AUD/USD holding first support at 7710/00 retests first resistance at 7740/50

AUD/USD, NZD/USD, AUD/JPY

AUDUSD has been trading up one day, down the next day in the sideways trend for 6 weeks. The pair has held a range of just 150 pips in this period. Quite unbelievable!

Yesterday we recovered Tuesday’s losses holding first resistance at 7740/50. Not unexpected!

NZDUSD also recovers Tuesday’s losses – holding above 7200 targets 7240/45. AUDJPY remains in a sideways trend for 2 months in a range of only 200 pips for the last 5 weeks.

Daily analysis

AUDUSD holding first support at 7710/00 retests first resistance at 7740/50. A break higher targets 7780/90.

Below 7700 risks a retest of 7675/70 with support at 7630/20. Longs need stops below 7610.

NZDUSD holding above 7200 targets 7240/45 before a retest of 7275/85. Very strong resistance at 7300/10.

Holding below 7190 risks a slide to 7155/45, perhaps as far as 7115/10.

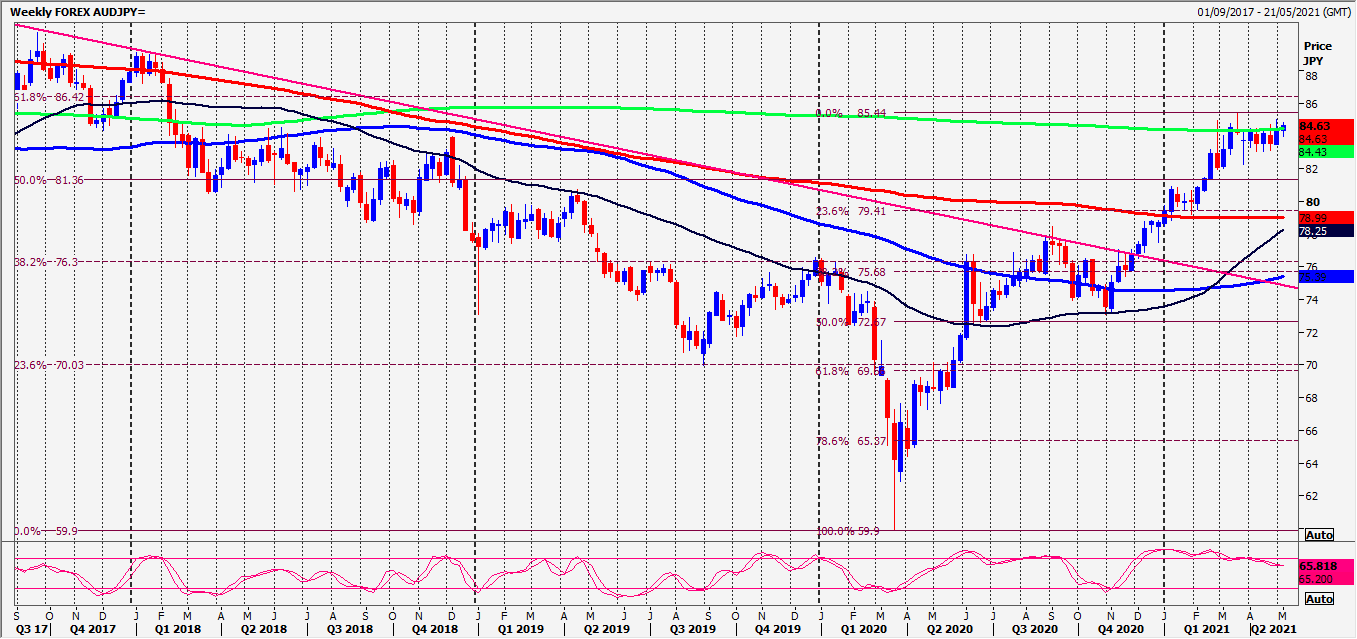

AUDJPY holding below 500 week plus 200 & 100 month moving average resistance at 8440/70 is negative for this week. Yesterday we collapsed from 8480. First support at 8395/85 (we bottomed here this week) but below 8375 targets 8355/45, perhaps as far as support at 8310/00.

Key resistance at 8440/70. Shorts need stops above 8510. A break higher this week targets the March high at 8534/45.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk