Are the commercial Dollar traders early, wrong, or neither?

Extreme Reading But What Does It Mean?

Here is McClellan's Tweet.

From the comments on this post, some clarification is in order. Every futures contract is 1 long and 1 short position, held by diff. parties. Total longs=shorts always. But it matters who holds them. The commercials are supposedly the smart money, but they are often early.

Further Clarification Needed

McClellan is correct that long and short contracts net to zero. But as discussed with gold, the commercials are not the smart money.

With currencies, the commercials consist of two groups.

- Importers, exporters, and raw material buyers who genuinely want to hedge against a fluctuating dollar.

- Broker dealers, who take the other side of the trade and those on the sell side with ETFs and other product offerings.

Neither group is either smart or dumb. First, let's go over where one can find the data.

Disaggregated Reports vs Legacy Reports

- US Dollar Legacy Report Futures Only

- US Dollar Legacy Report Futures and Options

- US Dollar Disaggregated Report Futures Only

- US Dollar Disaggregated Report Futures and Options

- Index to ALL COT Reports

In the Index, the disaggregated reports have nice groupings.

The legacy reports are a mess. Other than trial and error it is hard to find where various products fit.

The Legacy US Dollar Index COTs are in the ICE Futures U.S. Group.

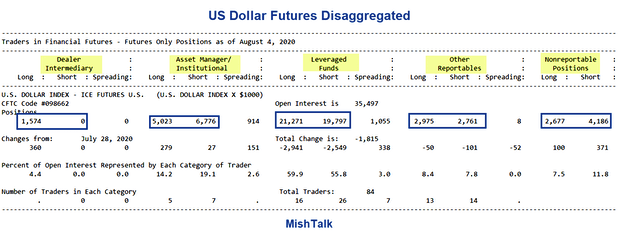

Disaggregated Report Futures Only

Legacy Report Futures Only

Smart Money Silliness

One look at the above details show the silliness of these smart-money, dumb-money takes.

For example, look at the disaggregated leveraged fund details. There are 21,271 longs and 19,797 shorts.

In the Legacy report we see Commercials are long 10,550 contracts and short 2,566 contracts.

The disaggregated report shows Dealer Intermediaries are long 1,574 contracts.

Is this smart or dumb?

To answer let's look at Financial Report Groupings.

The TFF report divides the financial futures market participants into the “sell side” and “buy side.” This traditional functional division of financial market participants focuses on their respective roles in the broader marketplace, not whether they are buyers or sellers of futures/option contracts.

Dealer/Intermediary : These participants are what are typically described as the “sell side” of the market. Though they may not predominately sell futures, they do design and sell various financial assets to clients. They tend to have matched books or offset their risk across markets and clients. Futures contracts are part of the pricing and balancing of risk associated with the products they sell and their activities. These include large banks (U.S. and non-U.S.) and dealers in securities, swaps and other derivatives. The rest of the market comprises the “buy-side,” which is divided into three separate categories.

Asset Manager/Institutional: These are institutional investors, including pension funds, endowments, insurance companies, mutual funds and those portfolio/investment managers whose clients are predominantly institutional.

Leveraged Funds: These are typically hedge funds and various types of money managers, including registered commodity trading advisors (CTAs); registered commodity pool operators (CPOs) or unregistered funds identified by CFTC. The strategies may involve taking outright positions or arbitrage within and across markets. The traders may be engaged in managing and conducting proprietary futures trading and trading on behalf of speculative clients.

Other Reportables: Reportable traders that are not placed into one of the first three categories are placed into the “other reportables” category. The traders in this category mostly are using markets to hedge business risk, whether that risk is related to foreign exchange, equities or interest rates. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories.

Smart Money?

The alleged commercial "Smart Money" does not exist.

Netting this all out to suggest the commercials may be "early" is more silliness.

My chart shows the commercials were hugely short the US dollar index from May of 2018 through May of 2020 as the dollar index rose from 93 to 103.

What was "smart" or "early" about that, besides nothing?

What about Extreme Positioning?

My chart dating to 2001 shows extreme positioning is at best a very short-term signal.

Commercial Focus is Wrong

The focus on the commercial side is simply wrong.

Rather it is short and long liquidation by speculators that generally drives the process.

Gold COTs

For a discussion of gold Cot positions please see Gold Soars to New High Above $2000 While Managed Money Sat it Out.

We frequently hear things like "commercials covered" their shorts or the commercials are the "smart money".

That is nonsense. The producers don't buy gold and the swap dealers are hedged (long gold and short equivalent futures). There is nothing "smart" about being forced to take the other side of a trade.

This subject comes up all the time.

For example, on December 27, Tom McClellan said "Gold COT Data Call for More of a Drop"

Gold was at the $1500 level.

On March 12, McClellan saidGold Moving Lower Despite Covid-19.

McClellan said "Gold prices should start trending down now, and for the next 5 years, according to this week’s chart."

It's pretty clear that many analysts don't understand COTs. They also do not understand the supply of Bitcoin and gold.

Misunderstanding the Supply of Bitcoin and Gold Leads to Silly Projections

The fundamental drivers for gold as well as the supply of gold and Bitcoin are also widely misunderstood.

For discussion, please see Nonsense from the WSJ on Gold vs the Dollar.

Here's a hint: Jewelry demand is irrelevant.

Also see Misunderstanding the Supply of Bitcoin and Gold Leads to Silly Projections

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc