AUD/USD Price Forecast: Outlook should shift to bullish above the 200-day SMA

- AUD/USD could not sustain an initial move to fresh yearly tops near 0.6450.

- The US Dollar gathered fresh upside impulse on easing tariff concerns.

- Australia’s inflation data should take centre stage in the next few days.

The Australian Dollar (AUD) climbed to a fresh yearly high near 0.6450 vs. the US Dollar (USD) on Tuesday, although AUD/USD could not sustain that initial push and eventually receded to the sub-0.6400 region as the Greenback’s momentum improved as the day progressed.

The US Dollar’s recovery was largely driven by mitigated jitters on the US-China trade conflict, while a week packed of key data releases in the US is expected to keep the volatility around the currency on the rise.

Given Australia’s deep economic ties with China, the Aussie remains highly sensitive to geopolitical trade developments.

Central banks hold steady as inflation and tariffs loom

Both the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA) opted to leave interest rates unchanged at their most recent meetings, adopting a wait-and-see stance amid persistent inflation risks and global trade uncertainty.

Fed Chair Jerome Powell reaffirmed the central bank’s commitment to anchoring inflation expectations, while noting that future policy decisions would remain data dependent.

Meanwhile, RBA Governor Michele Bullock cited sticky inflation and a tight labour market as reasons for keeping rates on hold at 4.10%. Markets are now pricing in a roughly 70% chance of a rate cut by the RBA in May.

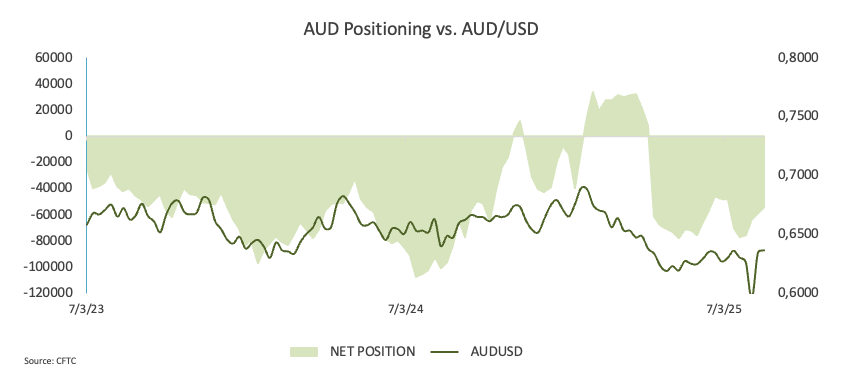

Speculative positioning: Shift in sentiment?

Speculative positioning on the Aussie continued to improve in the week to April 22, according to the latest CFTC report. That said, non-commercial traders reduced their net short bets to around 54.5K contracts amid a decent increase in open interest. This decline suggests that bearish sentiment may be starting to ease.

What’s next in Oz

A quite interesting docket Down Under will feature Q1 Inflation Rate, the RBA’s Monthly CPI Indicator, Housing Credit, and Private Sector Credit figures on April 30, while the release of the final S&P Global Manufacturing PMI, Balance of Trade data, Commodity Prices, and Q1 Import and Export Prices are expected on May 1. Finally, the always relevant Retail Sales figures wil grab attention on May 2, seconded by Producer Prices.

