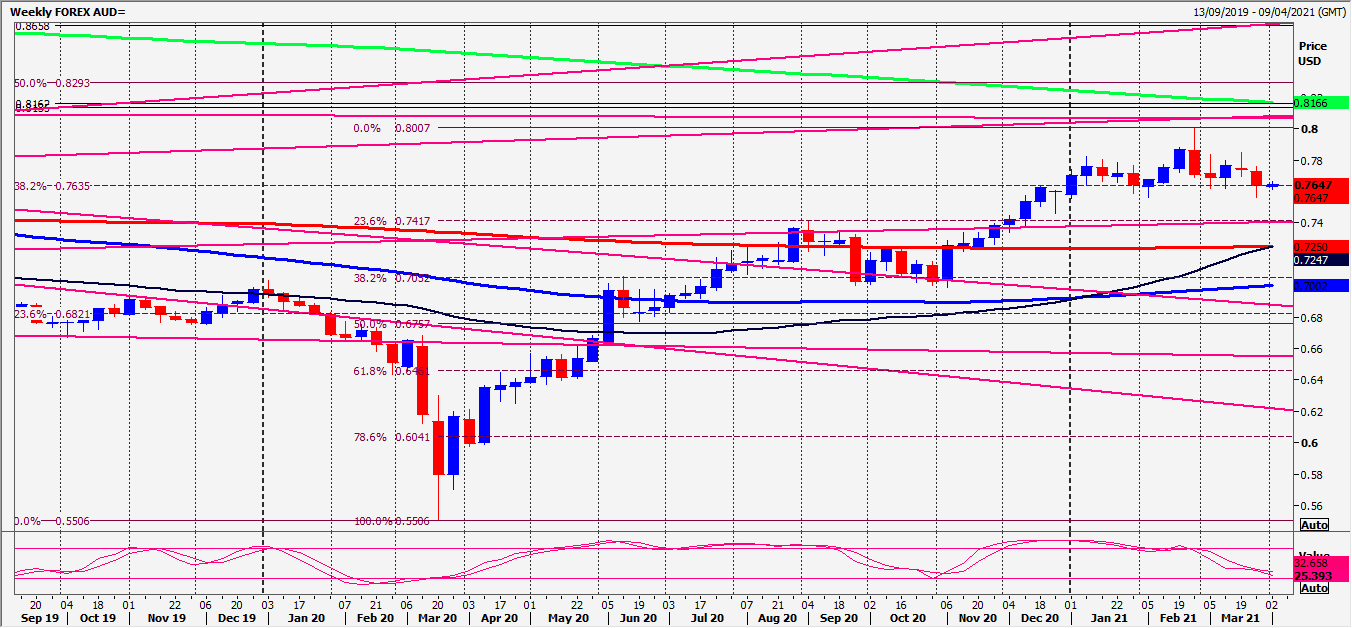

AUD/USD: A good chance of a high for the day

AUD/USD, NZD/USD, AUD/JPY

AUDUSD recovered almost 50% of the late February to early April losses over the past 2 weeks, reaching 7761.

NZDUSD higher to 7180.

AUDJPY first resistance at resistance at the April high of 8435/45 in the 2 month sideways trend.

Daily Analysis

AUDUSD minor resistance at 7740/45 before stronger resistance at 7765/75. A good chance of a high for the day here. Shorts need stops above 7785. A break higher targets 7820/25.

Strong support at 7715/05 & again at 7680/70. Longs need stops below 7655.

NZDUSD holding first support at 7130/20 today re-targets 7155/60 before a retest of last week’s high at 7175/80, perhaps as far as minor resistance at 7200/7205.

Strong support at 713/20 & again at 7095/85. Longs need stops below 7070.

AUDJPY first support at 8385/75 could hold the downside in the morning session at least. Longs need stops below 8365. A break lower to targets 8350/40 perhaps as far as 8310/00.

A break above 8455 targets 8475/80.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk