AUD/USD Forecast: Australian government announced new stimulus measures

AUD/USD Current Price: 0.5785

- Australian PM Morrison announced a stimulus package of A$66.4 billion.

- Coronavirus pandemic to continue to set the tone for major currencies.

- AUD/USD remains extremely oversold despite bouncing 300 pips from its lows.

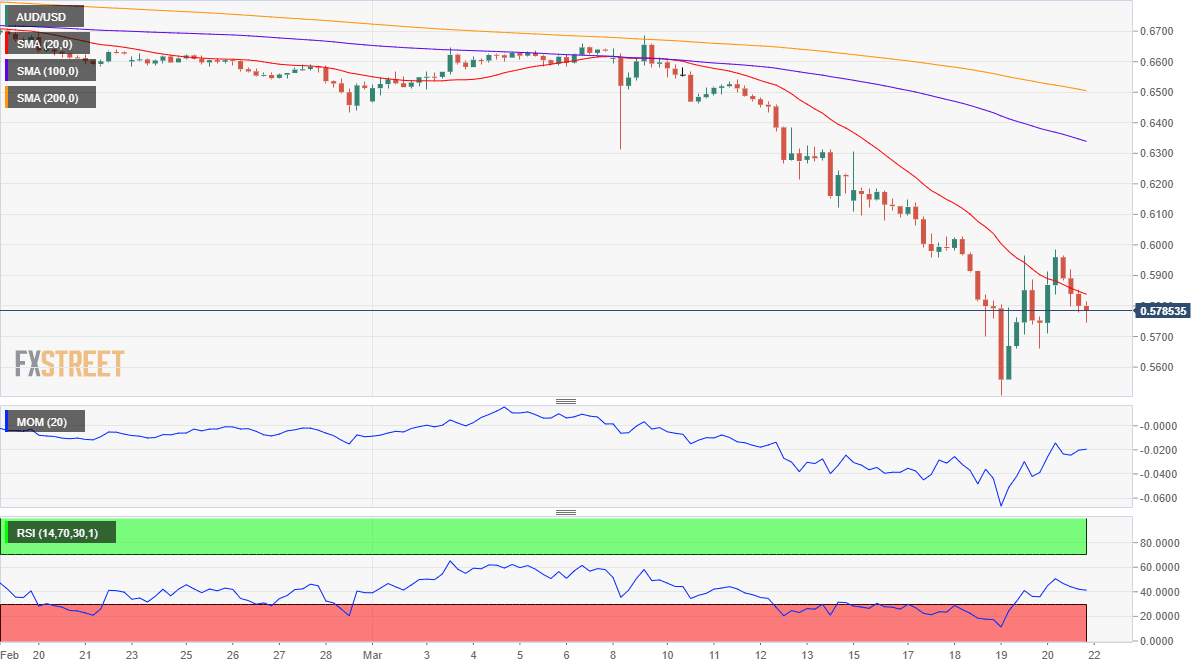

The AUD/USD pair posted a modest advance on Friday to finish the week around 0.5800, down for a second consecutive week and up from a multi-year low of 0.5506. The Aussie advanced against its American rival to 0.5985 as Fed’s decision to expand the currency swap lines to nine more banks brought some temporal relief to markets, which anyway was reverted on Friday, as the coronavirus crisis keeps escalating worldwide.

On Sunday, Australian PM Morrison announced the government would pump in A$66.4 billion into the economy to counter the economic impact of the coronavirus pandemic. The government will provide A$25.2 billion in support to businesses and not-for-profit charities while also offer support to small businesses. Morrison added that more measures and more support are in the pipeline. Australia won’t release relevant data this Monday.

AUD/USD short-term technical outlook

The AUD/USD pair remains extremely oversold, but chances that it could turn the tie are extremely low, given the crisis context. In the daily chart, technical indicators have recovered modestly but remain in extreme levels, while the 20 DMA heads south almost vertically over 500 pips above the current level. In the 4-hour chart, the pair tried to recover above a bearish 20 SMA, but settled below it, while technical indicators have recovered from extreme oversold levels, but lost their strength within negative levels.

Support levels: 0.5745 0.5700 0.5640

Resistance levels: 0.5840 0.5895 0.5930

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.