AUD/USD Price Forecast: Next on the downside comes 0.6180

- AUD/USD managed to leave behind four consecutive daily drops.

- The US Dollar rose further and hit multi-week highs on tariff narrative.

- The Australian business activity surprised to the upside in March.

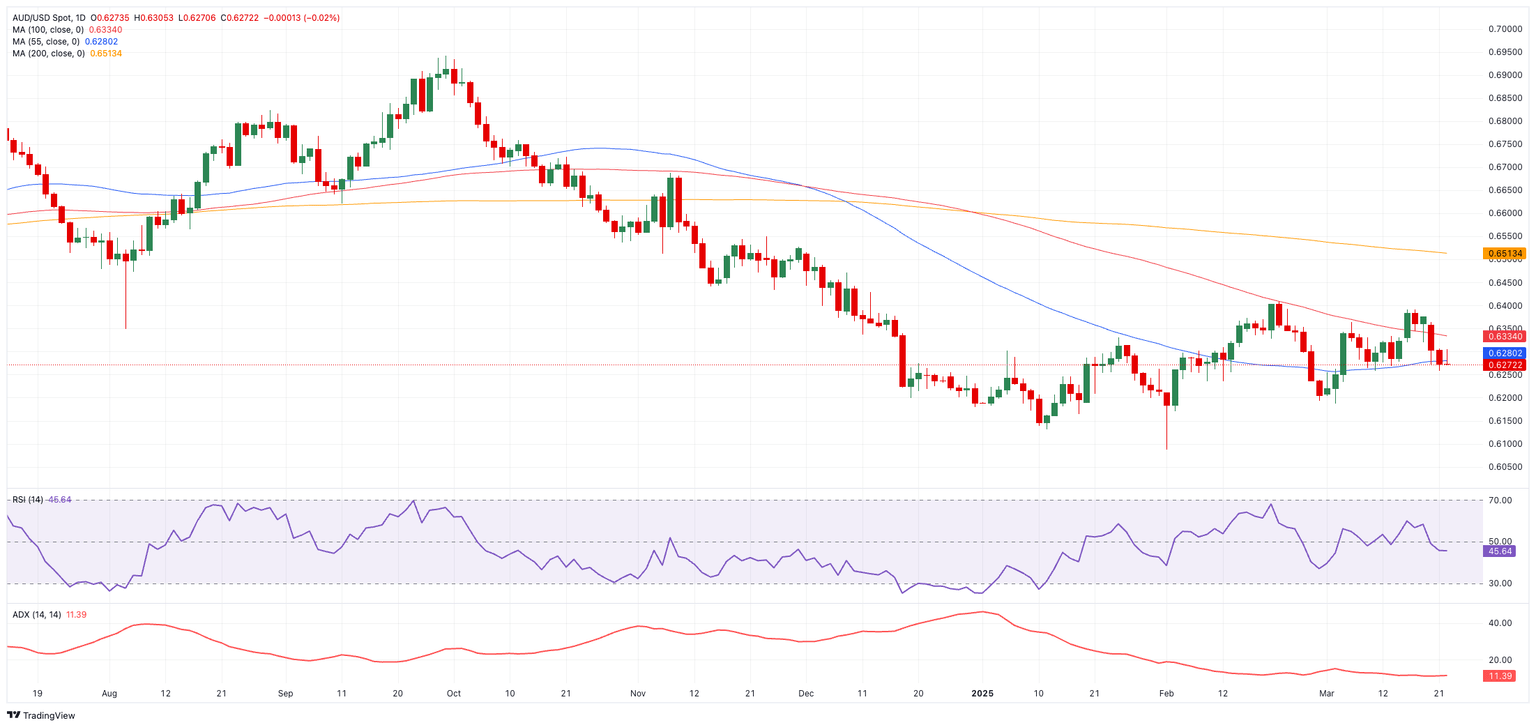

The Australian Dollar (AUD) found itself on a positive footing on Monday, reversing four daily declines in a row and with AUD/USD bouncing off the 0.6260 support area, retesting the provisional 55-day Simple Moving Average (SMA).

Surprisingly, the daily recovery in the pair came amid further gains in the US Dollar (USD), always amid rising expectations that the Federal Reserve (Fed) might prolong its restrictive monetary policy stance following the latest FOMC meeting and comments from Chair Jerome Powell, while latest tariff headlines also seem to have propped up the Greenback. This momentum helped the US Dollar Index (DXY) rose to three-week peaks well past the key 104.00 mark.

Trade tensions: A lingering threat

Uncertainty over US trade policy remains a major concern for investors, who worry about potential retaliatory measures from America’s trading partners. The mere hint of a broader trade war is keeping risk-sensitive currencies—like the Aussie—under pressure.

