Argentina, Italy, UK Data, Gold, Oil

Political uncertainty drags on sentiment

Global politics continues to dominate the headlines this week and investors aren't responding too favourably to it.

Europe is once again in negative territory, as the Italian Senate ponders a data for the no-confidence vote in the coalition government. An election in October looks most likely at this moment as Salvini's League party looks to capitalise on its surge in the polls but until then, Italian stocks may remain vulnerable to the prospect of more political instability.

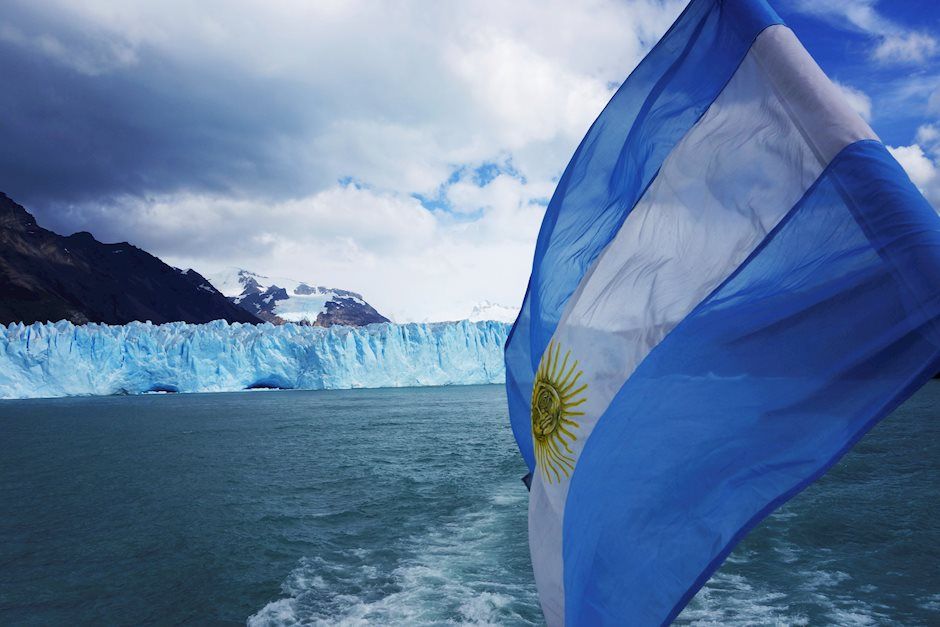

Issues elsewhere, be it Hong Kong and now Argentina, obviously aren't making investors feel particularly comfortable. It's easy to ignore these issues when they few and far between but we seem to be speaking about a new potential problem on a regular basis.

The trade war continues to tick along in the background, although all of the other political unrest has given it a bit of a break from the headlines. We still don't know if talks will continue between the US and China in the near-term or whether the latest flare up was a reflection of the fact that they've broken down again.

GBP steady after jobs data

Traders broadly shrugged off the latest UK employment data which was an even balance of positive and negative points. The obvious highlight is wages which continue to rise at well above inflation rates - just below 2% when accounting for inflation. This is somewhat offset by the rise in the unemployment number, weaker productivity and the amount of part-time work that contributed to the employment growth which isn't exactly a vote of confidence.

Sterling didn't really really respond much to the data and remains depressed by the rising prospect of no-deal Brexit. Of course, it's the summer and nothing was ever likely to be achieved now but time is fast running out and neither side is showing any sign of backing down. The only question that remains is how Boris could deliver no-deal and perhaps that's the only thing stopping the pound plunging further at this moment.

Gold tearing higher again in shaky political environment

As ever, the winner in all of this turmoil is gold which is benefiting from its role as a safe haven. Everything is lining up nicely for the yellow metal, whether it be negative bonds yields, risk-aversion, a softer dollar or central bank easing. We're now clear above $1,500 and into the area between $1,520 and $1,560 which was previously a pivotal area for gold.

Momentum remains with the rally as it continues to tear higher, extending its gains to more than 20% since the end of May. It will be interesting to see if this continues to be the case or whether history will repeat itself and profit taking kicks in.

Oil steady after brief correction

Oil is trading a little flat so far on Tuesday, following a few days in which it's pared some of its losses. WTI is trading back around $55, off its lows just above $50 but it's already stalling. This comes around an area which previously offered support in the second half of July so perhaps this is playing on traders minds, particularly given the current environment. The demand side of the equation remains a concern given the growth fears which may keep prices under pressure.

Author

Craig Erlam

MarketPulse

Based in London, Craig Erlam joined OANDA in 2015 as a market analyst. With many years of experience as a financial market analyst and trader, he focuses on both fundamental and technical analysis while producing macroeconomic commentary.