Another recovery stimulus would reduce risk-aversion pressure driving the dollar up

Outlook:

The Covid-19 pandemic driving of the markets is spotty. In Australia, the state of Victoria got alarmed by a spike in cases and locked down Melbourne, again. The RBA left rates on hold at 0.25%, where they have been since March, which should have been at least a little AUD-friendly. But instead it reacted to the downside, falling from 0.6980 last evening to 0.6918 by 5 am (although it’s coming back at 7:30 am). And the S&P ASX fell 1.1%. It must be the number of Covid-19 cases and the lockdown, and not the central bank.

While we can trace cause-and-effect Down Under, it’s a lot harder in the euro. We might want to blame the European Commission forecasting a 8.2% contraction in 2020, worse than 7.7% earlier forecast for the EU and 7.4% for the eurozone, but the euro was on the verge of a drop long before the report came out and signaled by a forlorn spike around 9 pm ET, after trading had begun in Australia. Did the Melbourne lockdown contaminate the euro, too?

We have a distinct shortage of factors to drive FX today, at least in the US. We get the JOLTS report, but job openings have to be so skewed by the shutdown and job losses that it can have no meaning. We also get speeches by four Feds, including Vice-Chairman Quarles. We might expect some mild and carefully worded mention of Congress needing to step up with the next rescue package, since the limit of what a central bank can do has been reached.

Congress looks like waiting for the 11th hour. Looking ahead, a new payroll protection plan and another $1200 check are probably not only welcome, but absolutely needed to keep people afloat. The payroll plan ends this month and the Senate doesn’t come back until the 20th, so stretching it pretty thin. Now that the rescue loans are disclosed to have been given to already rich people and some directly tied to the Trumps, the White House needs a new distraction and another $1200 check would come in handy.

In addition to the political aspect, another recovery stimulus would be welcomed by the stock market and would reduce risk-aversion pressure driving the dollar up. Trump would get three benefits from calling his Congressional cronies and pushing for it. The fiscal hawks can squawk.

Trump’s rejection of the US as global leader and embrace of only US self-interest might have sent a message to China—there’s room at the top. We dislike conspiracy theories as inherently improbable, but a hidden agenda is something else. China openly told citizens to buy equities, and so they did. This set off a round of buying around the world, and while that lasted only a short while, it showed the Chinese government’s raw power. Meanwhile, the dollar is tanking against the yuan, a gift to Trump. China is supposed to be managing against a basket of currencies, but never mind; it’s the dollar that counts. Perhaps most probative of an effort to become global leader comes from the Baltic Dry index, which just went through the roof.

See the chart. The Baltic Dry index slashed its way up 250% in June and past 1,800 in July for the first time in over eight months—driven by Chinese demand for iron ore. Other analysts note the ancient lore that commodity indices line up well with the Baltic Dry Index.

Talk of a new cold war between the US and China has been increasing in volume from whispers by the lunatic fringe, including a few in the White House, to the foreign affairs establishment and now the international capital markets. This is not actually new—the MSCI Emerging Market index started including China in 2018 and upped the percentage from 5% to 20% in 2019. You can read about “China and the Future of Equity Allocations”. The paper is a year old but still contains the alarming idea that China’s share of global equities is about to match that of the US. See the chart. As of over a year ago, the US had a 22% share of global allocations and China had 19%--not much difference and perhaps easily overcome.

We will stick to our judgment that China does not become the world leader in finance as long as laws do not explicitly protect the private property rights of individuals. And the yuan does not become the reserve currency of choice as long as it’s not freely traded. Still, it’s not outrageous to interpret these latest events as part and parcel of a longer-term effort to control asset prices.

Besides, whether we believe Chinese data or think it might be manipulated, China is the only country to be coming out of the vast economic retreat occasioned by Covid-19 lockdowns. China may be the only country to get the true V-shaped recovery while the rest of us get a U with a long center bar at the bottom. As noted yesterday, it’s ridiculous to consider an economy is actually going upward when all it has done is stop falling. But in China, it really is going upward. As the MSCI report notes, “China’s purchasing power overtook the U.S. in 2014 and is forecast to be 1.5 times the size of the U.S. by 2024. This drastic shift in the balance of economic power may have significant implications for investors’ equity portfolios if they seek exposure from financial assets that may benefit from this growth trend.”

Investors seek return and diversification. China is the place to go. Now change mind-sets and consider the stance of former Fed chief Volcker, who worried mightily about the decline on the dollar in the late 1970’s when the US government sought that outcome (Plaza Accord). Volcker’s concern was that a robust economy and the world’s top reserve currency should not persistently weak, let alone weakness be a policy objective. China learns. It’s not inconceivable that it seeks a rising stock market, rising allocations to its stock market, and a rising currency. For all we know, it’s just stockpiling commodities including oil and metals, and doesn’t really have that robust economy it pretends to have. But it’s painting an alluring picture, whereas in the US, we have policy incoherence if we can be said to have any policies at all that are not directly linked to Trump’s perception of what will get him re-elected.

It’s not clear what, if anything, this has to do with the immediate outlook for the dollar, assuming it’s the correct perspective in the first place. But it may well be one more link in the argument against the dollar,

US Politics: According to the NYT, the once secret loans to prop up the economy “helped support more than 50 million jobs, according to the Small Business Administration. The average loan size was $107,000, although borrowers can take out up to $10 million. Not included in the data is the roughly $30 billion in loans that were returned by companies that realized they weren’t eligible, worried about meeting the conditions to make the loans forgivable or frightened by the public outcry about big firms getting funds. Only the names of borrowers who took out more than $150,000 were released.

Here are some of the recipients of P.P.P. money that may raise eyebrows:

- Investment firms that manage billions, including Semper Capital Management, Domini Impact Investments and Brevet Holdings.

- At least 45 major law firms, including Boies Schiller Flexner, Kasowitz Benson Torres and Wiley Rein.

- Some companies connected to federal lawmakers or their families, including the Republican representatives Markwayne Mullin and Devin Nunes and the Republican senator Susan Collins, as well as Ms. Collins’s Democratic challenger, Sara Gideon.

- Several start-ups that still laid off employees.

- The Ayn Rand Institute, which is dedicated to the anti-statist philosopher, and an arm of Americans for Tax Reform, the group founded by the famously anti-tax activist Grover Norquist.”

Nobody is surprised that greed and cheating is going on. What we don’t know is how much the hypocrisy is damaging Trump’s reelection chances. After all, he claimed he would drain the swamp, but appears to be the crocodile-in-chief.

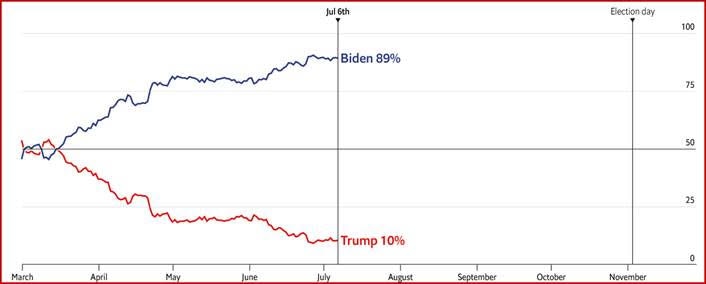

Here is the daily update from The Economist on Trump’s chances of winning the 2020 election:

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat