AUD/USD Forecast: Extra gains now look to data and the US Dollar

- AUD/USD advances for the third session in a row on Tuesday.

- Further losses in the US Dollar give fresh additional wings to the pair.

- Australian preliminary Retail Sales surprised to the downside in April.

The ongoing selling pressure on the US Dollar (USD) supported extra gains in AUD/USD, pushing it to four-day highs near 0.6680 on Tuesday.

The persistently bearish tone in the Greenback came pari passu with investors’ evaluation of the possibility of the Federal Reserve (Fed) beginning its easing programme later this year, potentially at the September meeting.

This sentiment has been bolstered by cautious remarks from several Fed officials in the past few weeks, emphasizing the need for more evidence of inflation moving towards the Fed's target before considering rate cuts.

Shifting to the domestic scenario, the Australian Dollar's bullish position was strengthened by the continuation of the recovery in copper prices and further range bound trading in iron ore prices.

Regarding monetary policy, the Reserve Bank of Australia's (RBA) recently released Minutes from its May meeting, which highlighted discussions on interest rate hikes. The RBA might be one of the last major central banks, alongside the Fed, to adjust its monetary policy. The futures markets are currently predicting...

It's worth noting that the RBA kept its interest rate steady at 4.35% this month, adopting a neutral stance while showing flexibility. The RBA's economic forecasts indicate that inflation will remain high until Q2 2025, driven by service price inflation, before returning to the 2%–3% target range by late 2025 and reaching the midpoint by 2026. Investors currently expect the RBA to keep its Official Cash Rate (OCR) unchanged at its June 18 meeting, with no rate cuts anticipated this year.

Given the Fed's commitment to monetary policy tightening and the possibility of the RBA maintaining its restrictive stance for a prolonged period, further consolidation in AUD/USD is possible in the coming months.

On the docket, the Westpac Leading Index and the RBA’s Monthly CPI Indicator are both due on Wednesday.