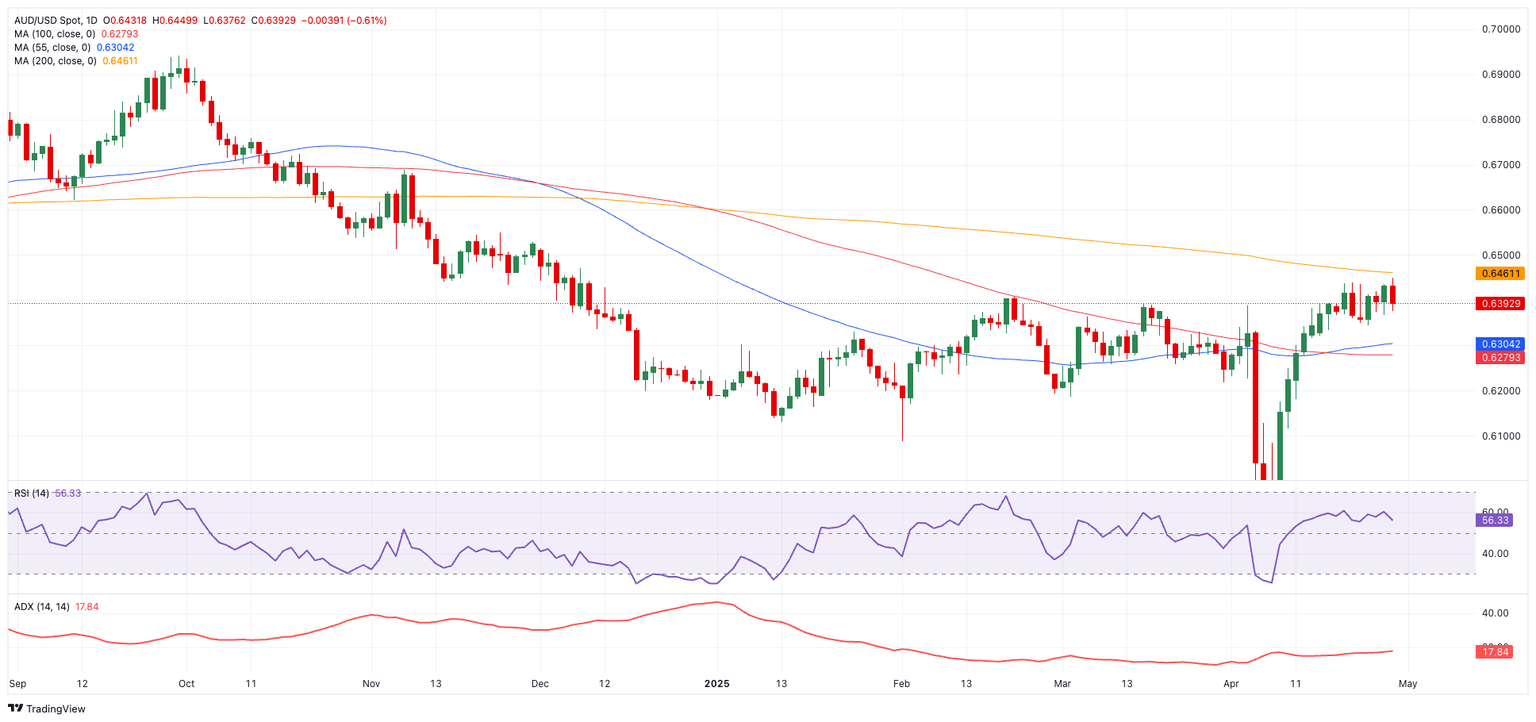

Technical landscape

AUD/USD remains capped below its 200-day simple moving average (SMA), currently at 0.6464. A decisive break above that threshold could signal a more bullish near-term outlook and would put the November 2024 peak of 0.6687 back on the radar.

On the downside, failure to hold support at the provisional 55-day and 100-day SMAs, at 0.6302 and 0.6281, respectively, would expose the pair to further declines, potentially toward the 2025 bottom of 0.5913 and even the pandemic-era trough at 0.5506.

Momentum indicators offer mixed signals. The Relative Strength Index (RSI), near 56, points to further upside potential, but a low Average Directional Index (ADX) reading of around 18 suggests the current uptrend may lack strong conviction.

AUD/USD daily chart

Outlook: Navigating uncertainty

With tariff risks and incoming economic data continuing to steer sentiment, AUD/USD is likely to remain volatile. Traders should remain alert to policy shifts from both Washington and Beijing as they assess the path ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.