AUD/USD Forecast: On its way to challenge 0.7000

AUD/USD Current Price: 0.6971

- News that China resumed Australian coal imports underpinned the AUD.

- The US Dollar collapsed on speculation the US Federal Reserve would start hiking by 25 bps.

- AUD/USD retains its strong bullish momentum and is poised to keep rallying.

The Australian Dollar surged Thursday, trading against its American rival at around 0.6970. AUD/USD started the day on a strong footing, helped by news coming from China, as the country resumed Australian coal imports after banning them for almost three years. Additionally, the pair found support in upbeat Australian data, as the November Trade Balance posted a surplus of AUD 13.2 billion, beating expectations.

However, most gains were achieved after the release of the United States Consumer Price Index (CPI), which rose at an annual pace of 6.5% in December, further easing from multi-decade highs. Dwindling price pressures open the door for a slower Federal Reserve pace of tightening, something the market has been waiting for since the last quarter of 2022. Federal Reserve Bank of Philadelphia President Patrick Harker put the last nail in the US Dollar’s coffin, as right after the release of US data, he hit the wires hinting at 25 bps rate hikes for the upcoming meetings.

Wall Street seesawed between gains and losses but finally went for the upside, with the three major indexes posting substantial gains and adding support to AUD/USD. On Friday, Australia will publish November Home Loans and Investment Lending for Homes.

AUD/USD short-term technical outlook

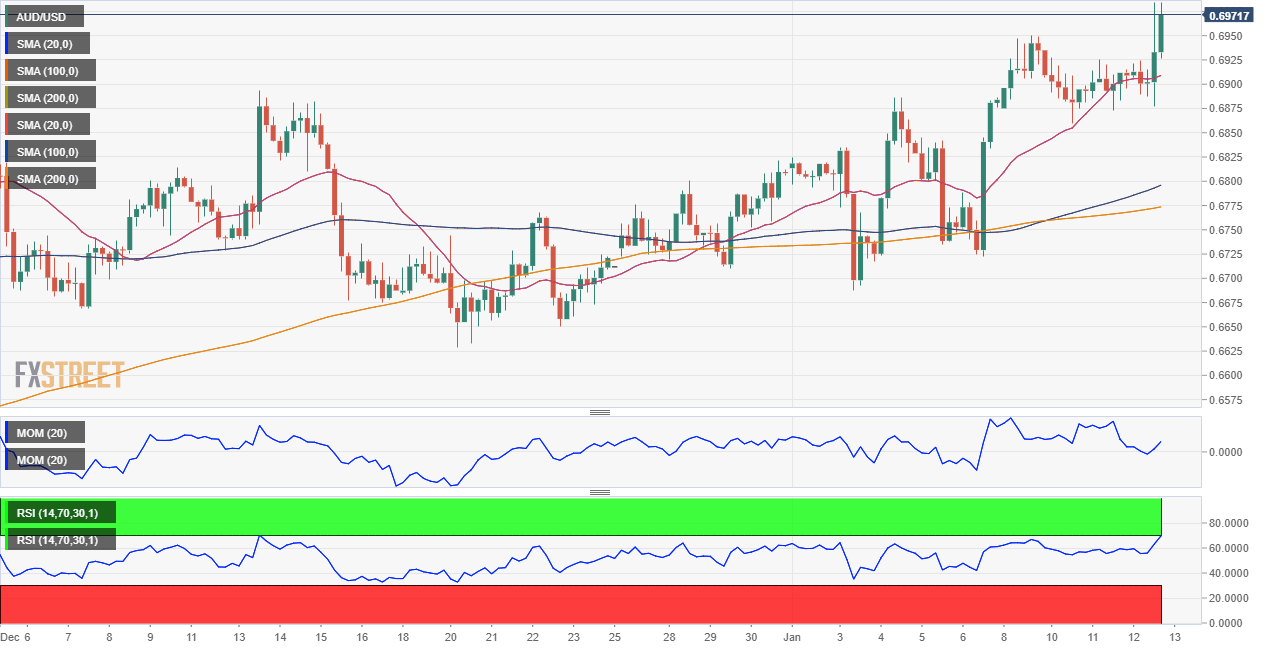

The AUD/USD pair retains Thursday’s gains and is poised to extend its advance, according to technical readings in the daily chart. The pair rallied past before all of its moving averages, with the 20 SMA heading north but still trapped between the longer ones. Technical indicators, on the other hand, head north almost vertically, approaching overbought readings.

The 4-hour chart reflects buyers’ strength, as the pair dipped over 100 pips early in the US session but quickly trimmed such losses to reach a fresh daily high. At the same time, the Momentum indicator maintains its upward slope well above its midline while the RSI consolidates at around 68, skewing the risk to the upside. Finally, a bullish 20 SMA keeps leading the way higher, as slides below it quickly attract buying interest.

Support levels: 0.6960 0.6920 0.6880

Resistance levels: 0.6990 0.7030 0.7075

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.