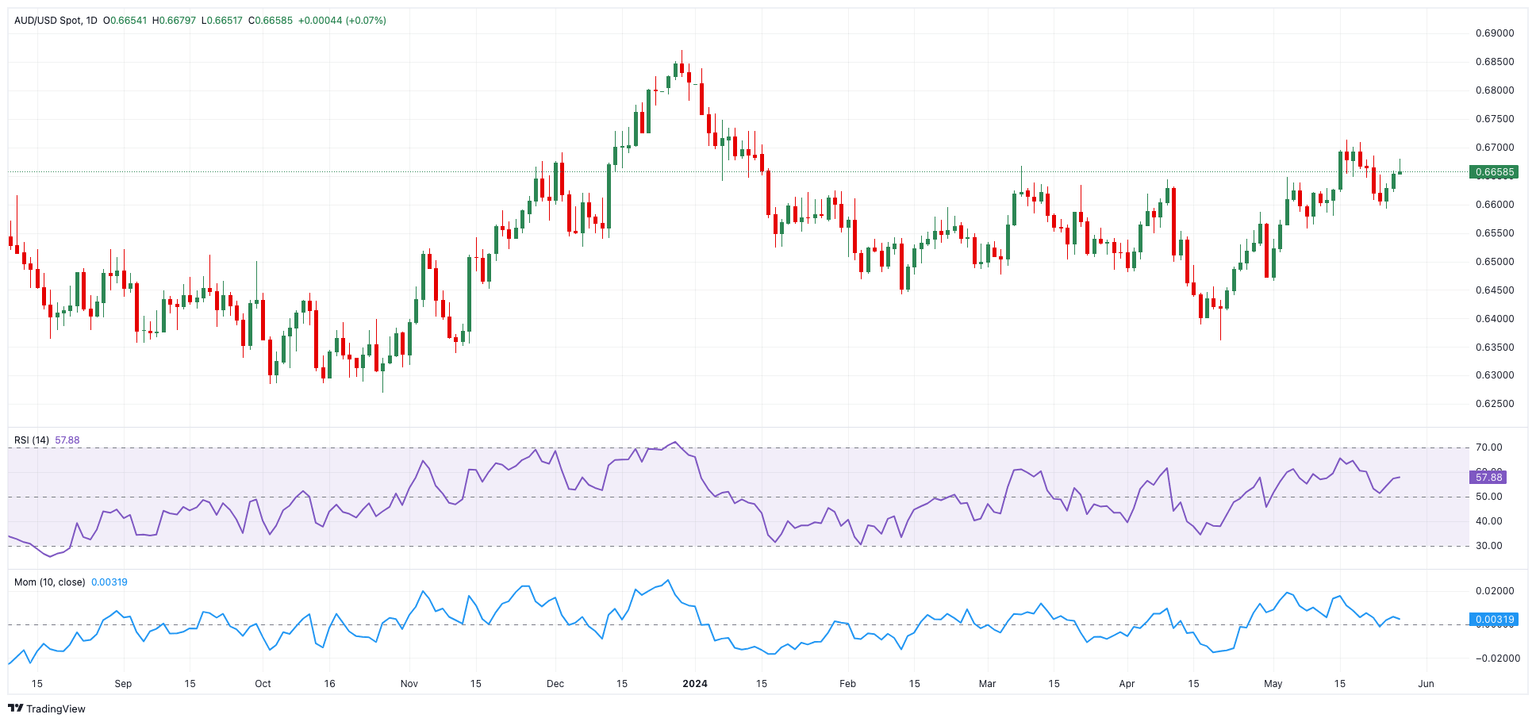

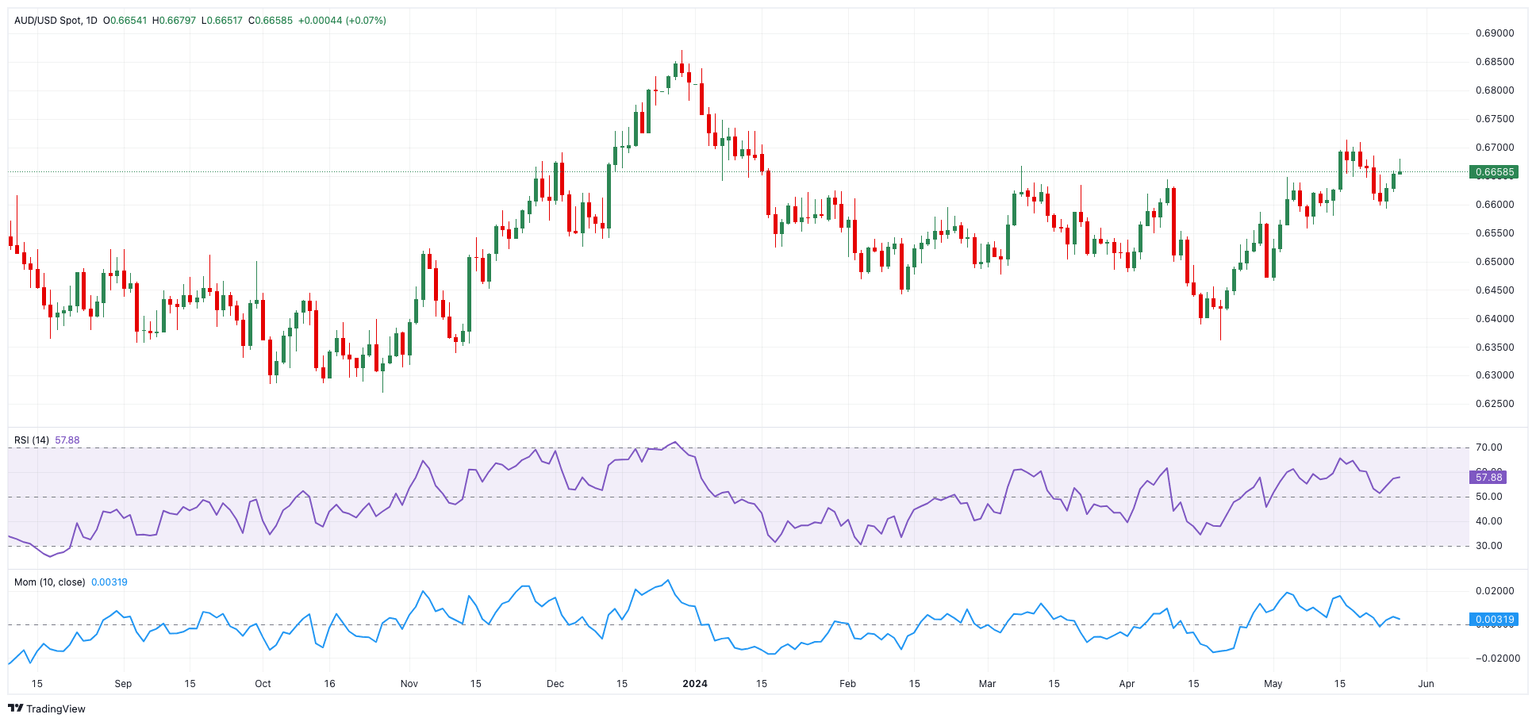

AUD/USD daily chart

AUD/USD short-term technical outlook

AUD/USD short-term technical outlook

Extra gains may push the AUD/USD to challenge the May high of 0.6714 (May 16), before aiming for the December 2023 top of 0.6871 and the July 2023 peak of 0.6894 (July 14), all ahead of the important 0.7000 mark.

Meanwhile, bearish attempts might push the pair to the intermediate 100-day and 55-day SMAs in the 0.6560 range, then to the key 200-day SMA of 0.6530. The loss of the later could open the door to a visit to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Looking at the larger picture, more gains are expected as long as the price stays above the 200-day SMA.

On the four-hour chart, the recovery appears to have met some resistance near 0.6680. That said, first on the upswing comes 0.6685 acts as a first hurdle, followed by 0.6709 and 0.6714. On the other side, 0.6607 provides immediate support, prior to 0.6570 and the 200-SMA at 0.6562. The RSI lost ground and retested the 56 zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.