AUD/USD Forecast: Awaiting US CPI in a familiar range

AUD/USD Current Price: 0.6673

- RBA Governor Lowe will deliver a speech on Wednesday.

- The US Dollar continues to be the key driver, with US CPI data on Wednesday expected to be crucial.

- The AUD/USD continues to move sideways within the range of 0.6600 and 0.6700.

The AUD/USD approached the 0.6700 area during the Asian session but then pulled back, holding in the familiar range as the market remains choppy, awaiting US inflation data. Those numbers will likely trigger volatility and an increase in volume. Prior to that release, the current consolidation path could continue. Higher equity prices continue to offer support to the Aussie.

Data released on Tuesday showed the National Australia Bank Business Condition Index rose modestly in June from 8 to 9, while the Confidence Index recovered from -4 to 0. The index is above the average, showing resilience among businesses. The Westpac-Melbourne Institute Consumer Sentiment rose by 2.7% to 81.3 in July. The report mentioned that "sentiment remains at the deeply pessimistic levels that have prevailed for just over a year now" and added that "a significant reported fall in inflation looks to have boosted confidence".

On Wednesday, Reserve Bank of Australia Governor Lowe will deliver a speech on "The Reserve Bank Review and Monetary Policy". At the July meeting, the RBA kept interest rates unchanged at 4.1%. Comments from Lowe will be watched closely. The next RBA meeting is on August 1, and the June CPI will be released on July 27. Also of relevance for the Aussie on Wednesday will be the Reserve Bank of New Zealand's decision. No change is expected from the RBNZ.

The key driver in AUD/USD will likely continue to be the US Dollar, particularly ahead of a crucial report. The US Consumer Price Index (CPI) will be released on Wednesday, with a 0.3% monthly increase expected in June. Those figures will be critical for monetary policy expectations ahead of the July 25-26 FOMC meeting. Market participants appear to be on the sidelines, waiting for those figures before making any significant trading decisions.

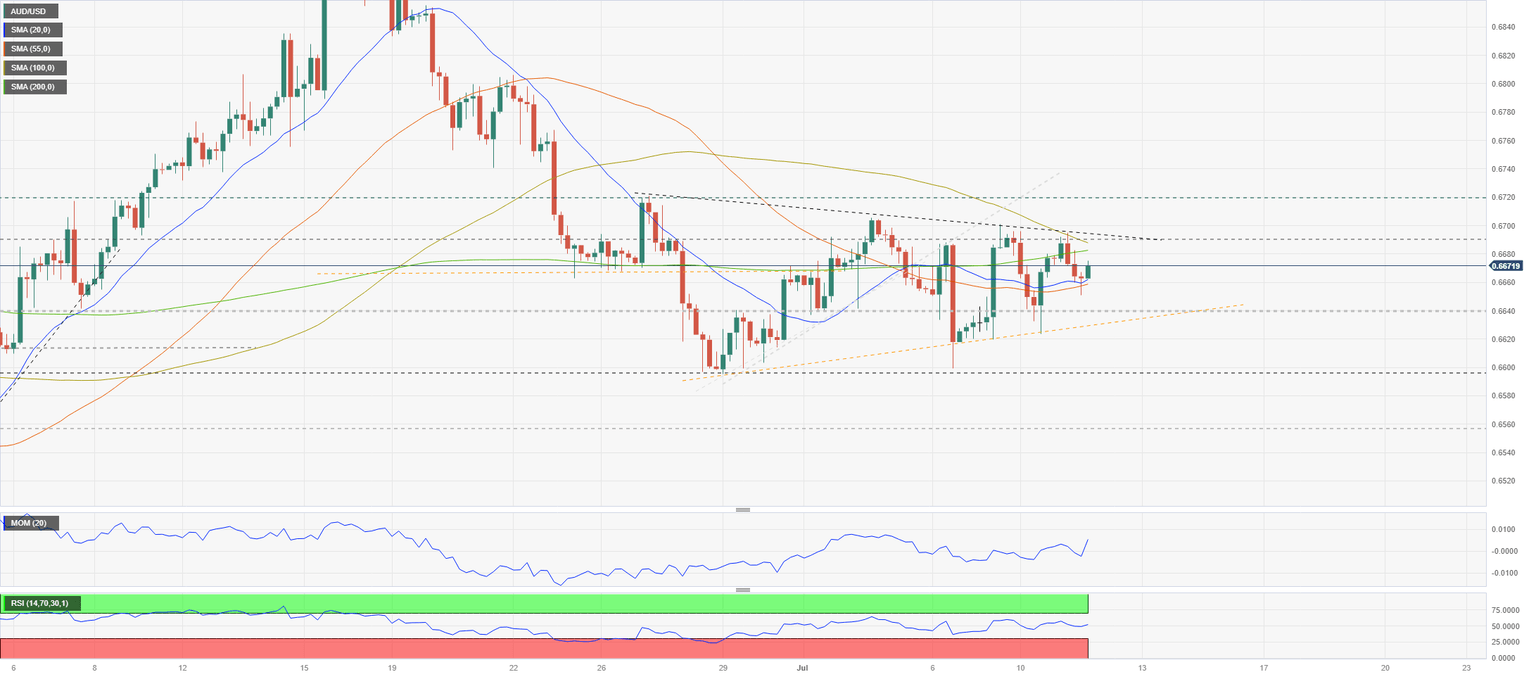

AUD/USD short-term technical outlook

Not much has changed for the AUD/USD over the last few sessions. The pair continues to move below the 20- and 200-day Simple Moving Averages (SMA), at 0.6717 and 0.6695, respectively. The key resistance is the 0.6700 zone, and consolidation above 0.6720 would open the door to further gains, probably to the 0.6800 zone. On the flip side, the relevant support stands at 0.6590, and a break lower would leave the Aussie vulnerable to further losses, with the next support at 0.6560 (March low).

On the 4-hour chart, AUD/USD is moving sideways, without clear signs around 0.6670 and near the 20-SMA. The Relative Strength Index (RSI) is flat at 50, while momentum is accelerating on the upside. The risk appears tilted to the upside in the short term ahead of the Asian session. As it approaches 0.6700, resistance is likely to strengthen, and a break above should trigger a bullish acceleration. On the flip side, below 0.6650, the pair could weaken modestly, exposing a trendline around 0.6630, which should limit the downside. Below that level, a slide to 0.6600 seems likely.

Support levels: 0.6630 0.6595 0.6560

Resistance levels: 0.6695 0.6720 0.6755

View Live Chart for the AUD/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.