AUD/USD Price Forecast: A decline to 0.6000 in the offing?

- AUD/USD broke below the 0.6100 support, reaching multi-year lows.

- The US Dollar rose sharply on the back of Trump’s US tariffs.

- The pair faces the likelihood of a move towards the key 0.6000 level.

On Monday, the US Dollar (USD) regained strong upside impulse, accelerating its momentum to the boundaries of the 110.00 mark, or three-week tops, when tracked by the US Dollar Index (DXY). On the other hand, the Australian dollar (AUD) gapped lower and briefly pierced the 0.6100 key support for the first time since April 2020.

Impact of US tariffs on the Aussie

This market shift followed President Donald Trump's tariff announcement last Friday, sparking fears of a potential trade war. The US slapped a 25% duty on goods from Canada and Mexico and a 10% tax on Chinese imports.

In response, Canada and Mexico—America's two largest trading partners—vowed swift retaliatory measures, while China declared it would challenge the tariffs at the WTO.

The news pushed risk-linked assets to fresh lows as market participants factored in the likelihood of a global trade war, potentially triggering a resurgence of inflationary pressures in the US and likely prompting a tighter-for-longer stance from the Federal Reserve (Fed).

There is no light at the end of the tunnel yet

Earlier in the month, the AUD enjoyed a brief rally, pushing past the 0.6300 level—a high not seen earlier in the year. However, that bounce was more about a cooling US dollar than any robust strength in Australia’s economy. There is growing speculation about the Reserve Bank of Australia’s (RBA) next move, especially since recent data suggest that inflationary pressures in Australia are easing.

Recent Q4 Consumer Price Index (CPI) data in Australia bolster the case for an RBA rate cut at its February 18 meeting. Headline inflation increased by 2.5% year-on-year, down from 2.8% the previous quarter, and the trimmed mean CPI—a key gauge for the RBA—fell to a three-year low of 3.2%, underperforming expectations and previous forecasts. This softer inflation data has led the market to fully price in a 25 basis point rate cut by the RBA in February, with total easing expected to reach 85 basis points over the next year as confidence grows in a more dovish policy approach.

Commodity Influence

On the commodities front, weak demand from China continues to pressure Australian exports like iron ore and copper, which generally support the AUD. However, iron ore prices and copper prices hit yearly highs last week, all in all lending a bit of support to the Australian dollar.

Outlook for the AUD

Looking ahead, the AUD faces an uphill battle. A looser monetary policy at home, combined with a sluggish Chinese economy, could further weaken the Aussie. Meanwhile, the Fed’s tighter policy stance may widen the gap between the two central banks, putting extra downward pressure on the AUD.

What’s Next for AUD/USD?

The outlook for AUD/USD remains challenging. The US dollar is expected to hold strong if the Fed sticks to its restrictive policies, while uncertainties about China's recovery and Australia's economic momentum will continue to weigh on the AUD. However, any hints of a more dovish turn from the Fed could offer some relief.

Technical Outlook

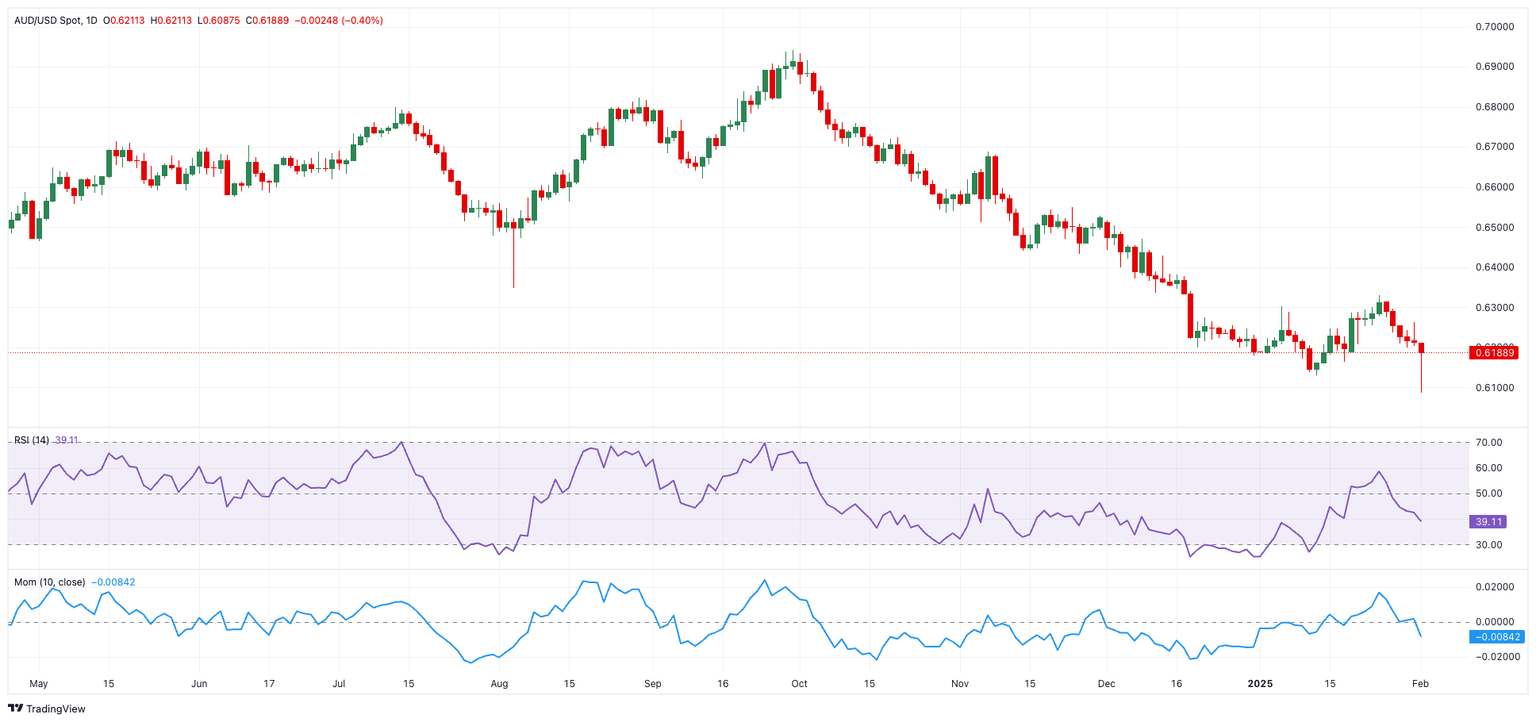

From a technical perspective, caution is advised. Key support for AUD/USD is at 0.6087—the lowest level for 2025—with a break below that possibly pushing the pair toward the psychological 0.6000 level. On the upside, resistance is seen at 0.6330, near the 2025 peak, with further resistance at the weekly high of 0.6549.

Meanwhile, momentum indicators do not look promising: the Relative Strength Index (RSI) dipped to around 38, hinting at bearish pressure, and the Average Directional Index (ADX) around 20 points to a weakening trend.

AUD/USD daily chart

Key Data to Watch

Moving forward, the attention will be on domestic data including final Manufacturing and Services PMIs, the Ai Group Manufacturing Index, and Balance of Trade results.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.