AUD/USD Forecast: Setup favours bulls ahead of flash US PMIs and Australian CPI

- AUD/USD edges higher for the third successive day on Tuesday amid renewed USD selling bias.

- Rising bets for smaller Fed rate hikes, a positive risk tone continue to undermine the greenback.

- Odds for additional RBA rate hikes benefit the Aussie and support prospects for further gains.

- Traders look to the flash US PMIs for some impetus ahead of the Australian CPI on Wednesday.

The AUD/USD pair holds steady just below mid-0.7000s through the Asian session on Tuesday and remains well within the striking distance of its highest level since August 15 touched last week. A combination of factors prompts fresh selling around the US Dollar, which, in turn, is seen acting as a tailwind for the major. Growing acceptance that the Federal Reserve will soften its hawkish stance amid signs of easing inflationary pressures continues to act as a headwind for the greenback. In fact, the current market pricing indicates a greater chance of a smaller 25 bps Fed rate hike move in February. This, along with a generally positive tone around the equity markets, undermines the safe-haven greenback and benefits the risk-sensitive Australian Dollar.

The Aussie draws additional support from rising odds for an additional rate hike by the Reserve Bank of Australia (RBA) in February. The bets were lifted by the Australian consumer inflation figures released earlier this month, which showed that the headline CPI re-accelerated to the 7.3% YoY rate - a 32-year-high - in November. Hence, the market focus will remain glued to the fourth-quarter Australian CPI report, due on Wednesday. A softer reading, along with worries about a deeper global economic downturn, might force bullish traders to lighten their positions and weigh heavily on the AUD/USD pair. In the meantime, the flash version of the US PMI prints will be looked upon for short-term opportunities later during the early North American session this Tuesday.

The fundamental backdrop supports prospects for further gains, though bulls might refrain from placing aggressive bets ahead of the crucial Australian data. Investors might also prefer to move to the sidelines ahead of the highly-anticipated FOMC monetary policy meeting, scheduled next week. This makes it prudent to wait for strong follow-through buying before positioning for an extension of the recent well-established uptrend witnessed over the past three months or so.

Technical Outlook

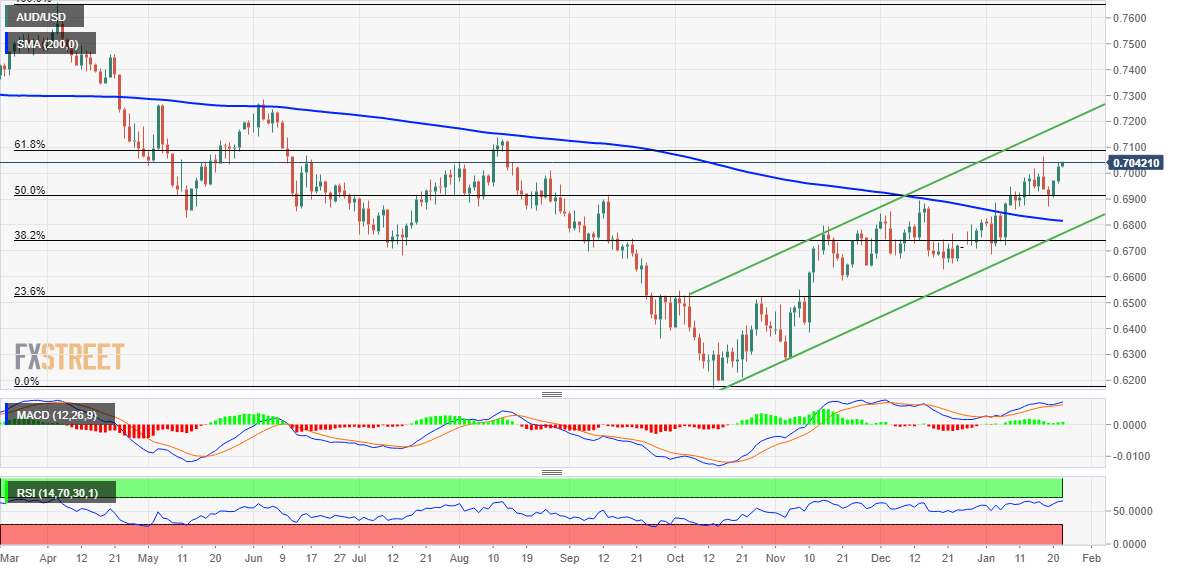

From a technical perspective, the AUD/USD pair has been scaling higher along an ascending channel, which points to a well-established short-term bullish trend. Adding to this, the recent breakout through the very important 200-day SMA and the 50% Fibonacci retracement level of the April-October 2022 downfall adds credence to the positive outlook. Moreover, oscillators on the daily chart are holding comfortably in the bullish territory and are still far from being in the overbought zone. The aforementioned technical setup suggests that the path of least resistance for spot prices is to the upside.

Some follow-through buying beyond the multi-month peak, around the 0.7065 area, touched last week will reaffirm the outlook and allow the AUD/USD pair to reclaim the 0.7100 mark. The latter coincides with 61.8% Fibo. level and is closely followed by the August 2022 swing high, around the 0.7125 region. The latter should act as a pivotal point for bullish traders, above which spot prices could accelerate the momentum towards the 0.7160-0.7165 area en route to the 0.7200 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.