AUD/USD Price Forecast: Further weakness likely below 0.6350

- AUD/USD dropped to multi-day troughs below the 0.6400 support.

- The US Dollar picked up extra pace following positive US-China trade talks.

- Focus shifts to the release of US inflation data on Tuesday.

The Australian Dollar (AUD) slipped further on Monday, extending the monthly correction against the US Dollar (USD).

In fact, AUD/USD deepened its recent breakdown of the critical 200-day simple moving average, extending the drop to multi-day lows near 0.6360 in response to the intense buying pressure surrounding the Greenback.

AUD/USD began the week on the back foot, weighed down by broad US Dollar strength, even as sentiment improved following constructive US-China trade talks held over the weekend in Switzerland.

While the Greenback’s gains pressured the pair, progress on the trade front could ultimately benefit the Australian Dollar, given Australia’s strong economic ties to China.

On the policy front, the People’s Bank of China (PBoC) recently introduced targeted easing measures in response to softening domestic data, including a cut to the 7-day reverse repo rate and a reduction in the reserve requirement ratio (RRR). Additional efforts included increased lending quotas and rate cuts aimed at specific sectors.

Latest data in China showed the Inflation Rate up 0.1% MoM in April, while dropping 0.1% over the last twelve months.

Diverging rate paths under scrutiny

Monetary policy divergence has also shaped recent AUD/USD moves. While both the Federal Reserve (Fed) and Reserve Bank of Australia (RBA) held rates steady, their guidance diverged.

Fed Chair Jerome Powell maintained a hawkish tone, reiterating a “wait-and-see” stance after the Fed’s decision. In contrast, RBA Governor Michele Bullock pointed to persistent inflation and labour market tightness as justification for holding the cash rate at 4.10%.

Though markets still price in a potential 25 basis point cut at the RBA’s 20 May meeting, expectations for deeper easing have moderated, with forecasts now pointing to up to 125 basis points in reductions over the coming year.

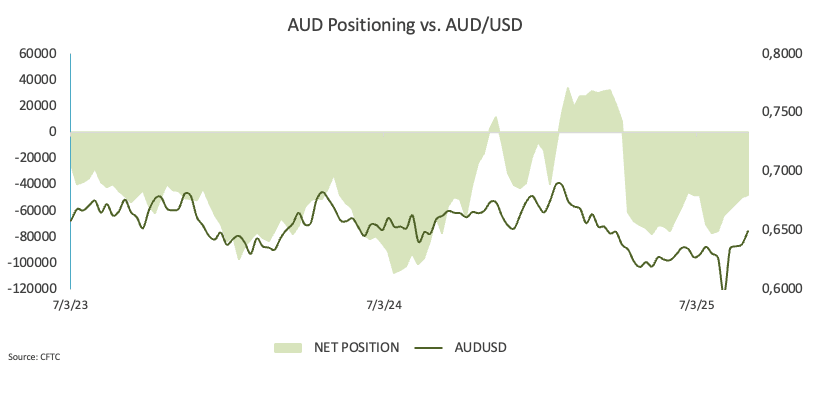

Positioning signals tentative optimism

Latest data from the CFTC showed net short positions on the AUD falling to an eight-week low of around 48.3K contracts as of May 6. A slight decline in open interest suggests sentiment may be stabilising.

