AUD/USD Price Forecast: Gains remain on the table above the 200-day SMA

- AUD/USD left behind the previous day’s pullback and advanced past 0.6500.

- The US Dollar sold off to more than three-year lows following safe-haven demand.

- US-China trade uncertainty continued to cloud the near-term future for the Aussie.

The Australian Dollar (AUD) got back on track on Thursday, as the US Dollar (USD) fell sharply. This made AUD/USD cross the 0.6500 mark again and continue its slow but steady rise.

Policy difference is the main topic of discussion

Currency markets remained connected to central bank messages as traders kept thinking about how interest rates may change.

The Federal Reserve (Fed) in the US kept rates the same in May, which was what most people expected. Chair Jerome Powell said again that the Fed's decisions will be based on evidence. After that, lower inflation data (from both the Consumer Price Index and the Producer Price Index) and signals that the economy is slowing down have made markets more likely to expect a rate decrease by September, followed by a similar move in October.

The Reserve Bank of Australia (RBA) dropped its cash rate by 25 basis points, as was predicted, bringing it down to 3.85%. The central bank said that interest rates will gradually go down, with a target of 3.20% by 2027, inflation slowing to 2.6%, and GDP growth slowing to 2.1% in 2025. However, it also said that if consumer demand and wages fall, it might make even bigger cuts. On the other hand, officials said they may stop easing if things go worse across the world.

Australia's future is uncertain since China is weak

Even if the trade winds seem to have calmed down since the US-China deal, feelings are still mixed since China's recovery from the epidemic has been unequal.

Even if industrial production was better than expected in the first quarter, slow consumer spending and poor fixed-asset investment showed that there were still fundamental problems.

The People's Bank of China (PboC) also slashed rates in May, lowering the 1-year and 5-year Loan Prime Rates (LPR) to 3.00% and 3.50%, respectively.

Last month, the Caixin Manufacturing PMI went even deeper into contraction zone, and consumer prices declined 0.1% over the last year. This shows that deflationary forces are still strong in the world's second-largest economy.

Traders are being careful with the Aussie

The more cautious tone is seen in speculative posture. CFTC statistics through June 3 show that net short bets on the Aussie climbed to about 63.2K contracts. This is the most negative exposure in a few weeks.

Important levels to keep an eye on

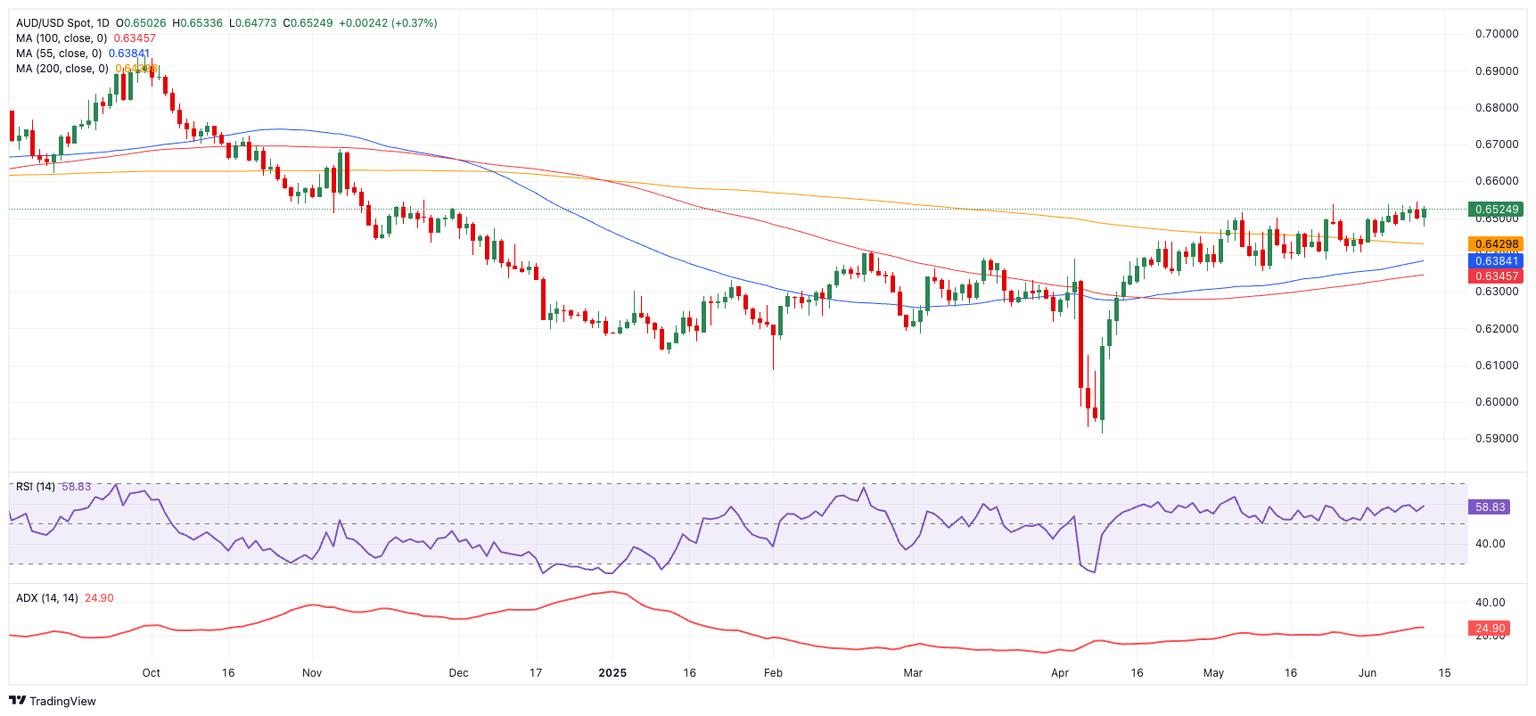

On the technical side, AUD/USD is having trouble hitting its 2025 high of 0.6545 (June 11). If it breaks above, the top of 0.6687 on November 7, 2024, and the high of 0.6942 on September 30, 2024, would come into view.

The first level of support is at the important 200-day SMA at 0.6433, and the second level is at the May low of 0.6356 (May 12). If prices keep going down, they may hit the 100-day SMA at 0.6344, but the 0.6000 handle, which is a more important level in the mind of traders, will provide additional support.

Momentum indicators are turning bullish. The Average Directional Index (ADX) has gotten close to 27, which means the trend is becoming stronger, and the Relative Strength Index (RSI) has bounced back to almost 59, which means there is room for further short-term gains.

AUD/USD daily chart

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.