AUD/USD Price Forecast: Bears seize control ahead of RBA rate decision on Tuesday

- AUD/USD continues to lose ground for the third straight day amid a broadly stronger USD.

- Trade uncertainties and geopolitical risks benefit the Greenback’s relative safe-haven status.

- Fed rate cut bets might cap the buck and support the pair ahead of the RBA on Tuesday.

The AUD/USD pair attracts heavy selling on Monday and drops to a one-and-a-half-week trough, around the 0.6500 psychological mark during the early European session. This marks the third straight day of a negative move and is sponsored by a fresh wave of the global risk-aversion trade, which tends to benefit the safe-haven US Dollar (USD) and undermine the risk-sensitive Aussie. Against the uncertainty surrounding US President Donald Trump's trade policies ahead of the July 9 deadline, geopolitical risks stemming from fresh conflicts in the Middle East weigh on investors' sentiment.

In fact, the Israeli military carried out intense strikes on Houthi targets in three Yemeni ports and a power plant early today, for the first time in almost a month in response to repeated attacks by the Iran-aligned group on Israel. Meanwhile, Trump said on his social media that the US tariff letters, and/or deals, with various countries from around the world, will be delivered starting 12:00 P.M. on July 7th. Trump followed up with a warning, stating that any country aligning with the anti-American policies of BRICS will be charged an additional 10% tariff and there will be no exceptions to this policy.

The Australian Dollar (AUD) is further weighed down by rising bets that the Reserve Bank of Australia (RBA) will cut its Official Cash Rate (OCR) for the third time in July. Traders, however, might refrain from placing aggressive directional bets ahead of the RBA decision on Tuesday. In the meantime, worries that Trump's ‘One Big Beautiful Bill’ would worsen the country's long-term debt problems might hold back the USD bulls from placing aggressive bets. Moreover, expectations that the Federal Reserve (Fed) will resume its rate-cutting cycle in the near future should cap the USD and support the AUD/USD pair.

Traders are currently pricing in over a 70% chance of a Fed rate cut in September and at least two 25 basis point rate reductions by the end of this year. In the absence of any relevant market-moving economic releases, the fundamental backdrop warrants some caution for the USD bulls. Hence, it will be prudent to wait for strong follow-through selling before positioning for an extension of the AUD/USD pair's retracement slide from the vicinity of the 0.6600 mark, or its highest level since November 2024 touched last week.

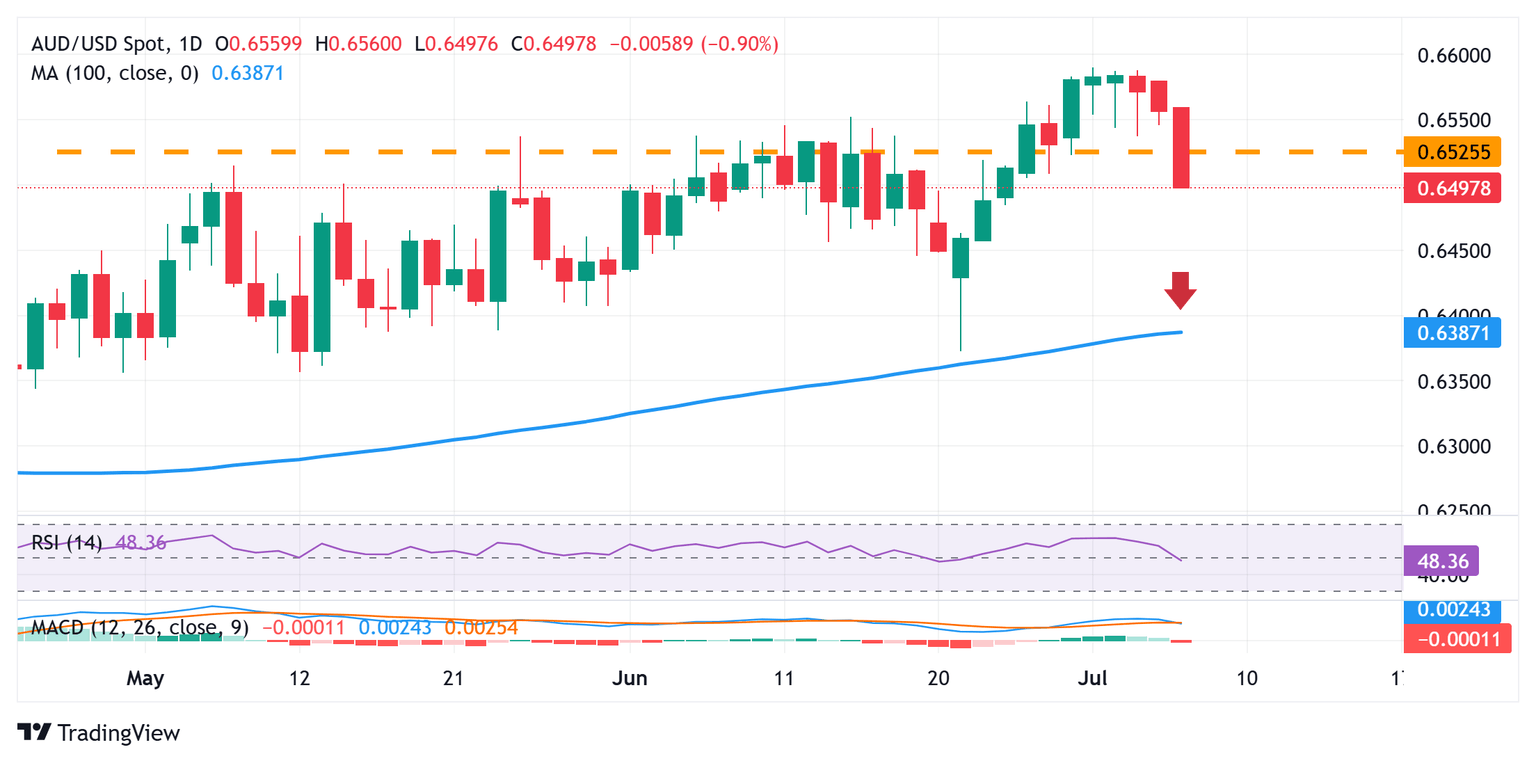

AUD/USD daily chart

Technical Outlook

An intraday breakdown through the 0.6540-0.6530 horizontal resistance-turned-support and a subsequent fall below the 0.6500 psychological mark will be seen as a key trigger for bearish traders. The latter represents the 200-period Simple Moving Average (SMA) on the 4-hour chart. Given that oscillators on the daily chart have just started gaining negative traction, the AUD/USD pair might then accelerate the fall towards the 0.6465-0.6460 intermediate support en route to the 0.6420-0.6415 region, or the 200-day SMA, and the June monthly swing low, around the 0.6375-0.6370 area.

On the flip side, the 0.6530-0.6540 region now becomes an immediate barrier, above which the AUD/USD pair is likely to make a fresh attempt to conquer the 0.6600 round figure. A sustained strength beyond the latter will be seen as a fresh trigger for bullish traders and lift spot prices to the next relevant hurdle near the 0.6640 hurdle. The upward trajectory could extend further towards the 0.6680 intermediate resistance, or November 2024 swing high, before the pair aims to reclaim the 0.6700 mark for the first time since October 2024.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.