AUD/USD outlook: Holds near new 2025 high ahead of RBA rate decision

AUD/USD

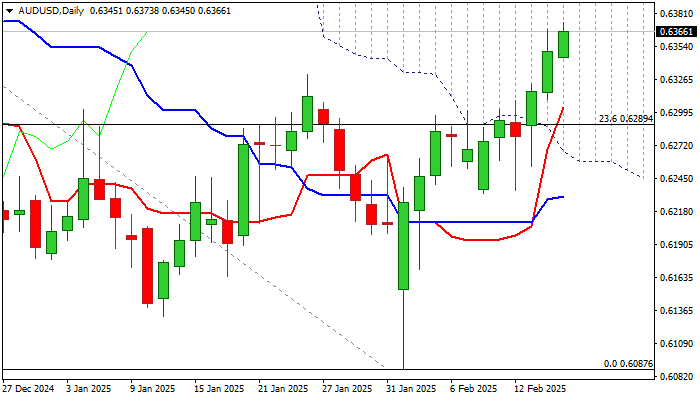

AUDUSD hit new 2025 high on Monday (the highest since mid-December) in extension of broader rally in past two weeks (up nearly 5% on bounce from the lowest level in almost four years).

Weaker US dollar continue to fuel Aussie dollar’s advance, which turned the picture on daily chart positive and generating initial reversal signal.

Near-term action is moving within thick daily Ichimoku cloud and underpinned by formation of daily Tenkan/Kijun-sen) bull-cross, focusing key resistances at 0.6410/14 (daily cloud top / Fibo 38.2% of 0.6942/0.6087 downtrend).

Break of these levels to confirm reversal signal, though increased headwinds should be expected at this zone on overbought conditions and RBA’s rate decision in early Tuesday.

The Australia’ central bank is widely expected to cut interest rates by 25 basis points on Tuesday’s policy meeting, in the first rate cut in more than four years that will mark the beginning of monetary policy easing cycle.

Former top of Jan 24 (0.6330) offers immediate support, with near term bias to remain biased higher as long as the price action stays above strong 0.6300/0.6290 support zone.

Res: 0.6414; 0.6441; 0.6500; 0.6515.

Sup: 0.6330; 0.6290; 0.6235; 0.6194.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.