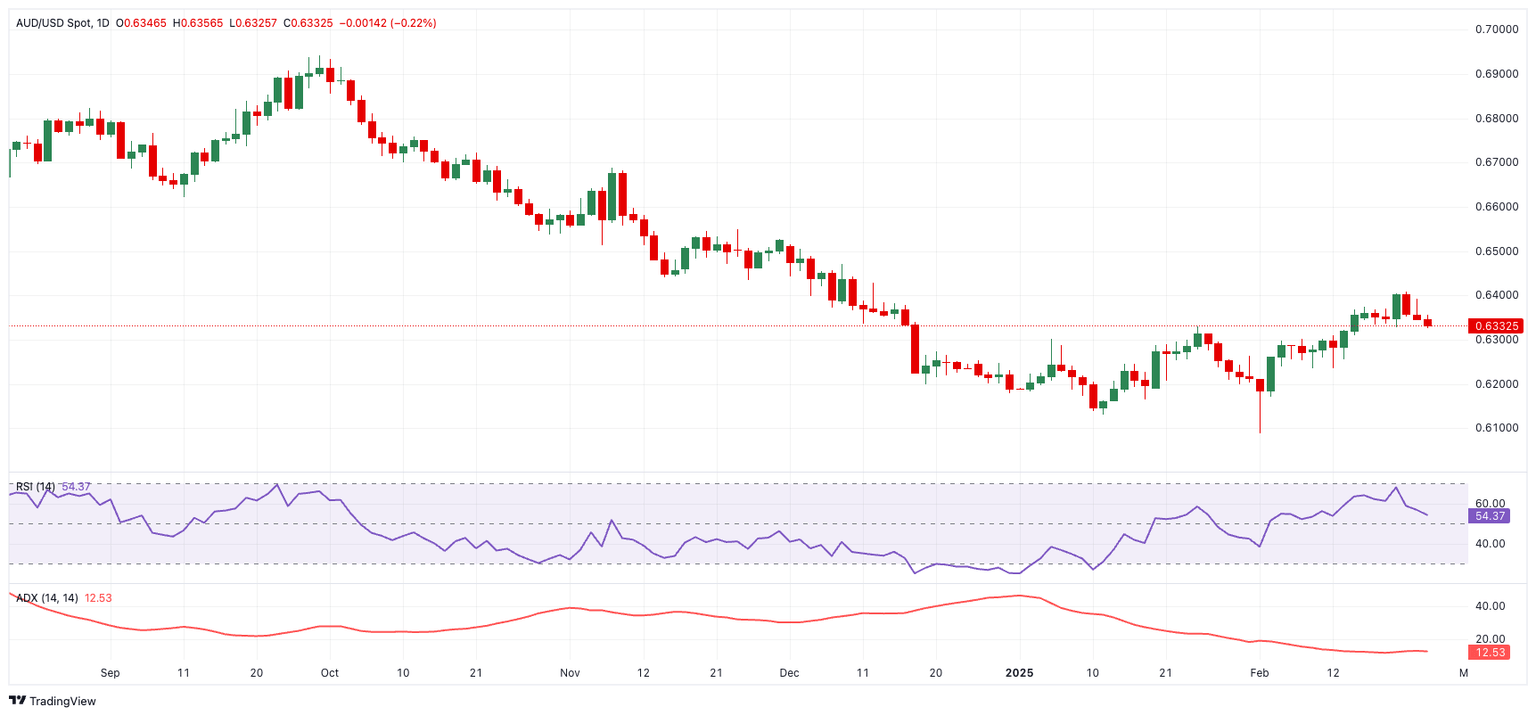

The immediate up-barrier is the 2025 high of 0.6408 (recorded on February 21), a level reinforced by the temporary 100-day Simple Moving Average (SMA). Further up comes the weekly top of 0.6549 (November 25), which aligns closely with the 200-day SMA.

On the downside, interim support stands at the 55-day SMA around 0.6272, then the 2025 bottom of 0.6087, and finally the psychological 0.6000 mark.

In addition, technical indicators offer mixed signals: the Relative Strength Index (RSI) drops to around 55, suggesting a mild loss of momentum, while the Average Directional Index (ADX) below 13 indicates a rather weak overall trend.

AUD/USD daily chart

Looking ahead

All eyes will be on the RBA’s Monthly CPI Indicator due on February 26, along with Construction Done figures. The following day brings quarterly Private Capital Expenditure (Q4) data, with Housing Credit and Private Sector Credit numbers rounding out the week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.