AUD/USD Price Forecast: Positive outlook intact above the 200-day SMA

- AUD/USD faltered just ahead of the key 0.6500 barrier on Monday.

- The US Dollar advanced amid decent gains following Friday’s sell-off.

- Australia’s final PMIs are next, alongside business activity prints in China.

The Australian Dollar (AUD) struggled to extend Friday’s upside momentum, with AUD/USD stuttering just ahead of the key 0.6500 barrier on Monday. The inconclusive price action in spot followed an acceptable bounce in the Greenback after investors digested the post-NFP steep decline.

A tale of two data sets

Domestic inflation proved stubborn in the second quarter, with headline CPI up 0.7% QoQ (2.1% YoY) and June’s CPI Monthly Indicator at 1.9%. Core pressures eased only slightly, as the RBA’s trimmed-mean measure rose 0.6% QoQ (2.7% YoY).

However, the flash PMIs provided some optimism: manufacturing increased to 51.6 and services to 53.8, both comfortably above the 50-point expansion threshold, while retail sales experienced a 1.2% increase in June. The labour market, by contrast, added just 2K jobs last month, pushing unemployment to 4.3% as participation crept up to 67.1%.

RBA on the sidelines… for now

Earlier this month, the Reserve Bank of Australia (RBA) surprised markets by leaving its cash rate at 3.85%. Governor Michele Bullock framed the decision as “timing rather than direction”, signalling readiness to cut if inflation continues easing. Futures markets now see roughly 75 basis points of rate cuts priced in for the year ahead, with August still possible—if far from certain. Last week, Deputy Governor Andrew Hauser called June’s inflation print “very welcome” and reiterated the RBA’s commitment to a gradual path lower.

China’s fitful recovery

Australia’s largest trading partner remains uneven. Q2 GDP rose 5.2% YoY and industrial output 7%, yet retail sales languished below 5%. Beijing has held its one- and five-year Loan Prime Rates (LPR) at 3.00% and 3.50%, respectively, for now. Meanwhile, July’s Manufacturing and Non-Manufacturing PMIs slipped to 49.3 and 50.1, respectively, underscoring the fragility of China’s rebound. On Tuesday, Caixin gauges of business activity should give further details on how both the manufacturing and services sectors fared last month.

Widening policy divide

With the Fed signalling a prudent approach to tame US inflation—and lawmakers squaring up over tariffs—the yield gap continues to weigh on the Aussie. By contrast, the RBA flirts with easing, keeping the currency pinned in its familiar summer range.

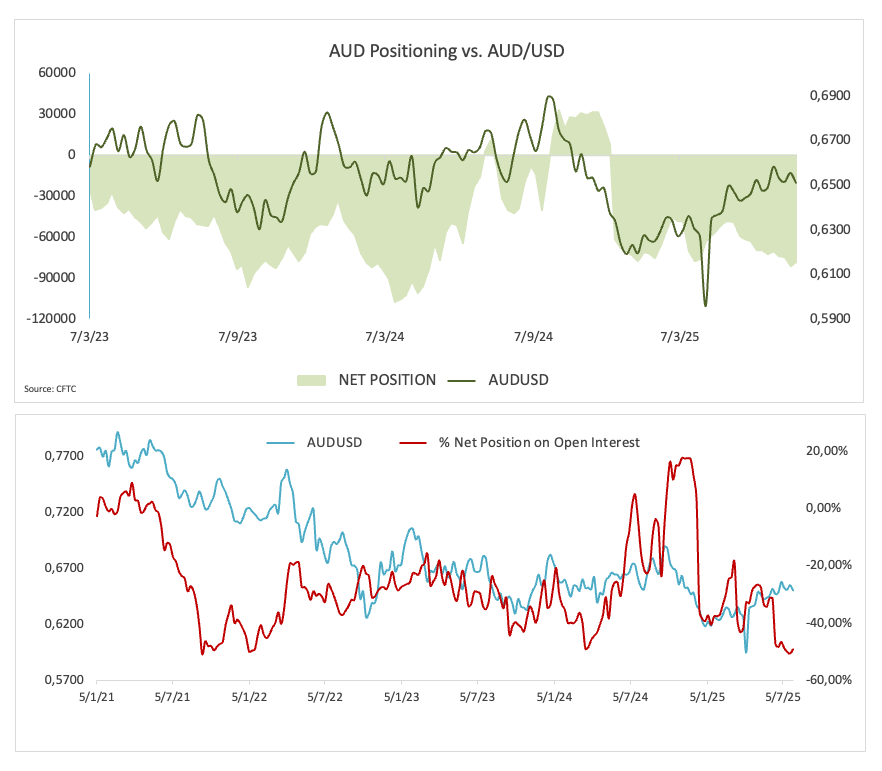

Speculative shorts drop

Commodity Futures Trading Commission (CFTC) data for the week to 29 July show speculators trimming AUD shorts, pushing net positions to just over 78K contracts—or two-week lows—while open interest eased to around 159.7K contracts.

