AUD/USD Analysis: Rallies to fresh multi-month peak on stronger inflation data

- AUD/USD jumps to more than the five-month top in reaction to more robust Australian CPI figures.

- The data lifts bets for further rate hikes by the RBA and triggers a fresh bout of short covering.

- Expectations for a less aggressive Fed keep the USD on the defensive and remain supportive.

The AUD/USD pair gains strong positive traction for the fourth successive day and retakes the 0.7100 mark for the first time since mid-August during the Asian session on Wednesday. The Australian Dollar jumps in reaction to the stronger domestic consumer inflation figures, giving the Reserve Bank of Australia (RBA) reasons to keep raising interest rates. The Australian Bureau of Statistics reported that the headline CPI rose 1.9% in the three months to December, higher than the 1.6% anticipated and the previous quarter's reading of 1.8%. Furthermore, the yearly rate accelerated from 7.3% in the third quarter to 7.8% - marking the highest level since 1990.

The data smashed expectations that the RBA might pause its tightening campaign and triggered a fresh bout of a short-covering around the Australian Dollar. Adding to this, a generally positive tone around the Asian equity markets is another factor driving flows towards the risk-sensitive Aussie. This, along with subdued US Dollar price action, provides an additional boost to the AUD/USD pair and remains supportive of the ongoing positive momentum. The USD Index, which measures the greenback's performance against a basket of currencies, stays depressed near a nine-month low amid rising bets for a less aggressive policy tightening by the Federal Reserve.

The markets seem convinced that the US central bank will soften its hawkish stance and have been pricing in a smaller 25 bps rate hike in February. The USD is also weighed down by the flash US PMIs released on Tuesday, which showed that business activity in the manufacturing and services sectors continued to contract in January. The downturn moderated for the first time since September, though it did little to provide any respite to the USD bulls. That said, worries about a deeper global economic downturn seem to benefit the greenback's relative safe-haven status and might cap any further gains for the AUD/USD pair, at least for the time being.

Nevertheless, the fundamental backdrop seems tilted firmly in favour of bullish traders and supports prospects for a further near-term appreciating move without any relevant US macro data. The market focus now shifts to the Advance US Q4 GDP print, scheduled for release on Thursday. This, along with the Core PCE Price Index on Friday, will influence the Fed's interest rate strategy and drive the USD demand ahead of the highly-anticipated FOMC policy meeting next week.

Technical Outlook

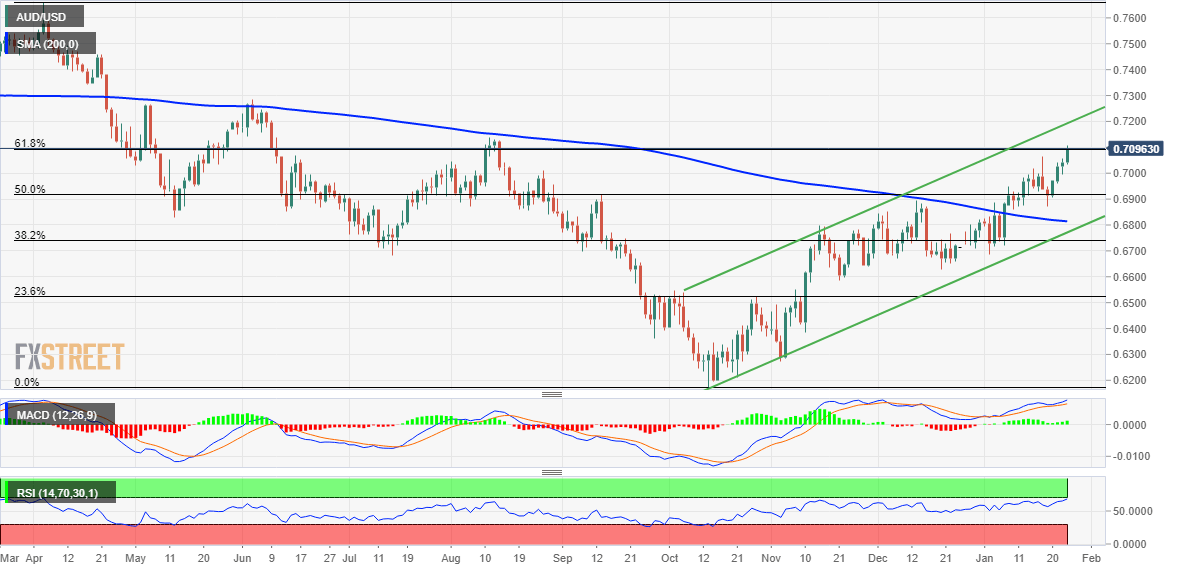

From a technical perspective, Wednesday's positive move pushes the AUD/USD pair beyond the 61.8% Fibonacci retracement level of the April-October 2022 downfall. This comes from the recent breakout through the important 200-day SMA and adds credence to the near-term positive outlook. Hence, a subsequent move towards testing the August 2022 swing high, around the 0.7130-0.7135 zone, looks like a distinct possibility. Some follow-through buying has the potential to lift spot prices further and allow bulls to aim to reclaim the 0.7200 round figure for the first time since June 2022.

On the flip side, the 0.7065-0.7060 region now protects the immediate downside ahead of the 0.7000 psychological mark. Failure to defend the said support levels might prompt technical selling and drag the AUD/USD pair back towards the 0.6900 mark. The latter is followed by the lower end of a short-term ascending trend channel extending from the October 2022 swing low, currently around the 0.6865 region, which should now act as a strong base for spot prices. A convincing break below the trend-channel support will negate the positive outlook and shift the near-term bias in favour of bearish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.