AUD/USD Forecast: Extra gains remain on the cards near term

- AUD/USD rose to four-month highs beyond 0.6700.

- The rebound in the Dollar weighed on the pair.

- The Australian labour market report came in mixed in April.

The mild rebound in the US Dollar (USD) sparked some renewed selling bias in broad risky assets, motivating AUD/USD to return to the negative zone after hitting fresh four-month peaks just above the 0.6700 barrier on Thursday.

Additionally, the USD met some fresh buying orders as investors continued to digest the release of US inflation data tracked by the Consumer Price Index (CPI), which indicated a decline in April. This reinforced investors' anticipation of the potential initiation of the Fed's easing programme in the latter half of the year, most likely at the September 18 meeting.

The subdued US CPI figures aligned with Chief Jerome Powell's earlier statements in the week, where he dismissed the possibility of a rate hike and anticipated subdued inflation throughout the year.

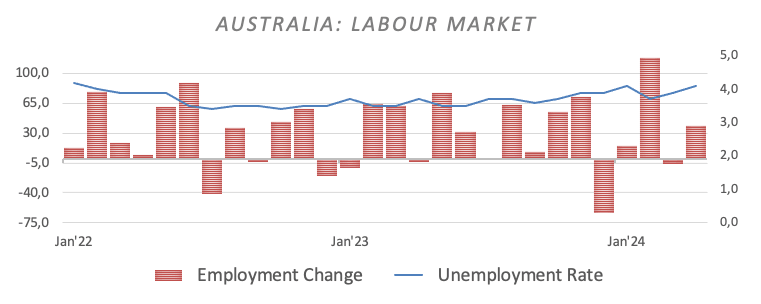

Domestically, the Australian dollar ignored the additional advance in copper prices, contrasting with relatively stable iron ore prices. On the docket, the labour market showed mixed feelings after the Unemployment Rate ticked higher to 4.1% and Employment Change increased more than expected by 38.5K individuals in April.

Regarding monetary policy, the Reserve Bank of Australia (RBA) opted to keep its interest rate steady at 4.35% during its May 7 meeting, maintaining a neutral stance and signalling flexibility. The RBA's economic projections foresee elevated inflation rates until Q2 2025, driven by service price inflation, with an eventual return to the 2%–3% target range by late 2025, reaching the midpoint by 2026.

During the subsequent press briefing, Governor Michele Bullock adopted a balanced stance, suggesting potential rate adjustments but without a definitive commitment.

Currently, the swaps market largely discounts the likelihood of further rate hikes in the next six months, with expectations of a decline in the subsequent period.

Furthermore, both the RBA and the Federal Reserve are anticipated to implement easing measures later than many of their G10 counterparts.

Considering the Fed's commitment to monetary policy tightening and the potential for RBA easing later in the year, sustained upward movements in AUD/USD are anticipated to encounter limitations.

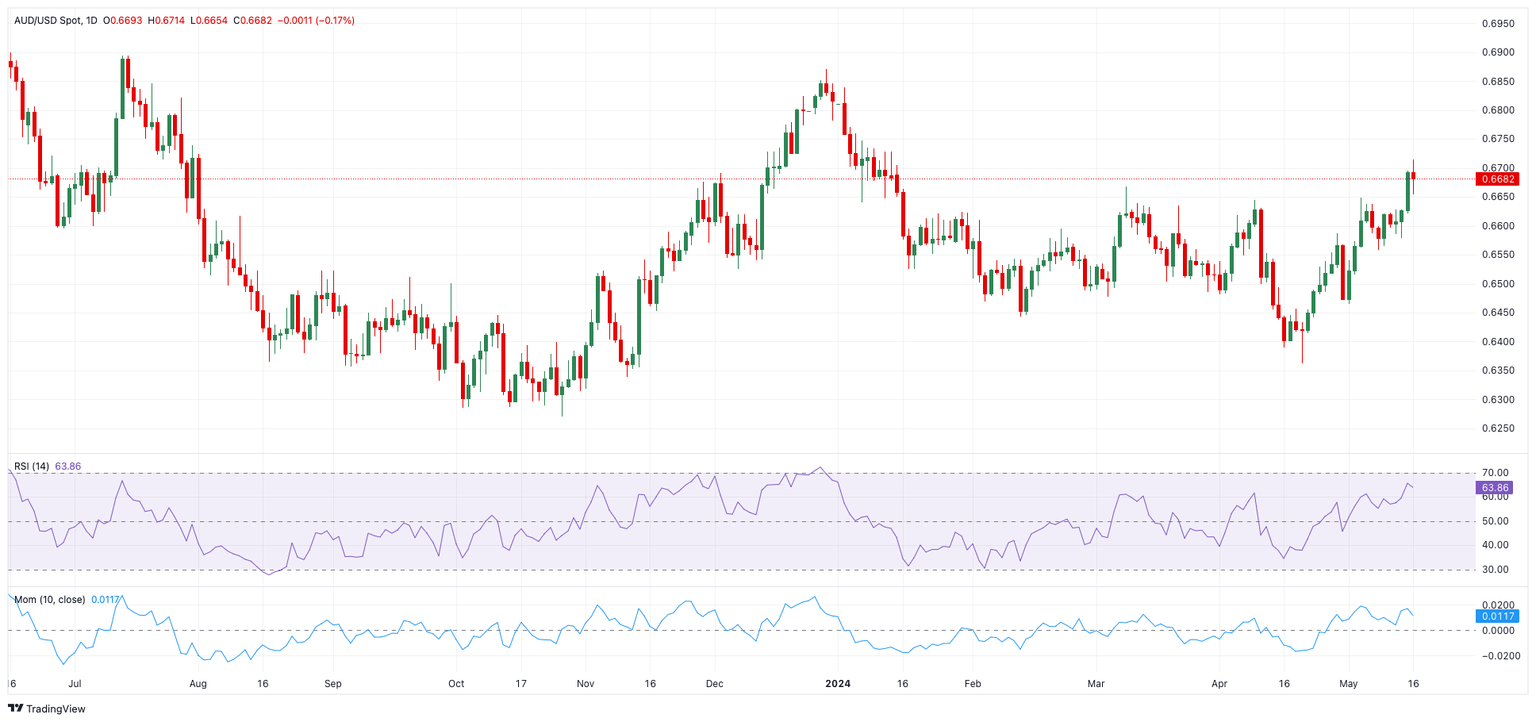

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may cause the AUD/USD to initially try the May high of 0.6714 (May 16) before the December 2023 top of 0.6871 and the July 2023 peak of 0.6894 (July 14), all ahead of the key 0.7000 yardstick.

Meanwhile, occasional bearish attempts could drag spot the interim 100-day and 55-day SMAs of 0.6567 and 0.6548, respectively, before the more significant 200-day SMA of 0.6522, all before dropping to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Looking at the larger picture, further gains are possible as long as spot continues above the 200-day SMA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.