Levels to watch

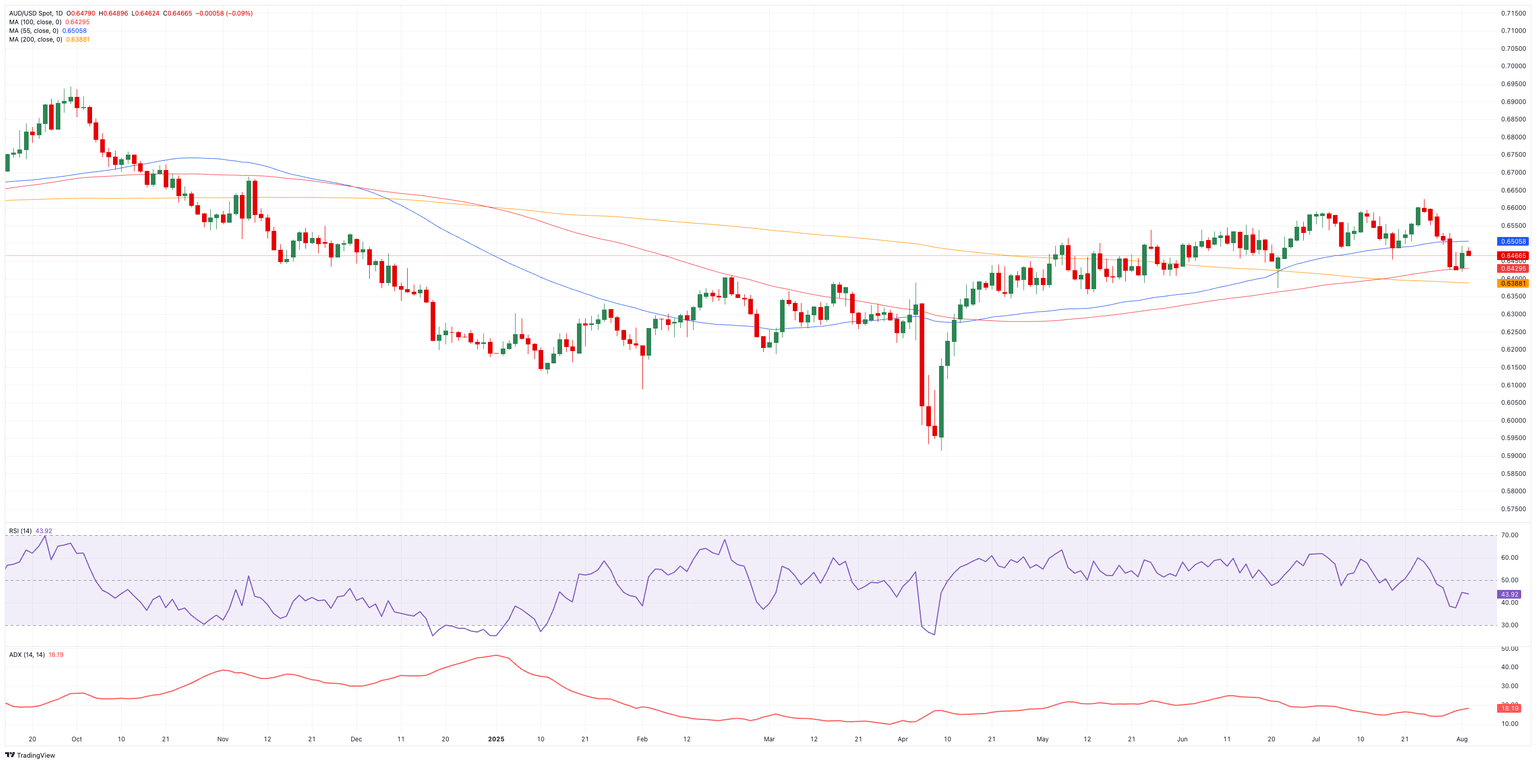

The pair’s immediate upside barriers stand at 0.6625, the 2025 high (July 24), with resistance then rising to the November 2024 ceiling of 0.6687 (November 7) and the key 0.7000 mark.

To the downside, The August floor of 0.6418 (August 1) precedes the ley 200-day SMA at 0.6390 and the June base of 0.6372 (June 23).

The Relative Strength Index (RSI) remains around 44, still signalling downward pressure, yet an Average Directional Index (ADX) above 18 suggests the current trend still lacks conviction.

AUD/USD daily chart

Looking ahead

Unless China stuns markets with stronger data, the Fed pivots on policy, or the RBA springs a surprise, the Aussie is likely to drift through its familiar summer range—waiting for a fresh catalyst to trigger the next meaningful breakout.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.