AUD/USD Forecast: Poised to defy the 0.7400 threshold

AUD/USD Current Price: 0.7388

- Australian NAB’s Business Confidence contracted to 17 in the second quarter.

- The focus will be on the preliminary estimates of the July Commonwealth PMIs.

- AUD/USD is bullish in the near-term, still needs to overcome the 0.7400 resistance.

The AUD/USD pair peaked at 0.7396, retreating modestly afterwards to close the day around 0.7380. The pair found support in the better tone of Asian and European indexes, which posted substantial gains. The positive mood eased during American trading hours, preventing the pair from advancing further.

Australian data released at the beginning of the day missed expectations. NAB’s Business Confidence contracted to 17 in the second quarter from 19 in the previous quarter, also missing the market’s expectations of 21. On Friday, the country will publish the preliminary July estimates of the Commonwealth Bank PMIs.

AUD/USD short-term technical outlook

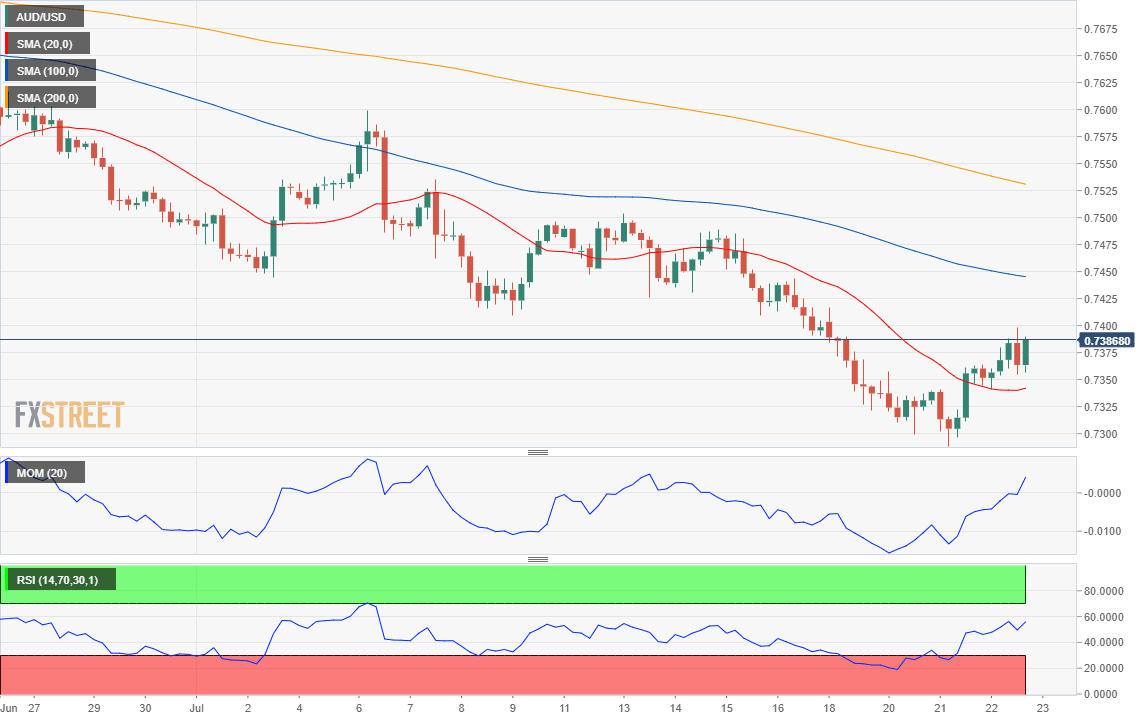

The near-term picture for the AUD/USD pair is bullish. The 4-hour chart shows that it has advanced above a now flat 20 SMA, although it holds well below bearish 100 and 200 SMAs. In the meantime, technical indicators head firmly higher within positive levels, anticipating another leg north, mainly on a break above the 0.7400 figure.

Support levels: 0.7330 0.7290 0.7260

Resistance levels: 0.7400 0.7440 0.7475

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.