AUD/USD Forecast: Losing bullish potential, but close to 0.6600

AUD/USD Current Price: 0.6536

- Aussie weighed by the poor performance of equities, dismal market’s mood.

- Tensions between Australia and China likely to set the tone for the pair this week.

- AUD/USD could ease in the short-term, but the risk of a steep decline seems limited.

The AUD/USD pair settled at 0.6535, easing on Friday for a second consecutive day. Tensions between Australia and China weighed on the Aussie, amid Australia backing an investigation on the origins of COVID-19 and condemning Chin’s move to undermine Hong Kong’s autonomy through a strict national security law. Firmer gold prices kept the downside limited for the pair, which anyway was unable to hold above the elusive 0.6600 threshold. China banned imports from Australian beef and imposed punitive tariffs on Australian barley, which also hit investor’s confidence in an economic recovery.

The Australian macroeconomic calendar will remain empty at the beginning of the week, with the focus on the country’s relationship with China.

AUD/USD short-term technical outlook

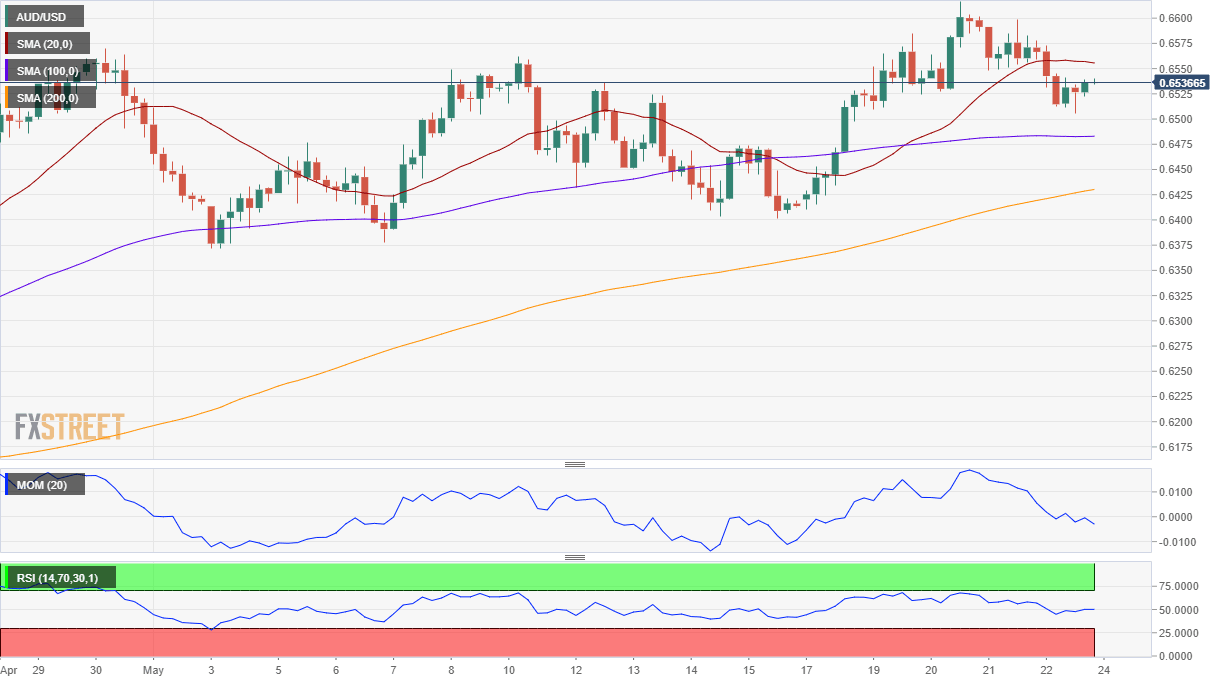

The AUD/USD pair has posted a weekly gain, despite easing at the end of it, and after posting a fresh 2-month high of 0.6615. The daily chart shows that the pair is losing its bullish potential, but it’s also far from bearish, as it holds above its 20 and 100 SMA, both converging at 0.6495, the immediate support level. Technical indicators, in the meantime, have turned lower but hold above their midlines. In the 4-hour chart, however, the pair is neutral-to-bearish, as the pair has settled below a now flat 20 SMA, while the Momentum indicator maintains its bearish slope within negative levels.

Support levels: 0.6495 0.6460 0.6420

Resistance levels: 0.6580 0.6615 0.6650

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.