AUD/USD Forecast: Aussie’s bullish potential well limited

AUD/USD Current Price: 0.7360

- Australian data missed expectations, Retail Sales fell 1.8% in June.

- A better market mood helped the pair recover from a fresh 2021 low of 2021.

- AUD/USD recovered on a better mood, but the bullish potential is limited.

The AUD/USD pair fell to a fresh 2021 low of 0.7288 but finished the day with gains in the 0.7360 price zone. The pair recovered on a better market mood, although gains were modest, as demand for the aussie remains subdued. Australian data released at the beginning of the day was discouraging, as the June Westpac Leading Index printed at -0.06% in June, down from the previous 0.04%.

Additionally, the preliminary estimate of June Retail Sales printed at -1.8% worse than anticipated. On Thursday, Australia will publish NAB’s Business Confidence for the second quarter of the year, foreseen at 21 from 17 in Q1.

AUD/USD short-term technical outlook

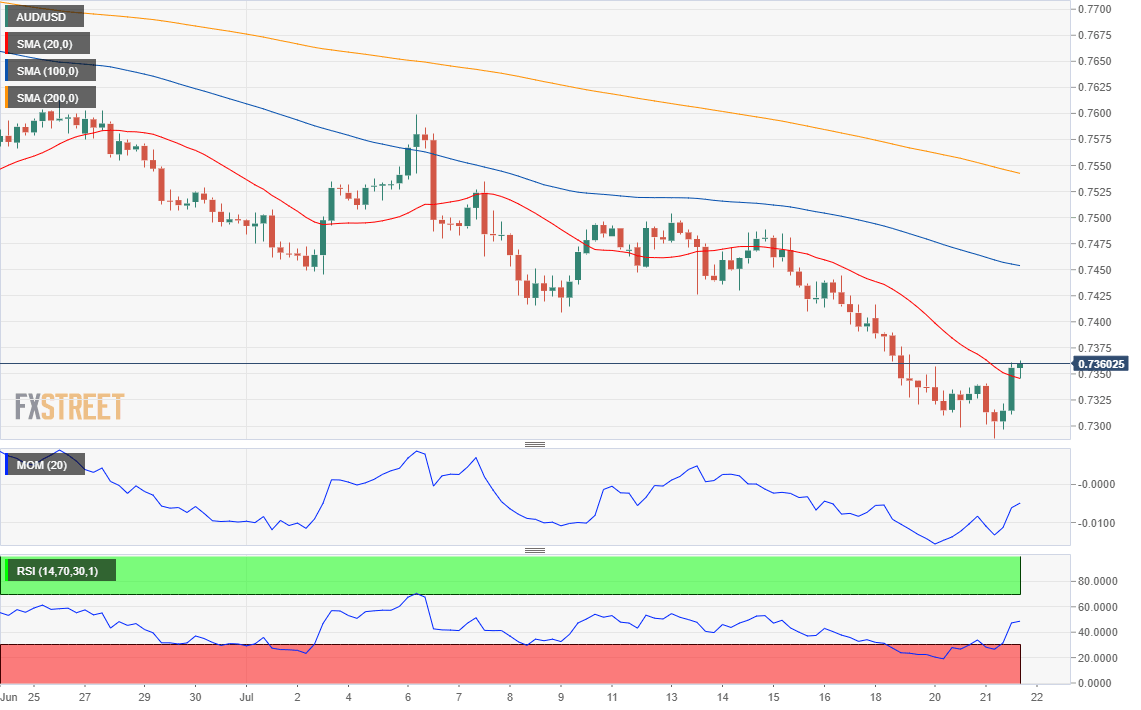

The AUD/USD pair has limited bullish potential. The 4-hour chart shows that it is trading a handful of pips above a firmly bearish 20 SMA, while the longer ones maintain their downward slopes far above the current level. Technical indicators have decelerated their advances after nearing their midlines, with the Momentum standing around its 100 level and the RSI consolidating around 47. The recovery failed to confirm a bullish extension, and the pair may resume its decline on a break below 0.7290, the immediate support level.

Support levels: 0.7290 0.7260 0.7215

Resistance levels: 0.7365 0.7400 0.7440

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.