AUD/USD Analysis: Bullish potential, sellers around 0.6900

AUD/USD Current Price: 0.6865

- Australian Q3 inflation expected to remain well below RBA’s target.

- RBA’s Governor Lowe reiterated its dovish stance, weighing on the Aussie.

- AUD/USD in recovery mode amid dollar’s weakness, but bullish scope limited.

The Australian dollar surged against the greenback to 0.6871, its highest in almost a week, on the back of broad dollar’s weakness. The pair seesawed between gains and losses at the beginning of the day, amid positive US-China trade headlines, but discouraging comments from RBA’s Governor, Phillip Lowe, who repeated that the governing board was prepared to ease the monetary policy further and reiterated that rate cuts are helping the economy. The pair later advanced on dollar’s weakness, in spite of negative news related to the US-China relationship.

Australia will release this Wednesday New Home Sales and Q3 inflation estimates. Quarterly inflation is expected to have risen by 0.5%, after advancing 0.6% in the previous quarter, while yearly basis, the CPI is seen at 1.7% from 1.6% previously. The RBA Trimmed Mean estimates are seen at .04% and 1.6% respectively, unchanged from the previous quarterly estimates.

AUD/USD short-term technical outlook

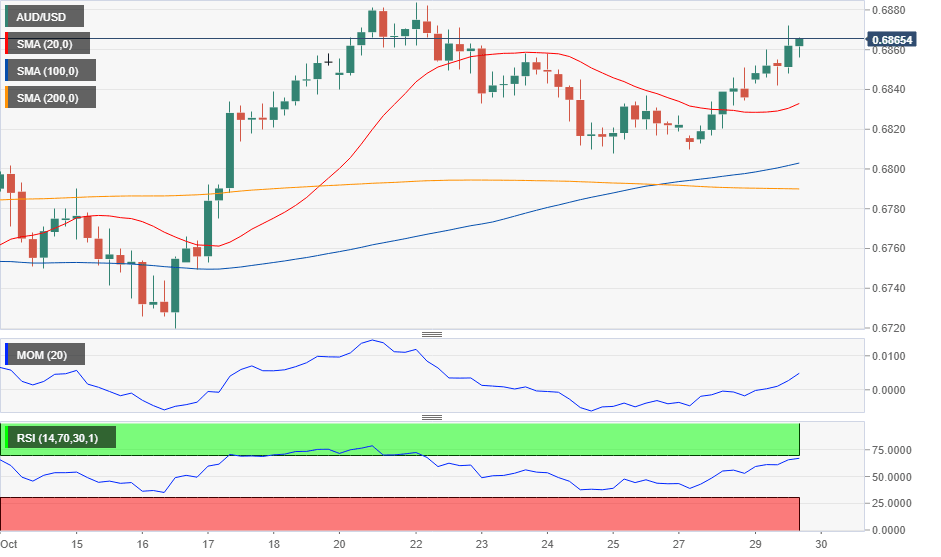

The AUD/USD pair holds on to daily gains in the 0.6860 price zone, bullish in the short-term, as the 4-hour chart shows that it remains above all of its moving averages, which anyway remain directionless and as technical indicators attempt to recover within positive levels. The bullish potential of the pair will increase on a break above 0.6877, so far the monthly high, although large selling interest is suspected around the 0.6900 level.

Support levels: 0.6840 0.6800 0.6770

Resistance levels: 0.6875 0.6900 0.6930

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.