Are growth stocks back? Get a hint from ARKK ETF [Video]

![Are growth stocks back? Get a hint from ARKK ETF [Video]](https://editorial.fxstreet.com/images/Macroeconomics/EconomicIndicator/EconomicHealth/GDP/Growth/investor-drawing-chart-gm480304834-68588679_XtraLarge.jpg)

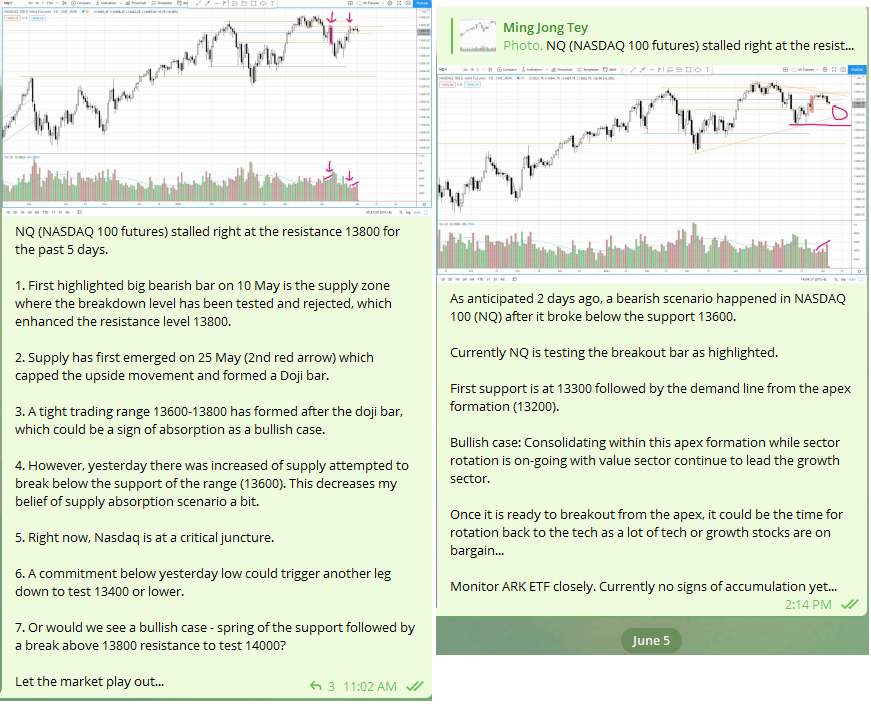

On 2 & 4 Jun 2021, I updated NASDAQ in my Telegram Group, refer to the screenshot below:

The Non-farm payroll (NFP) on last Friday saved NASDAQ and reversed the price action. A weaker than expected NFP headline at 559k vs 650k with the unemployment rate dropped to 5.8% vs 5.9% expected boosted the market. Now, the bad news become good news to the market. Anyway, this type of impermanence market dynamic is not uncommon. Let the market to show its action so that we can trade accordingly.

Instead of continuation to the downside to test the support, NASDAQ had the most impressive rally and currently in the progress of breaking out of the resistance at 13800.

Since the price actions appeared to be a shakeout (or deep spring?), I favor a bullish scenario where NASDAQ can break above the resistance and challenge the previous high at 14000.

If NASDAQ can challenge its previous all time high, would that mean the growth stocks are back in the spotlight?

Let's take a look at Cathie Wood's ARKK ETF below, as it is a good proxy to the growth stocks.

As shown in the chart above, there is still structural weakness show up in ARKK. Resistance at 115-120 is the first level to overcome in order to turn neutral. In order to determine the directional bias of ARKK, we will need to judge the characters of the price movement (and volume) within the trading range 110-130 in the later stage.

Having said that, some of the growth stocks do show bullish behavior and they are some of the outperformed stocks which could be the future leaders when the dust has settled.

Check out the 3 growth stocks in the video below and find out how you can benefit with simple breakout trading strategy:

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.