Technical picture: Mixed signals

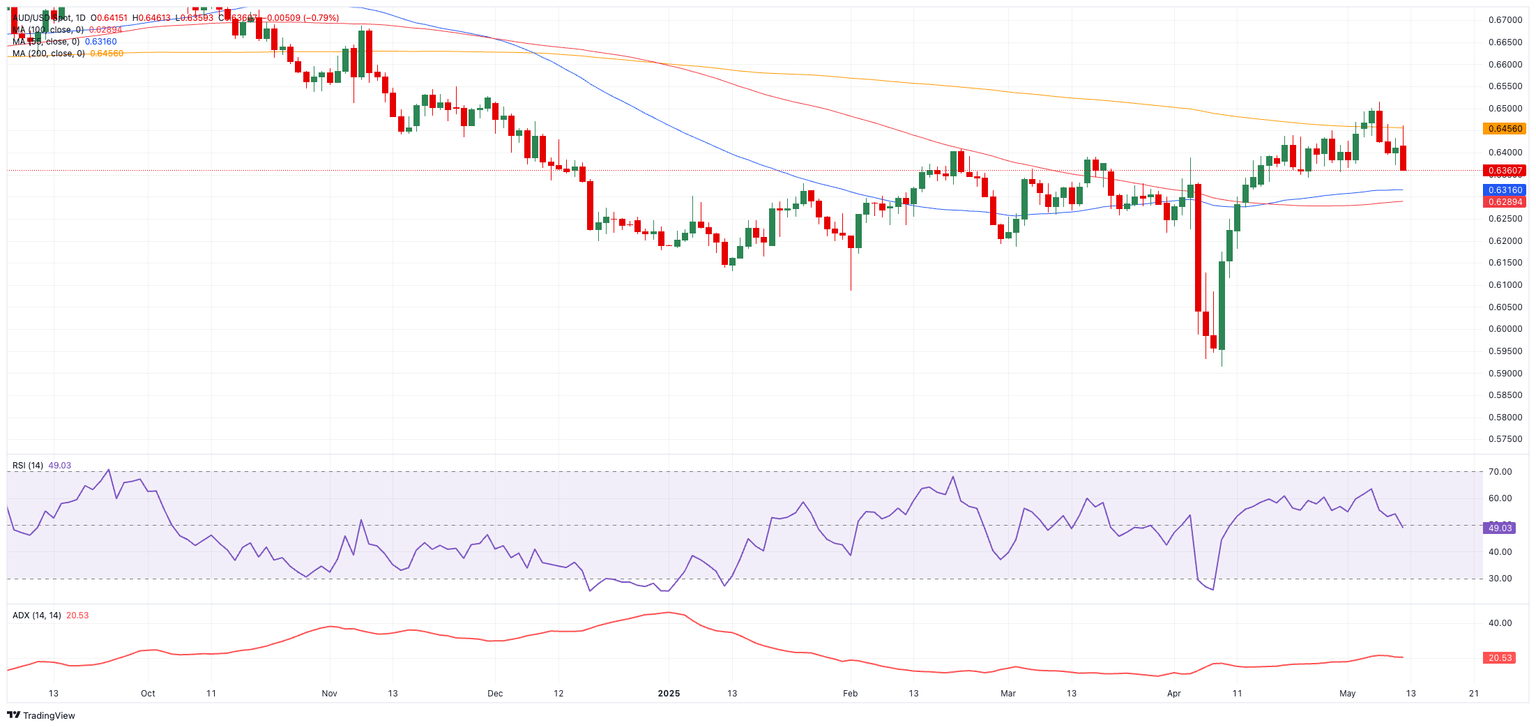

Technically, a clear break above the 200-day simple moving average (SMA) would likely tilt the AUD/USD outlook more constructively.

Resistance levels loom at the 2025 high of 0.6514 (May 7), followed by the November 2024 peak of 0.6687.

On the downside, interim support is seen at the 55-day and 100-day SMAs—currently at 0.6314 and 0.6288, respectively. A breach of these levels could expose the 2025 bottom at 0.5913 and possibly the pandemic-era trough near 0.5506.

Momentum indicators are showing early signs of fading strength, with the Relative Strength Index (RSI) easing to 49 and the Average Directional Index (ADX) receding toward 21.

AUD/USD daily chart

Outlook: Cautiously constructive

While technical and positioning signals looking mixed, the broader outlook for the AUD remains constrained. In addition, sticky domestic inflation, dependence on Chinese demand, and hopes on the trade front are expected to keep the price action volatile for the time being.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.