AUD/USD Forecast: Poised to test the 0.7060 resistance area

AUD/USD Current Price: 0.7011

- The RBA will release the Minutes of its latest meeting, followed by a speech from Governor Lowe.

- AUD/USD is modestly advancing above the 0.700 threshold but holds below its recent lows.

The AUD/USD pair is battling to extend gains beyond the 0.7000 level, trading a few pips above it. The pair advanced within range as the greenback remained out of the market’s favor, while higher commodities prices provided additional support to the Aussie. Nevertheless, market players started the week on a cautious note amid mixed coronavirus-related headlines and ahead of earnings reports. Early Tuesday, the RBA will release the Minutes of its latest meeting, later followed by a speech from Governor Lowe, who will discuss COVID 19, the Labour Market, and Public-sector Balance Sheets.

AUD/USD short-term technical outlook

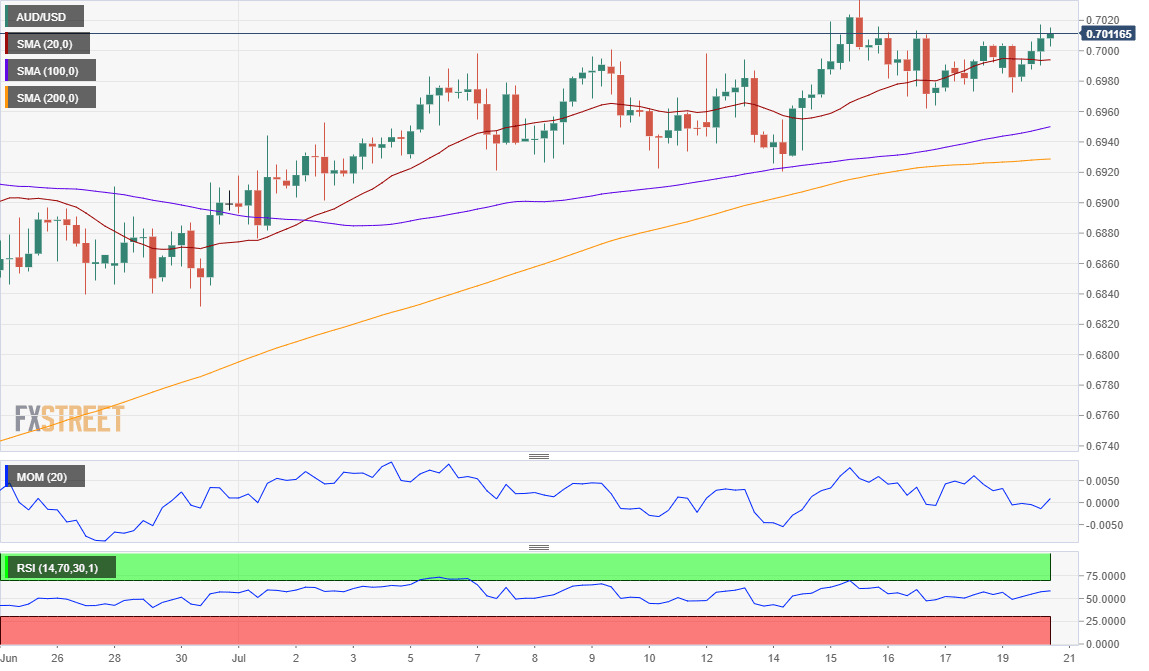

The AUD/USD pair is pressuring daily highs but still below the critical 0.7060 price zone, the level to surpass to confirm a new leg north. The short-term picture keeps favoring the upside, as, in the 4-hour chart, the pair continues to develop above all of its moving averages. Technical indicators, in the meantime, head north with moderate strength. The chances of a bullish extension would decrease on a break below 0.6975, the immediate support.

Support levels: 0.6975 0.6930 0.6895

Resistance levels: 0.7025 0.7060 0.7100

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.