Anxiety in the US as China creates the first major digital currency

Cyber Yuan vs Bitcoin and Altcoins

The cyber yuan is a government-sponsored digital currency designed to track the movement of every penny. Bitcoin promotes anonymity.

Apps like Apple Pay, Venmo, Paypal, and Google Pay just facilitate payments by skipping a credit or debit card middleman. They are not their own money.

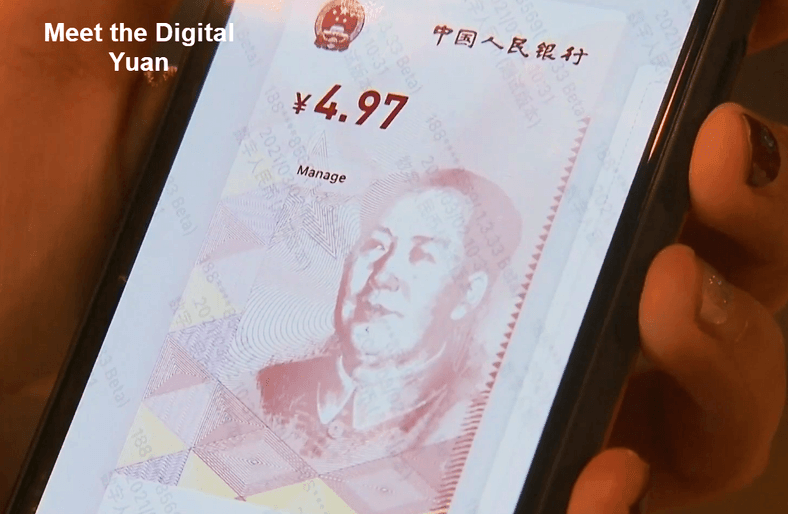

In contrast, China turned the yuan into a string of digits. It resides in cyberspace. On a screen it displays with a silhouette of Mao Zedong and looks just like the paper money.

First for Major Economy

Please consider China Creates its Own Digital Currency, a First for Major Economy

A thousand years ago, when money meant coins, China invented paper currency. Now the Chinese government is minting cash digitally, in a re-imagination of money that could shake a pillar of American power.

China’s version of a digital currency is controlled by its central bank, which will issue the new electronic money.

Beijing is also positioning the digital yuan for international use and designing it to be untethered to the global financial system, where the U.S. dollar has been king since World War II. China is embracing digitization in many forms, including money, in a bid to gain more centralized control while getting a head start on technologies of the future that it regards as up for grabs.

That an authoritarian state and U.S. rival has taken the lead to introduce a national digital currency is propelling what was once a wonky topic for cryptocurrency theorists into a point of anxiety in Washington.

Digitization wouldn’t by itself make the yuan a rival for the dollar in bank-to-bank wire transfers, analysts and economists say. But in its new incarnation, the yuan, also known as the renminbi, could gain traction on the margins of the international financial system.

Josh Lipsky, a former International Monetary Fund staffer now at the Atlantic Council think tank, said, “Anything that threatens the dollar is a national-security issue. This threatens the dollar over the long term.”

Encouraging Use

China already has 770 million mobile payment users.

To facilitate acceptance, China conducted free money lotteries. 750,000 people got some free money in these lotteries. It is working on a method to allow the app to work without an internet connection.

Coming soon, China will require everyone to use the digital currency. Paper money will be invalid.

China will know who is paying, where they are paying, and how much they are paying, and what they are buying.

Pros

- Merchants can avoid transaction fees

- Problems with handling cash vanish.

- Speed. Payment is immediate.

Cons

- Privacy concerns of all sorts. Governments can and will snoop.

- I fear things like "expiring money".

De-Dollarization a National Security Issue?

I do cheer one thing, and that's the de-dollarization of the global economy.

Under guise of national security, Trump made a global mess of things for reasons that had nothing to do with security. Unilateral sanctions on Iran and Gazprom are key examples.

In general competition is good. Soon, countries will be able to tell the US to go to hell unless there is full international cooperation.

The dollar, isn't going away and it will not be replaced by the yuan any time soon, if ever. But the end of the ability of the US to unilaterally call all the shots is on the near horizon.

That's a welcome development. So is anything that forces the US to mind its own business.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc