AUD/USD Forecast: Renewed bullish sentiment above the 200-day SMA

- AUD/USD added to Tuesday’s gains above 0.6500.

- Extra gains look likely above the key 200-day SMA.

- Further weakness in the Dollar propped up the pair’s uptick.

The increased downward pressure on the US Dollar (USD) spurred a notable recovery in AUD/USD on Wednesday, building on the previous session’s advance further north of 0.6500 the figure.

Simultaneously, the Australian dollar's daily resurgence was complemented by the ongoing uptrend in copper prices, reaching levels last observed in late April 2023 near the $800.00 mark, and another slight rebound in iron ore prices after encountering support near the crucial $100.00 per tonne mark in recent sessions.

In the meantime, recent auspicious results from Chinese PMIs collaborated with the recovery in AUD. While potential stimulus measures from both the government and the PBoC might provide temporary relief, sustained enhancements in economic metrics are essential to bolster the Australian currency and potentially initiate a more sustainable uptick in AUD/USD.

Regarding the Reserve Bank of Australia (RBA), the release of its Minutes from its March meeting (Tuesday) confirmed the central bank's shift away from considering tightening monetary policy. Unlike the February session, there was no discussion about raising the cash rate target in March. Instead, members concurred that characterizing the policy outlook as one with uncertain future adjustments to the cash rate target was appropriate. RBA cash rate futures still suggest an expectation of just under 50 bps of policy rate cuts in 2024.

It's important to note that the RBA is one of the last G10 central banks anticipated to contemplate interest rate adjustments this year.

Due to the differing timelines for monetary policy adjustments between the RBA and the Fed, the Australian dollar may gain momentum later in the year, potentially leading to further strengthening in AUD/USD. If the pair surpasses the December 2023 peak of 0.6871, it could target a significant level of 0.7000 in the short term.

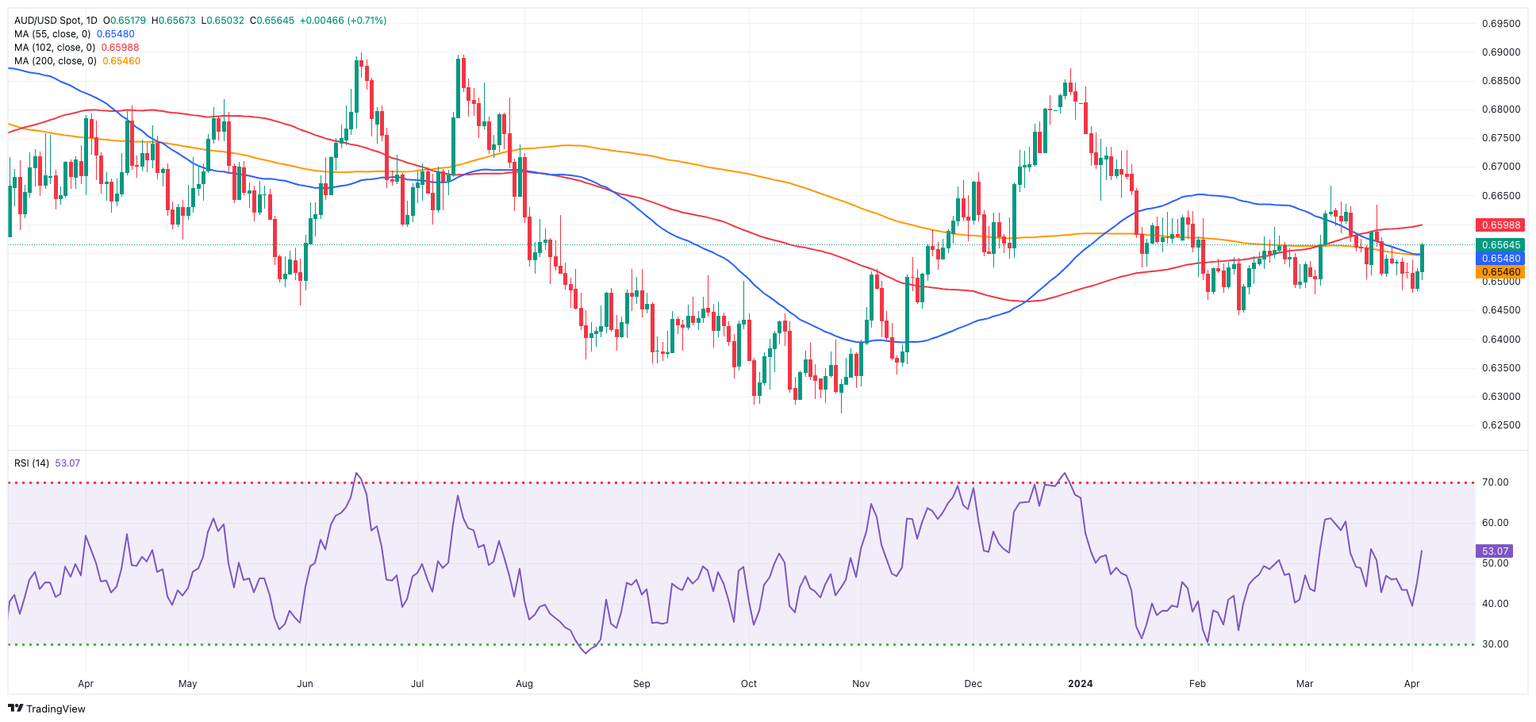

AUD/USD daily chart

AUD/USD short-term technical outlook

Further higher momentum in the AUD/USD should now challenge the interim 100-day SMA at 0.6596. Once this zone is cleared, spot might return to its March top of 0.6667 (March 8) before reaching its December 2023 peak of 0.6871 (December 28). Further north, monthly highs of 0.6894 (July 14) and 0.6899 (June 16) occur before the key 0.7000 threshold.

If sellers regain control, the pair could reach its April low of 0.6480 (April 1), then the March low of 0.6477 (March 5), and finally the 2024 bottom of 0.6442 (February 13). Breaking below this level may result in a test of the lowest level of 2023 at 0.6270 (October 26), prior to the round level of 0.6200.

Looking at the big picture, the pair is expected to extend its bullish trend if it convincingly surpasses the critical 200-day SMA.

On the 4-hour chart, the pair appears to have recovered its upward momentum. Against this, there is temporary resistance at 0.6634, closely followed by 0.6638 and then 0.6667. On the other hand, additional losses may cause the pair to retest 0.6480, then 06477, and eventually 0.6442. Furthermore, the MACD approached the positive zone, and the RSI rose to about 63.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.