Given Australia’s reliance on exporting commodities to China, any slowdown in its largest trading partner, particularly if triggered by US tariffs, could deal a blow to the Australian economy.

Central banks face an inflation puzzle

Fears that trade-driven inflation could push the Fed into a more prolonged tightening cycle are colliding with growing apprehension about a possible US economic slowdown, amid a still-firm labour market and stubborn inflation.

Last week, the Federal Open Market Committee (FOMC) delivered what many are calling a “mixed hold,” leaving the Fed funds target rate at 4.25–4.50%, in line with expectations. The Committee’s unanimous decision came with a slight adjustment to its statement, noting that uncertainty remains elevated.

Fed Chair Powell reiterated his March 7 stance, saying, “We do not need to be in a hurry, and are well positioned to wait for greater clarity.” While the Fed’s rate projections remain the same overall, the details now suggest a tilt toward less easing ahead.

The FOMC also updated its economic outlook, lowering its real GDP growth forecast and raising its inflation expectations. Powell attributed much of the inflation uptick to tariffs, stating that they “tend to bring growth down and they tend to bring inflation up.”

Meanwhile, across the Pacific, the Reserve Bank of Australia (RBA) cut its benchmark rate by 25 basis points in February to 4.10%. Governor Michele Bullock emphasised that any future moves depend on incoming inflation data, while Deputy Governor Andrew Hauser warned against assuming a rapid series of rate cuts. Nonetheless, many analysts believe the RBA could ease by up to 75 basis points if trade tensions escalate.

Recent RBA meeting minutes revealed policymakers weighing a rate hold against a smaller cut before ultimately settling on the 25-basis-point reduction. They stressed, however, that this move doesn’t necessarily foreshadow an extended easing cycle. Officials also noted that Australia’s peak rate remains comparatively low by global standards, in part due to the country’s robust labour market.

Speaking of which, the latest data showed a 52.8K decline in Employment Change for February, erasing the previous month’s gain, while the Unemployment Rate stayed at 4.1%.

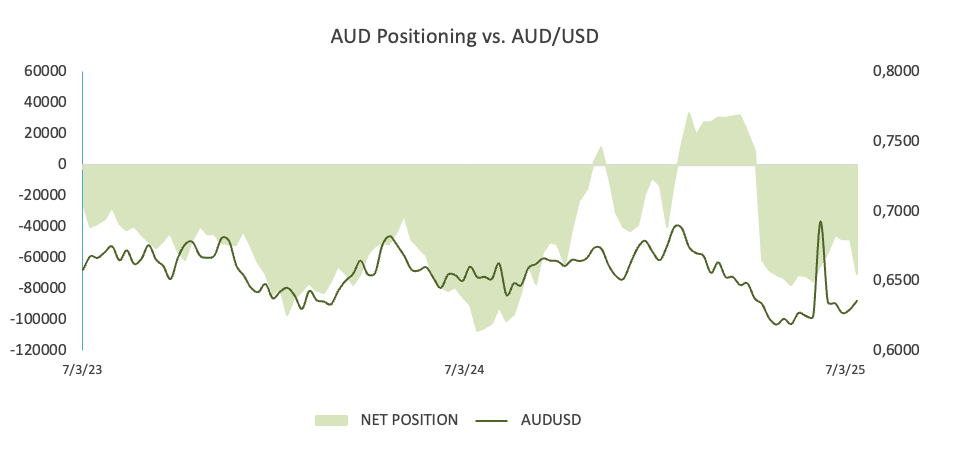

Speculators remain bearish on the Aussie

On the positioning front, net shorts in the Australian Dollar rose to multi-week peaks nearly 70.5K contracts in the week ending March 18, according to the CFTC Positioning Report. Bets on a weaker Aussie have been in place since mid-December and appear to have regained impulse on the back of tariff threats.

AUD/USD Technical Outlook

A decisive push above the 2025 peak at 0.6408 (February 21) could pave the way toward the 200-day SMA at 0.6516, with the November 2024 high at 0.6687 (November 7) lurking beyond.

On the downside, the March low of 0.6186 (March 4) stands as the first key support. A more pronounced pullback could challenge the 2025 trough at 0.6087, with the psychologically significant 0.6000 mark just below.

Momentum indicators send mixed signals: the Relative Strength Index (RSI) has dipped to around 46, indicating fading bullish momentum, while the Average Directional Index (ADX) near 11 points to a generally weak trend overall.

AUD/USD daily chart

Key data releases ahead

Looking forward, traders will be zeroing in on Australia’s 2025-26 Federal Budget on March 25, while the RBA’s Monthly CPI Indicator will come on March 26.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.