AUD/USD Forecast: Underpinned by Wall Street

AUD/USD Current Price: 0.7557

- Australia will publish the preliminary estimates of the June Commonwealth Bank PMIs.

- US indexes advanced towards record highs, supporting high-yielding currencies.

- AUD/USD pressures weekly highs and could extend its ongoing advance.

The AUD/USD pair posted a modest intraday advance, ending Tuesday in the 0.7560 price zone. The pair fell through the first half of the day, bouncing ahead of Wall Street opening and advancing alongside US stocks. However, the pair kept trading within familiar levels, and the ongoing advance could still be read as a corrective one.

During the upcoming Asian session, Australia will publish the preliminary estimates of the June Commonwealth Bank PMIs. The manufacturing index is foreseen unchanged from the previous month at 60.4, while services output is expected to have improved from 58 to 58.3.

AUD/USD short-term technical outlook

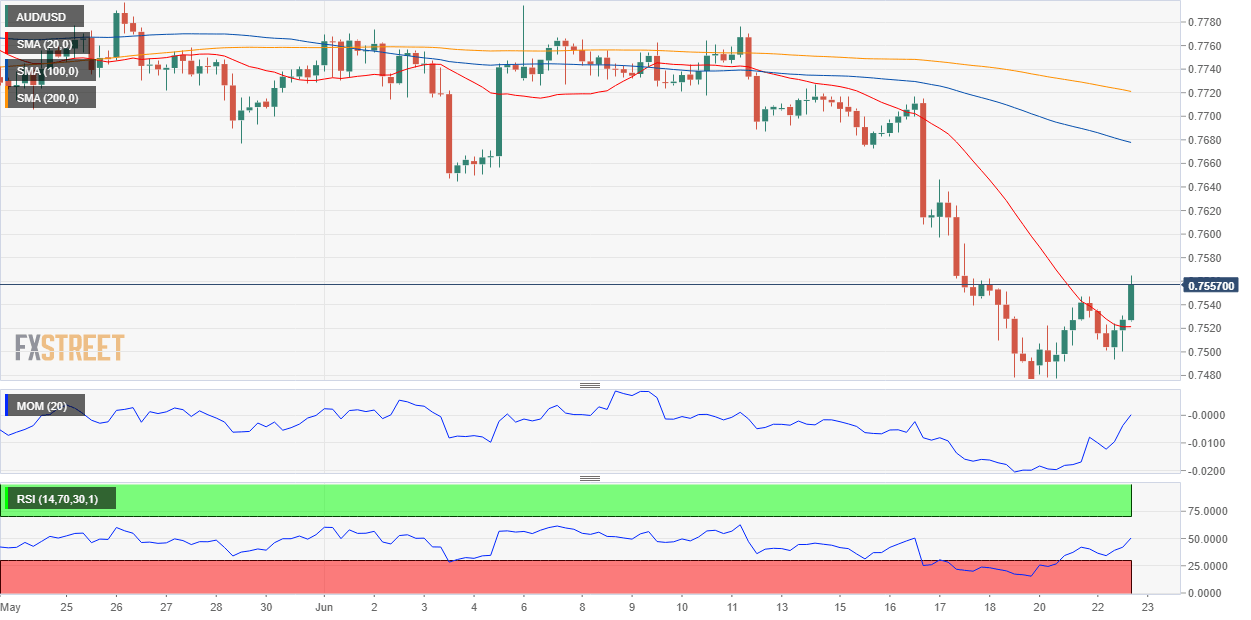

From a technical point of view, the AUD/USD pair continues advancing in the near-term, although sustainable gains are quite unlikely. The 4-hour chart shows that the pair keeps correcting extreme readings, with the Momentum indicator heading north above its midline but the RSI flat at around 48. The price advanced above its 20 SMA, which maintains a mildly bearish slope. The longer moving averages keep heading firmly lower, far above the current level, skewing the risk to the downside in the wider perspective.

Support levels: 0.7500 0.7460 0.7420

Resistance levels: 0.7590 0.7630 0.7675

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.