AUD/USD Forecast: Some consolidation likely near term

- AUD/USD’s upside momentum faltered ahead of 0.6600.

- Extra gains appear on the cards above the 200-day SMA.

- Australian flash PMIs came in mixed for the month of February.

The upward momentum of the Australian dollar paused as it faced selling pressure upon approaching the key 0.6600 hurdle vs. its American counterpart on Thursday.

In fact, the pair reversed six consecutive sessions of gains on the back of the tepid rebound in the Greenback, which was reinvigorated once again after further signs of tightness in the US labour market, this time via firm prints from weekly Initial Jobless Claims.

The day's fluctuation in spot coincided with a lacklustre performance for the US Dollar (USD), as investors continued to evaluate the timing of potential monetary easing by the Federal Reserve (Fed). This sentiment gained traction following resilient US inflation data reported by the Consumer Price Index (CPI) and Producer Price Index (PPI) for January, as well as persistent hawkish narrative from some Fed officials.

Meanwhile, on the calendar, advanced prints showed the Manufacturing PMI eased to 47.7 in February and the Services PMI improved to 52.8 in the same period.

Despite the ongoing recovery of AUD/USD, investors are anticipated to monitor developments in China, commodity prices (especially copper and iron ore), and movements in the US Dollar closely.

While additional stimulus measures in China could bolster a short-term rebound, news of a more sustainable recovery in the country is essential to provide stronger support for the Australian dollar and potentially trigger a more substantial upward movement in AUD/USD. A rebound in the Chinese economy is also expected to coincide with an uptick in commodity prices, further bolstering the AUD. Moreover, the current cautious stance of the RBA is likely to prevent significant downside pressure on the Aussie dollar.

Back to the RBA, the central bank released the Minutes of its February meeting on Tuesday, characterized as a "hawkish hold." The minutes disclosed discussions on whether to raise the cash rate by 25 basis points or maintain it at the current level. Ultimately, the decision was to keep the rate unchanged at 4.35%, citing a reduced risk of inflation deviating from the Board's target in a timely manner. Additionally, members agreed on the importance of neither explicitly endorsing nor dismissing the prospect of future interest rate hikes.

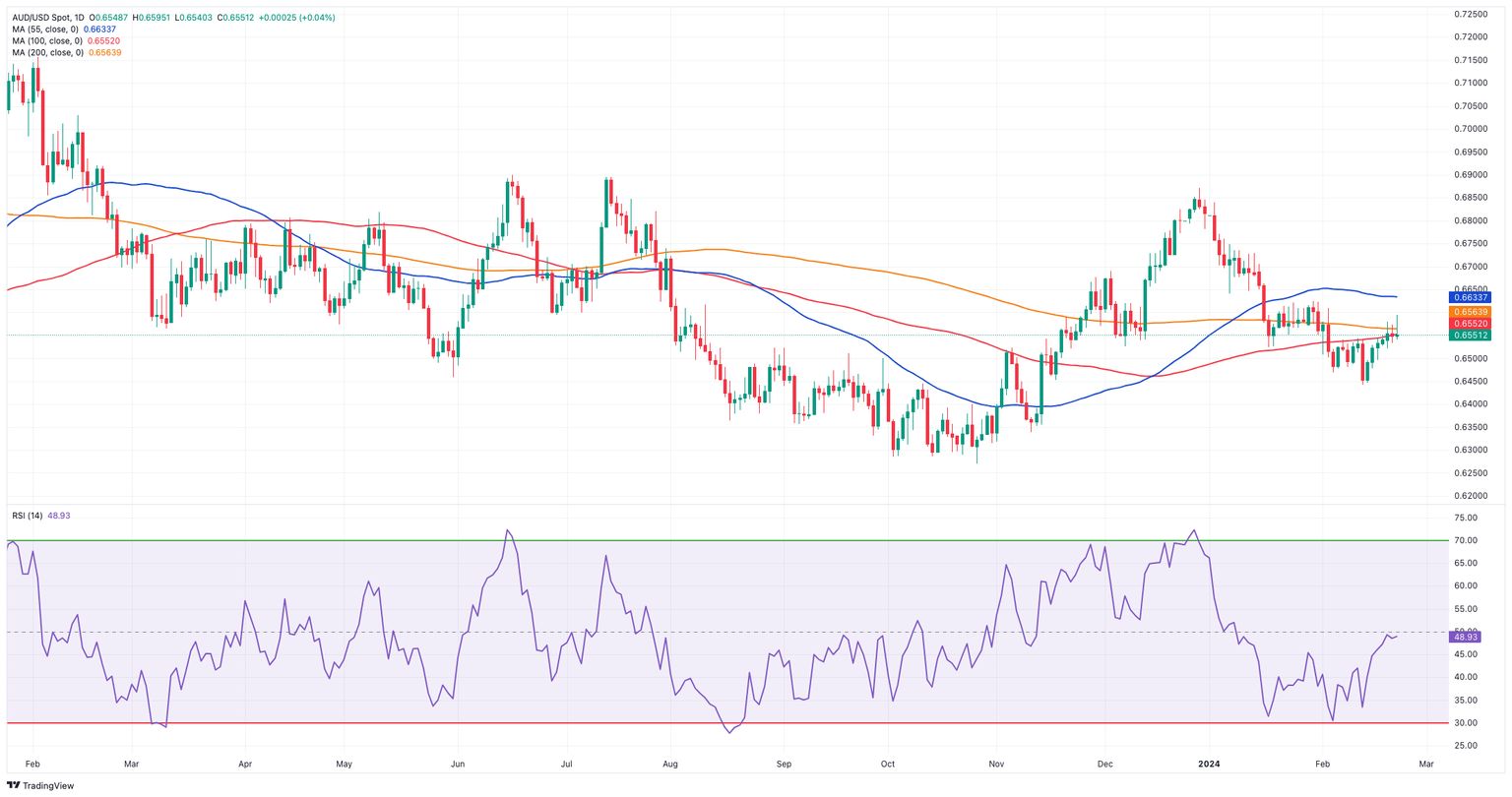

AUD/USD daily chart

AUD/USD short-term technical outlook

Once AUD/USD clears the weekly peak of 0.6595 (February 22), it could then retest the temporary 55-day SMA at 0.6628, which coincides with the late-January highs (January 30). A break above this range may take the pair to the December 2023 top of 0.6871 (December 28), followed by the July 2023 peak of 0.6894 (July 14) and the June 2023 high of 0.6899 (June 16), all before the important 0.7000 milestone.

On the other side, bearish attempts may cause the AUD/USD to initially hit its 2024 bottom at 0.6452 (February 13). Breaking below this level might result in a revisit to the 2023 bottom of 0.6270 (October 26), followed by the round level of 0.6200 and the 2022 low of 0.6169. (October 13).

It is worth noting that for the AUD/USD to experience more short-term gains, it must definitely leave behind the important 200-day SMA, which is now at 0.6561.

The 4-hour chart suggests some consolidation in the short-term horizon. In comparison, the initial resistance level is 0.6595, closely followed by 0.6610. Surpassing this zone implies a possible progress to 0.6728. Meanwhile, a breakdown of 0.6442 may result in a drop to 0.6347, then 0.6338. The MACD remained into the positive zone, while the RSI dropped to the 50 zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.