AUD/USD Analysis: Aussie weaker ahead of RBA Meeting’s Minutes

AUD/USD Current Price: 0.6773

- Australian dollar weighed by US-China trade talks’ lack of detail.

- RBA Meeting’s Minutes set to anticipate more rate cuts coming.

- AUD/USD to resume its decline on a break below 0.6730, the immediate support.

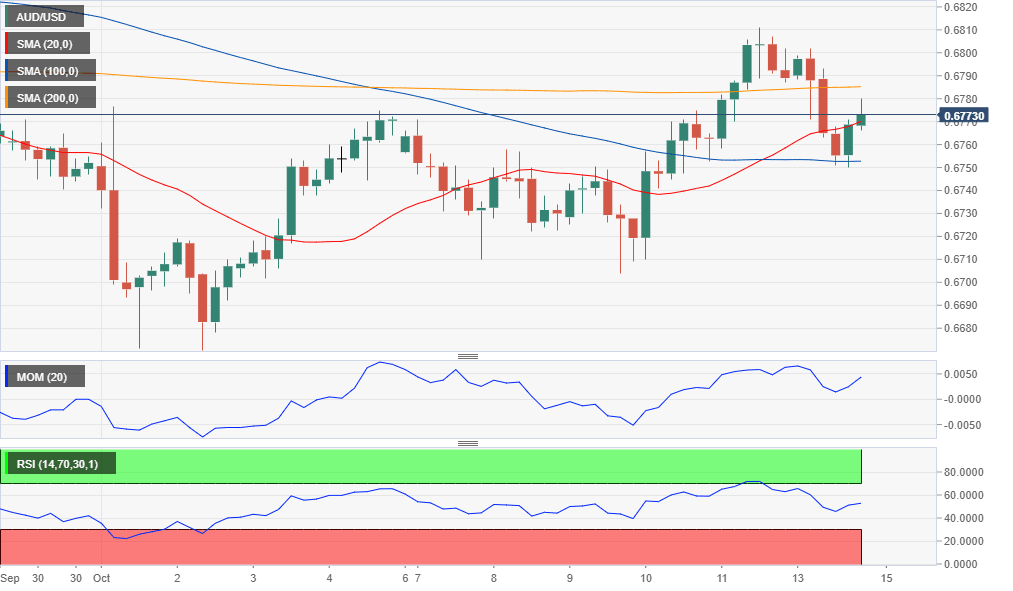

The AUD/USD pair is entering the Asian session trading in the 0.6770 price zone, bouncing in the final hours of the day after bottoming at 0.6750. The Australian dollar has been under selling pressure for most of the day, as the absence of clear details and a delay in the sign of the US-China trade agreement discouraged speculative interest. Chinese data released at the weekly opening was mixed, as the country's trade balance widened to $39.65 billion in September, much better than the $33.30B expected. The larger surplus, however, is the result of contracting imports, which in the mentioned period plummeted by 8.5%, while exports declined by 3.2%.

This Tuesday, the Reserve Bank of Australia will release the Minutes of its latest meeting, and the market anticipates a dovish stance, which may lead to additional losses in AUD/USD. Also, China will release September inflation data, which may have a limited impact on the Aussie.

AUD/USD short-term technical outlook

The AUD/USD pair is offering a neutral-to-bearish stance in its 4 hours chart, as it’s developing between directionless moving averages, while technical indicators quickly resumed their declines after a modest bounce from their midlines. The pair has spent the day hovering around the 23.6% retracement of its latest mid-term slump, with bears most likely taking over on a break below the 0.6730 support.

Support levels: 0.6730 0.6700 0.6665

Resistance levels: 0.6825 0.6860 0.6900

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.