AUD/USD Price Forecast: Lack of clear direction persists

- AUD/USD came under fresh downside pressure, challenging the 0.6400 region.

- The US Dollar managed to regain the smile and advanced modestly on Thursday.

- Flash S&P Global Manufacturing and Services PMIs did not disappoint in May.

The offered stance re-emerged around the Australian Dollar (AUD), prompting AUD/USD to return to the vicinity of the key 0.6400 contention zone on Thursday. In fact, after flirting with its key 200-day SMA near 0.6460, the pair lost momentum on the back of the resurgence of some buying interest in the US Dollar (USD), which was in turn propped up by firmer-than-expected PMI prints.

Diverging central bank paths and AUD/USD dynamics

A widening policy gap between the Federal Reserve (Fed) and the RBA is emerging as a defining narrative for AUD/USD.

At its May meeting, the Fed held rates steady, with Chair Jerome Powell striking a cautious tone, reiterating a data-dependent stance. Softer US inflation data for April and improved risk sentiment have encouraged markets to begin pricing in a potential rate cut as early as September.

In contrast, the RBA trimmed its official cash rate by 25 basis points to 3.85% on 20 May. The accompanying Monetary Policy Report (MPR) hinted at further easing, projecting the OCR could drift to around 3.2% by 2027. While policymakers acknowledged that monetary settings are now “somewhat less restrictive,” they flagged lingering uncertainty around domestic demand and global supply chains.

The RBA also revised its GDP growth forecast for 2025 lower to 2.1% and trimmed its inflation outlook, with the trimmed mean expected to settle at 2.6%.

Support from China wanes amid structural concerns

Earlier in the week, mixed data from China had offered the Aussie some support. While industrial output surprised to the upside, softer readings in retail sales and fixed asset investment pointed to a tentative slowdown in Q1. Still, the broader trajectory remains on track for roughly 5% growth in Q2.

However, underlying structural concerns persist. US tariff risks, along with continued fragility in China’s property market, remain prominent downside threats. Adding to the dovish tone, the People’s Bank of China (PBoC) cut both its 1-year and 5-year Loan Prime Rates by 10 basis points to 3.00% and 3.50%, respectively, on Tuesday.

Bearish sentiment on AUD moderates

CFTC data as of May 13 suggests bearish positioning on the AUD may be losing steam. Net short positions hovered near multi-week lows at around 49.3K contracts, while a dip in open interest indicates a potentially less pessimistic outlook among speculators.

Technical outlook: Bulls eye a breakout, but direction remains uncertain

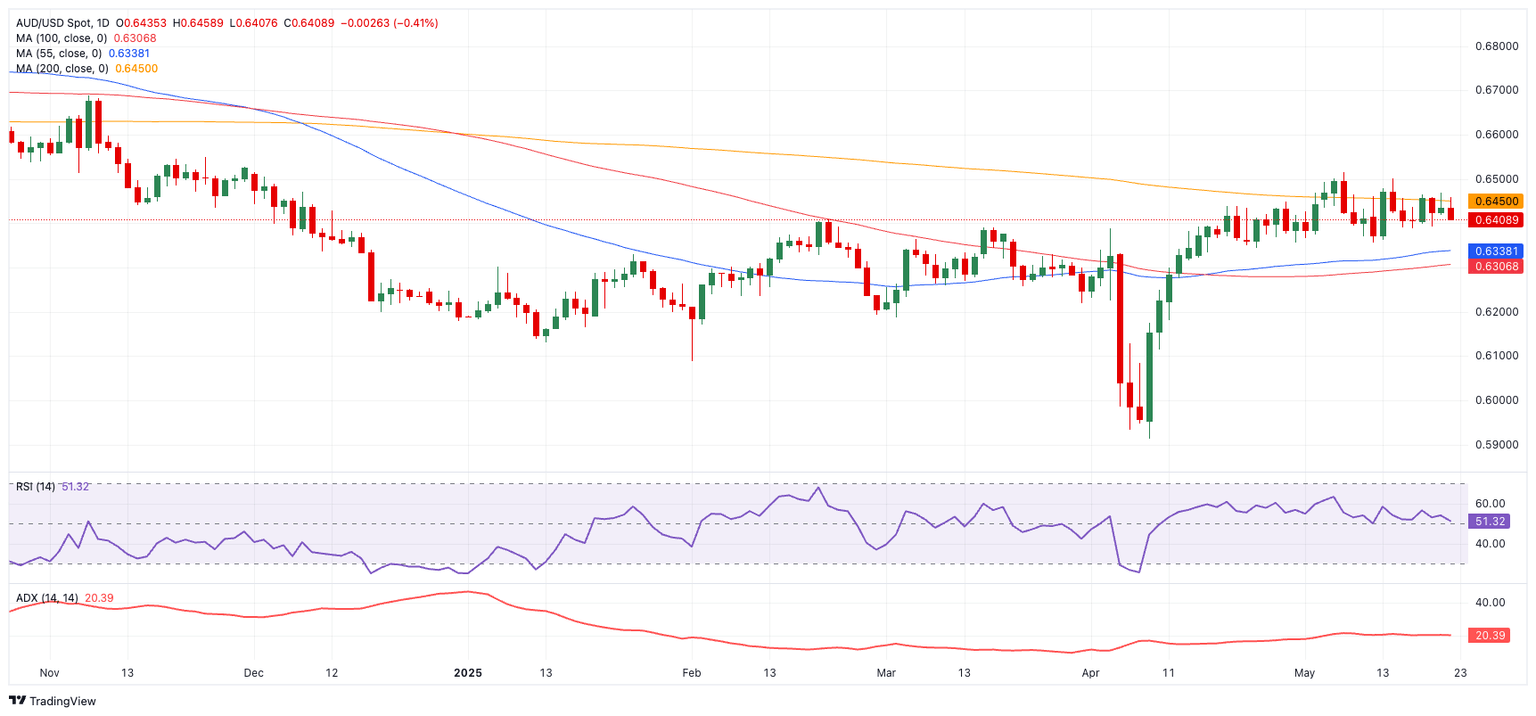

Technically, AUD/USD needs a clear break above the 200-day SMA at 0.6452 to re-establish bullish momentum. A sustained move above this threshold could pave the way toward the yearly high at 0.6514 (May 7), with the November 2024 peak at 0.6687 (November 7) acting as a further upside target.

On the downside, immediate support sits at the May low of 0.6356 (May 12), seconded by the transitory 55-day and 100-day SMAs at 0.6336 and 0.6305, respectively. Deeper losses could open the door toward the 2025 bottom at 0.5913 (April 9), and even the pandemic trough from March 2020 at 0.5506 (March 19).

Momentum indicators lean slightly bullish, with the Relative Strength Index (RSI) nearing 51, and the Average Directional Index (ADX) just above 21—pointing to a tentative uptrend.

AUD/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.