AUD/USD Forecast: Poised to challenge the 0.7000 level

AUD/USD Current Price: 0.7077

- Falling gold prices and pressured equities weighed on the Aussie.

- Australian Retail Sales fell 4.2% in August, according to preliminary estimates.

- AUD/USD is biased lower despite oversold and could even lose the 0.7000 mark.

The AUD/USD pair extended its weekly decline to 0.7075, holding around the mentioned low ahead of the Asian opening, as persistent demand for the greenback coupled with a sharp decline in US indexes. Adding pressure on the Aussie, gold prices edged lower for a third consecutive day, falling to $1,860.80, its lowest in two months.

Australian data released at the beginning of the day were mixed, as the Commonwealth Bank Services PMI came in at 50, while the Manufacturing PMI printed at 55.5, both beating expectations. However, the preliminary estimate of August Retail Sales resulted at -4.2%, from 3.2% in the previous month. The country won’t publish macroeconomic figures this Thursday.

AUD/USD short-term technical outlook

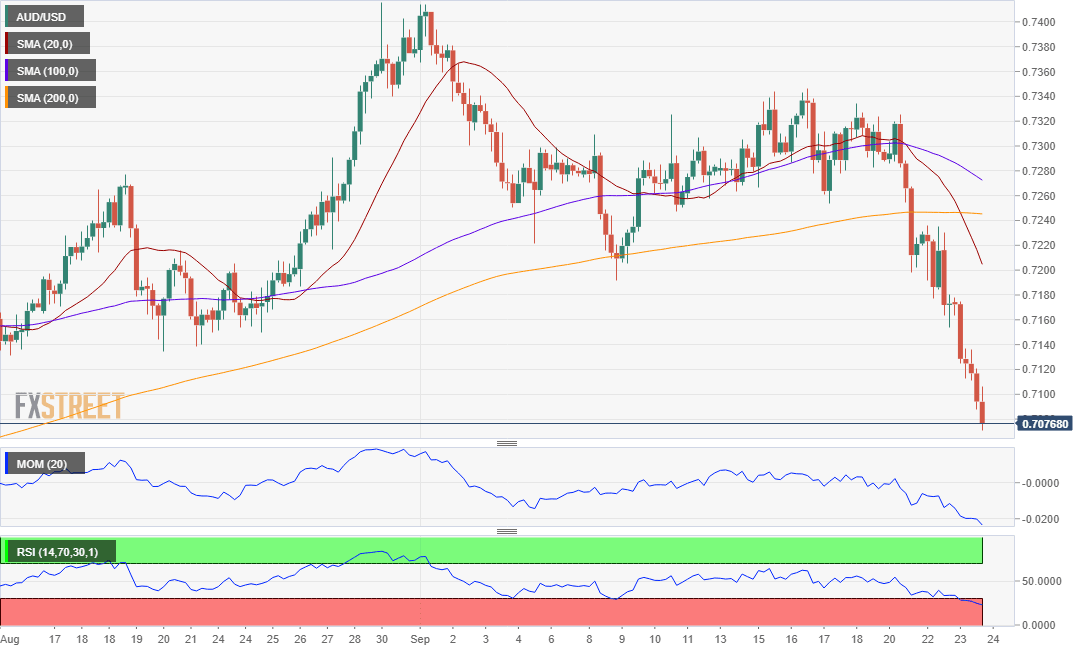

The AUD/USD pair is extremely oversold according to intraday technical readings, but with no signs of downward exhaustion. The 4-hour chart shows that the 20 SMA heads south almost vertically after crossing below the 200 SMA. The Momentum indicator has bounced modestly from its daily low, but the RSI indicator keeps heading lower, despite standing at 23. The pair is currently battling around August low 0.7075, en route to the psychological 0.7000 threshold.

Support levels: 0.7040 0.7000 0.6965

Resistance levels: 0.7110 0.7150 0.7190

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.